BHS to be wound down as rescue attempt fails

- Published

The BBC's Keith Doyle reports: "Great sadness and shock for the staff"

Department store BHS will be wound down with the loss of up to 11,000 jobs after efforts to find a buyer failed.

The decision followed a lengthy bidding process aimed at saving BHS, which went into administration in April.

But none of the offers was judged acceptable by administrators Duff & Phelps, which blamed "seismic shifts" in the retail sector for the collapse of the chain.

All 163 BHS stores will be holding closing sales over the coming weeks.

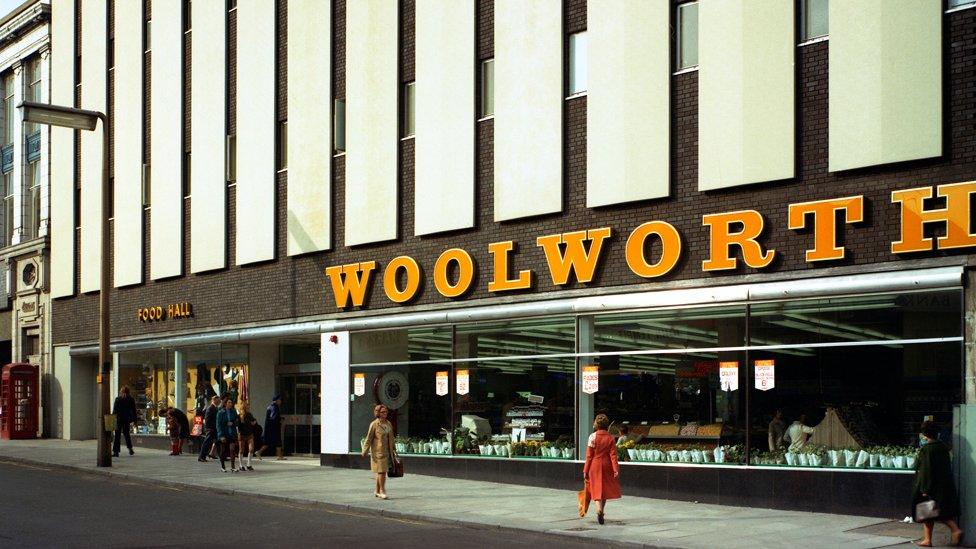

Former owner Sir Philip Green said he was "saddened and disappointed" by the biggest retail collapse since Woolworths in 2008.

A spokesman said the billionaire Topshop owner had hoped to see the company sold as a going concern.

Staff at one London store were only informed of the decision by a journalist. Customers were then told to leave the store and the shutters closed.

Hilco Retail Services has been appointed to assist in the process of winding down the BHS store network.

Hopes of rescuing the store chain had rested on a late offer from a company led by retailer Greg Tufnell and reportedly backed by Portuguese money.

But sources told the BBC that the financial backing needed for the bid failed to materialise.

Other bidders who failed to convince the administrators included a consortium led by Matalan founder John Hargreaves, as well as separate offers from Sports Direct's Mike Ashley and Poundstretcher boss Aziz Tayub.

Closing sales

One woman said she was "angry" that a British store could not be saved

"Despite the considerable efforts of the administrators and BHS senior management, it has not been possible to agree a sale of the business," said the administrators.

"Although multiple offers were received, none were able to complete a deal due to the working capital required to secure the future of the company.

"Our thoughts today are with the employees. We thank them for their professionalism and hard work. We would also like to thank the great British public for helping us in our efforts to save BHS resulting in several weeks of significant sales."

The jobs of 8,000 members of staff are likely to go, while a further 3,000 jobs of non-BHS employees who work in the stores may also be at risk.

"The British High Street is changing and in these turbulent times for retailers, BHS has fallen as another victim of the seismic shifts we are seeing," said Philip Duffy, managing director of Duff & Phelps and joint administrator.

"The tireless work and goodwill of the existing management team and employees of BHS with the support of my team were not enough to change the fortunes of the company."

John Hammett, general secretary of the retail union Usdaw, said the news was devastating but not necessarily the end of the road.

"There were a number of potential buyers here and the question is why they haven't been successful," he said. "We need to make sure that every opportunity has been covered before we accept defeat."

Inquiry continuing

BHS was sold by Sir Philip Green's Arcadia group to Retail Acquisitions for £1 in 2015.

The new owner was headed by Dominic Chappell, a former racing driver who had previously been declared bankrupt.

What is liquidation?

Hilco Retail Services - the company in charge of the liquidation process - will look for buyers for the stores and the business's other assets

It will ensure that the stores continue to trade for as long as possible to allow the administrators to generate the biggest possible returns for creditors - those owed money by BHS

Creditors include companies that have supplied goods or services to the retailer, as well as staff

Hilco has worked with other failed retailers including Woolworths

Work and pensions committee chairman Frank Field: "There is of course this real worry now, that the pension scheme - if there is no company - is in effect orphaned"

Two parliamentary committees are currently trying to ascertain what led to the retailer's collapse.

When it entered administration in April this year, it had a £571m pension deficit.

Gregg McClymont, head of retirement savings at Aberdeen Asset Management, said: "This is bad news for its pensioners and current staff members of the pension scheme. Responsibility for paying pensions will fall to the Pension Protection Fund, which does a fine job in difficult circumstances.

"More widely, BHS's fate, and the ongoing Tata process, are a reminder that [defined benefit] pension promises are expensive and depend on the solvency of the sponsoring employer."

- Published2 June 2016

- Published2 June 2016

- Published2 June 2016

- Published1 May 2016