Record low rates mean savers are worse off than ever

- Published

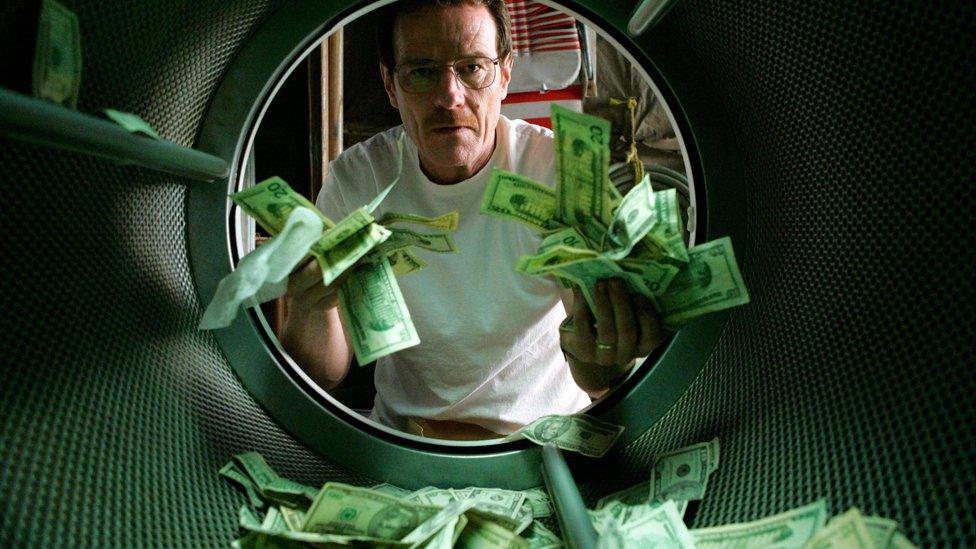

Record low rates are squeezing savers

Interest rates for savers have fallen to new record lows, after hundreds of cuts in recent months and more than 1,000 in the past year.

New analysis for BBC News shows that many people relying on their savings income are worse off than ever before.

Savings rates plummeted after the Bank of England slashed its base rate in the financial crisis.

Since last autumn, as the economic outlook has worsened, they have fallen again.

Tax-free Isas, fixed rate bonds and easy access accounts are all at or near their lowest points.

In research carried out for the BBC, the rate-checking firm Savings Champion recorded 1,440 savings rate cuts last year and more than 230 so far this year.

While low interest rates are welcomed by mortgage borrowers, they strike fear into those at or near retirement who had hoped that income from their nest eggs would help pay the bills.

A disappearing pot

"There's no light at the end of the tunnel," says 76-year-old Mick Bridge, one of a group of ramblers from Chesterfield who all depend on savings.

"Like most retired people, there was a plan and suddenly it's not like it was anymore. The pot's disappearing."

Mick Bridge: "There's no light at the end of the tunnel"

Fellow walker Sharon Beresford is worried that low interest rates will leave more older people needing help to pay for care.

"It's helping young people buy houses, but it's not helping me," she says, "There are a lot of us to be looked after."

The fall in rates has come across the board, with significant reductions from National Savings & Investments, Bank of Scotland, NatWest and Nationwide Building Society.

The average return from the five best easy access accounts has dropped from more than 3% in 2012 to under 1.3%.

Tax-free Isa rates are at their lowest ever. The average variable rate Isa is down to 1%, while a typical fixed-rate Isa pays 1.4%.

Record low rates from the Bank of England make life hard for savers

Pension age rise

Another Chesterfield rambler, 63-year-old Judith Knowles, started dipping into her savings when she discovered she would have to wait for her state pension because women's pension ages were being raised. Low savings rates have forced her to dip in again.

"It's worrying," she says. "I've had letters saying the rates are going down even more."

Some rates of return are so tiny that savers can improve their situation by switching to a better offer.

First Direct pays just 0.05% to customers in its Savings Account, while Santander has an Easy Isa with an interest rate of a mere 0.1%.

Anna Bowes, director of Savings Champion, traces the problem back to a decision by the previous Coalition government to supply banks with cheap money to boost their lending.

Frustrating times

"The competition between providers has been sucked out of the market," she explains, "They just don't need to raise money from savers any more, which has had a devastating impact."

A spokesman for the British Bankers' Association said: "These have been frustrating times for savers. The Bank of England's base rate has remained at a record low for several years.

"While this has been good news for borrowers, it has fostered a low-interest-rate environment which has not been easy for many savers to bear."

The looming EU referendum has confused the outlook for savers, with George Osborne warning borrowers that a vote to leave could lead to higher interest rates and others speculating that uncertainty could prompt the Bank of England to cut its base rate again.

Behind the scenes, senior bankers warn that very low savings rates are likely to be the "new normal", given the precarious economic situation across the world.

- Published26 March 2016

- Published14 March 2016

- Published15 March 2016