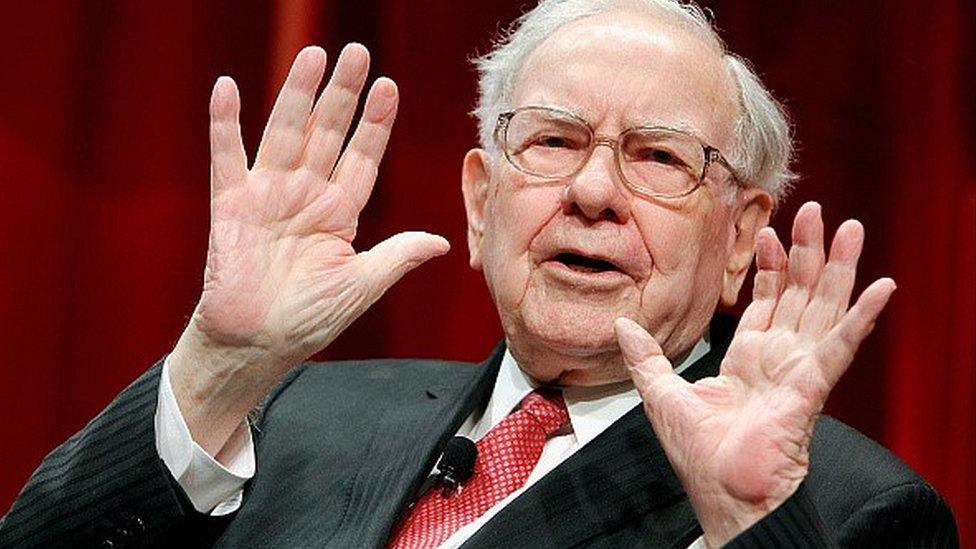

Warren Buffett reveals $1bn Apple stake

- Published

The billionaire investor Warren Buffett has revealed that his investment firm has bought a $1bn stake in the technology firm Apple.

Berkshire Hathaway disclosed a holding of 9.81 million shares in the iPhone maker in a regulatory filing, external.

Mr Buffett, who has traditionally shied away from tech stocks, is known for buying "value stocks", so it is being seen as significant for Apple.

Its shares have fallen almost 30% over the past year but rose on Monday.

They closed the trading session 3.7% higher at $93.88.

Slowing iPhone sales have led investors to question whether the company can maintain its huge profit levels.

Last week Apple temporarily lost its place as the world's most valuable company after a fall in shares pushed its total market value below that of Google parent Alphabet.

'Stunningly cheap'

"The stock is stunningly cheap, and it has a massive pile of cash," Steve Wallman, founder of Wallman Investment Counsel, told Reuters. He has owned Berkshire shares since 1982 and Apple since 2003.

"Apple is not getting credit for research and development it is doing behind the scenes, which will eventually show up in new products."

According to the Wall Street Journal, external, Mr Buffett did not make the actual investment himself, meaning the order would have been placed by his stock-picking team Todd Combs and Ted Weschler. The paper says they are willing to invest in areas that Mr Buffett himself wouldn't.

They are each thought to manage a $9bn portfolio and usually make the smaller investments, while Mr Buffett makes the big bets.

The Apple holding makes Berkshire Hathaway the 56th largest shareholder.

Apple is not Berkshire Hathaway's only technology investment. It is also the biggest shareholder in IBM and increased its holding in the first quarter.

However, Mr Buffett admitted at Berkshire's annual meeting last month that his investment firm had been slow to get involved in the new tech industry. He has always said he would not invest in companies he doesn't understand.

On Monday he also told CNBC that he would consider helping Dan Gilbert, chairman of Quicken Loans, finance a bid for the internet firm Yahoo.

- Published15 May 2016

- Published27 April 2016