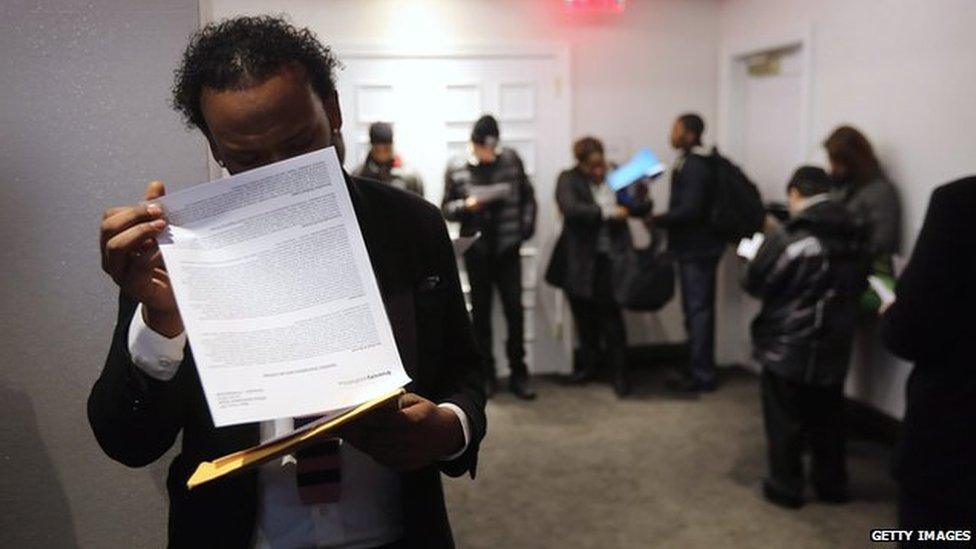

US job creation in May falls to lowest in five years

- Published

US job creation in May fell to its lowest level in more than five years, a sign of economic weakness that may limit the Federal Reserve's ability to raise interest rates soon.

The Labor Department said that employers added just 38,000 jobs last month, the fewest since September 2010.

The jobless rate fell to 4.7% from 5%, the lowest since November 2007.

But this was partly due to people dropping out of the labour force and no longer being counted as unemployed.

The government said a month-long Verizon strike had depressed employment growth by 34,000 jobs. The strikers would have been considered unemployed and counted in the figures. But even without the Verizon strike, non-farm payrolls would have increased by just 72,000.

The goods producing sector, which includes mining and manufacturing, shed 36,000 jobs, the most since February 2010.

Janet Yellen, chairwoman of the Federal Reserve, has hinted that interest rates could rise soon if US jobs growth picks up.

Ian Shepherdson, of Pantheon Capital, said the chances of June rise were now "dead", while the prospect of a July rise was "badly wounded".

'Bad, bad, bad'

The dollar immediately weakened after the data was released as investors speculated that a rate rise this month was unlikely. The main share markets opened down, led by a 0.6% fall in the S&P 500.

Mohamed el-Erian, chief economic adviser to Allianz, said "this unusual jobs report puts the Fed in a tricky position".

Analysis: Andrew Walker, BBC World Service economics correspondent

This is a weak report even if you make an allowance for the strike at Verizon. The number is still weak, and still short of what's needed to keep up with a growing population.

There's no mystery about weak job growth at the same time as there was a marked decline in the unemployment rate. That was down to people dropping out of the labour market. If someone is not looking for work they are not counted as unemployed even if they would like to have a job. The number "not in the labour force" rose by more than 600,000.

So, it is a disappointing monthly report. Still, unemployment below 5%, however the US got there, suggests a labour market doing a lot better than many other countries.

Joey Lake, US analyst at the Economist Intelligence Unit, described the jobs report as "bad, bad, bad: there is no positive spin to it".

He pointed out that the Labor Department also revised previous monthly figures lower.

"The labour market slowdown will make the Federal Reserve reconsider its next move," Mr Lake said. "It reduces the chance of a June rate increase and makes it more likely the Fed will wait until July, after the Brexit vote, which will also reduce the political risk from abroad."

Recent US data on consumer spending, industrial production, exports and housing had suggested that the economy was gathering speed after growth slowed to a 0.8% annualised rate in the first quarter.

Consumer spending surged in April on the back of sales of big-ticket items such as cars and household appliances. Sales of new homes reached an eight-year high in April.

Many economists had expect growth to speed up in the April-June quarter to an annualised pace of about 2.5%.

- Published31 May 2016

- Published27 May 2016

- Published19 May 2016