Payday lender Wonga saw losses double in 2015

- Published

The UK's biggest payday lender - Wonga - saw its losses double last year as tougher regulation in the industry continued to bite.

The short-term lender saw pre-tax losses grow from £38.1m in 2014 to £80.2m last year.

It has overhauled the way it assesses applications for credit, and extended the repayment term for some loans.

However, it suggested 2016 would be a "turning point" in its financial performance.

The company, along with other payday lenders, faces tougher rules from the regulator, the Financial Conduct Authority (FCA), which has ruled that customers must go through stricter affordability checks.

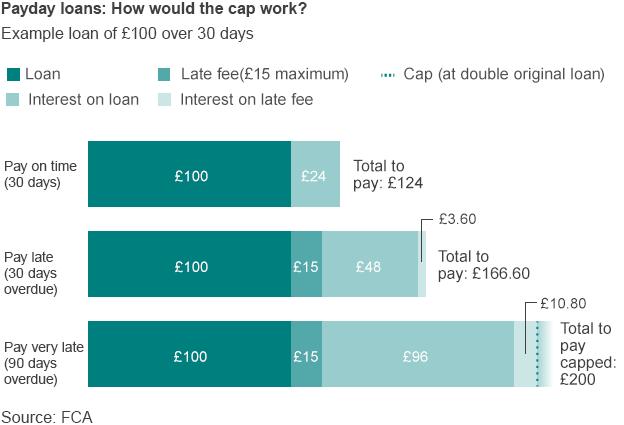

The regulator's main weapon is a cap on the cost of payday loans of 0.8% of the amount borrowed per day, which came into force in January 2015.

Analysis: Simon Gompertz, BBC personal finance correspondent

Once Wonga stopped selling high cost payday loans to people who could not afford them, its original market was always going to shrink.

Add in the lower returns after the price cap, the hit from compensation bills, plus the cost of complying with strict new regulation and you can see how profits disappeared as well.

Now the short-term lender has gone slightly less short term. It is selling three-month loans with more flexible repayment rules.

It believes there is still a market for its wares among young borrowers on around £18,000 a year who do not have credit cards.

In a way, it is remarkable that Wonga has survived after the mauling it received. It has even persisted with the tainted Wonga brand.

But it still faces a long haul: more losses this year, more backing needed to support the new-style loans, and more work to convince the public that it has cleaned up its act.

Wonga has tried to change its image in TV adverts

Image shift

After a period of rapid growth, Wonga and much of the payday loan industry were criticised by debt charities and MPs for lending to people who could not afford to repay these loans.

Many companies received fines from the regulator, including Wonga which had to apologise and compensate customers for the use of letters from fake legal firms, as well as write off millions of pounds worth of unsuitable loans.

In mid-2013, the Archbishop of Canterbury, Justin Welby, said he wanted to "compete Wonga out of existence", through credit unions.

For its part, Wonga said it had now overhauled the way it operated "ensuring all lending is responsible and affordable". Last year, it aimed to change its reputation and steer clear of the young and vulnerable with TV adverts that swapped its controversial puppets for "hard-working dinner ladies and mums".

The more controlled levels of lending have resulted in the default rate on UK loans falling from 6.6% to 2.8%.

Wonga said the stricter affordability checks, the cap imposed by the regulator, and the cost of a rigorous authorisation process from the FCA had all added to its costs.

The company also operates outside the UK, in countries such as Poland and South Africa, but the losses were primarily the result of the UK business, the lender said.

It expects to record a loss this year, but return to profit in 2017.

"We continued to focus on changing our culture to ensure customers are at the heart of our business, while strengthening our financial position," said chairman Andy Haste, a previous chief executive of insurer RSA, who joined Wonga in 2014.

"There is still a great deal to do."