MPs set to start their grilling of BHS players

- Published

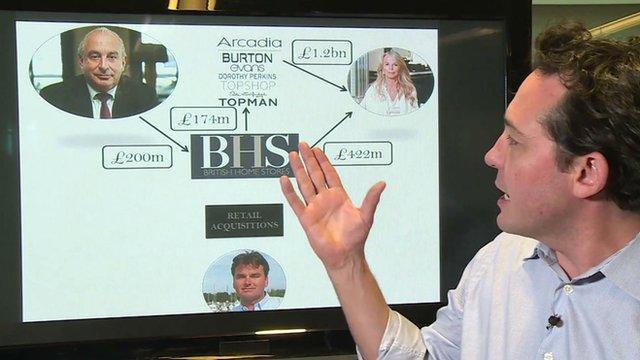

The cast of characters who have played a part in the demise of BHS is arguably worthy of a mini-series.

The larger than life billionaire retail tycoon, his Monaco-based wife, a former racing driver and bankrupt, surrounded by advisers and regulators, all help to weave a tale that affects 160 high streets and 31,000 mere mortals.

(That's 11,000 workers and 20,000 pension scheme members).

The parliamentary inquiry into the sorry tale begins in earnest on Monday.

Sir Philip Green, the former owner of BHS, has agreed in principle to appear before the inquiry in June.

With so many fingerprints on this scandal it's difficult to figure out how to apportion blame for a collapse that almost everyone in the industry seemed to predict but no-one seemed able to prevent.

Let's take a look at when some of the main players made their exits and their entrances:

2000

Sir Philip Green pays £200m to buy BHS

2000-4

BHS pays £422m in dividends to Sir Philip Green's family

2004-15

BHS pays rent and interest of £174m to Arcadia, Sir Philip Green's retailing company which owns other brands such as Dorothy Perkins and TopShop

2005

Arcadia pays £1.2bn dividend to Sir Philip Green's wife, Lady Green

2015

Sir Philip Green sells BHS for £1 to Retail Acquisitions, 90% owned by Dominic Chappell

2015-16

BHS pays Dominic Chappell and fellow directors £25m in fees and interest

March 2016

Landlords agree to massive rent discount to save the business

April 2016

BHS collapses under weight of £1.3bn debt, including £571m pension deficit

11,000 jobs are at risk and 20,000 pensioners stand to lose some of their pension

No wonder the Serious Fraud Office, Pensions Regulator, Insolvency Service and two Commons select committees are queuing up to ask questions.

The biggest question is why no-one seemed to want to know BEFORE it happened.

- Published6 May 2016

- Published2 May 2016

- Published6 May 2016