Bond markets hit by economic worries

- Published

The returns on British and German government debt, or bonds, have hit new all-time lows.

The market has been affected by concerns about the global economic outlook.

Weaker economic performance usually leads to cuts in interest rates and bond yields tend to move down in parallel.

An increasing number of government bonds are now giving negative returns, less than zero.

These moves have highlighted a question that is increasingly being asked in the markets: Is the world heading for another financial crisis, this time in the market for government and company debt?

The new records being hit by government bonds are the results of central bank policies of very low or even negative interest rates.

'Supernova'

Some experts fear that it is already damaging the commercial banks. They think it could all go horribly wrong when interest rates rise.

One called it, external "a supernova that will explode one day".

For many governments borrowing in the aftermath of the financial crisis has become very, very cheap. Since the New Year, and indeed in the last day or two, it has got cheaper still.

The place we go to for continuously updated information on this is the bond market.

Bonds are IOUs that are traded in the financial market. The returns, or yields, on government bonds give us some clues about what the borrowing costs will be when they next go to the market to raise money.

Switzerland's 10-year bond yield is negative

In some cases, the yield is negative, below zero.

For Switzerland and Japan the yield is negative for 10-year borrowing.

Germany is just above zero and below that for five-year bonds. That's also true for France and Belgium, two countries with uncomfortably large government debt burdens and even for two countries that were bailed out in the crisis, Ireland and Latvia.

If we go down to two-year bonds Spain and Italy are also members of this strange club.

Low bond yields are a sign that a borrower is viewed as unlikely to default. Although none of those countries do seem likely to fail to make their debt payments, it is still very striking that they are in the same boat, to some extent, as that ultimate safe borrower, modern Germany.

Problem for investors

And there is now an awful lot of debt around with a negative yield. The credit rating agency Fitch estimates that the total has now exceeded $10 trillion in value. Japan is the largest source.

Low and negative yields are a problem for investors that rely on government debt to generate returns. It is widely held by pension funds, insurance companies, banks and many other investment organisations that seek low risk assets.

The low return on these bonds is one of the reasons many pension funds have deficits.

The related phenomenon of low central bank interest rates is also squeezing banks' profitability, external. Where there are negative rates, it generally applies to some of the reserves they hold with the central bank. It costs them money. They are reluctant to compensate themselves by imposing negative rates on customers' accounts.

By making banks less profitable it is possible that they might make credit less available. Scott Mather of the bond investment fund Pimco, external argues that is the effect. He says negative rates also lead to higher interest rates for the banks' borrowers.

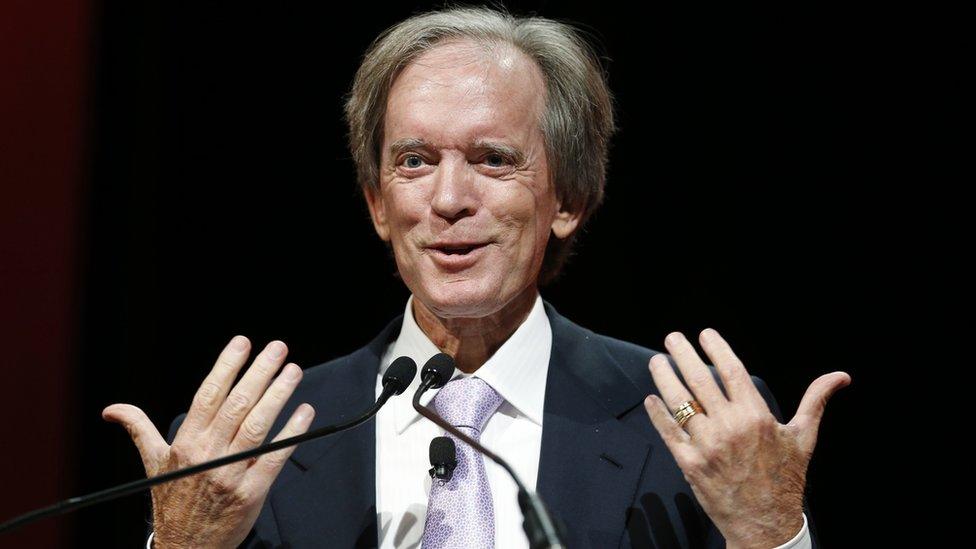

Bill Gross: low yields 'a supernova that will explode one day'

There is also a potential problem about large losses being incurred by the funds that own bonds with negative yields. The problem is that the price of a bond and the yield move in opposite directions. So if those negative yields turned sharply upwards, above zero, their prices would fall and the bondholders would lose.

This is probably what the "supernova" comment was about, which appeared in a tweet from Bill Gross, the founder of Pimco and who now works at Janus.

The investment bank Goldman Sachs warned in a recent research note that an unexpected upward move in interest rates of one percentage point would generate losses of $1tn for bondholders.

Another note from Goldman warned of a significant possibility of such a development in interest rates in the second half of this year.

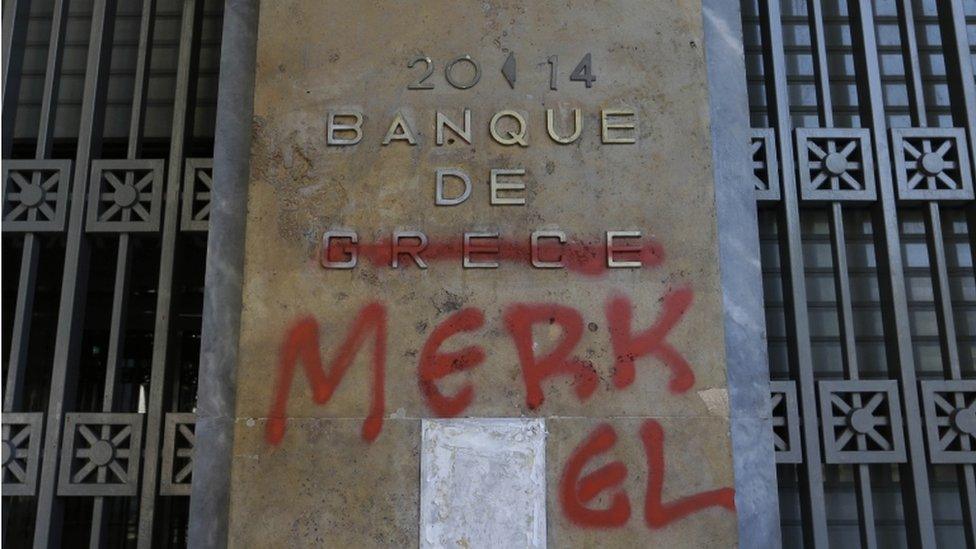

eurozone crisis

There are advantages in negative bond yields. Government debt burdens are more manageable.

Spain and Italy, for example, looked to have unsustainable debt burdens when their ten year borrowing costs were more than 7% in 2011 and 2012.

Now they are below 1.5%. They are not altogether in the clear, but their government finances are in much better shape than they were.

Still, there are people nervous about what lies ahead for the bond market. In more normal times it can exert real pressure on government spending plans. A rise in borrowing costs can be very bad news for a government's plans. It was in the bond market that the eurozone crisis nearly destroyed the EU's single currency.

In the early 1990s James Carville, an adviser to the then President Bill Clinton said: "I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody."

The nature of the threat from the bond market today is rather different. But some people really are quite intimidated.

- Published9 June 2016

- Published7 December 2015

- Published10 August 2015