Veteran US industrialist backs Brexit

- Published

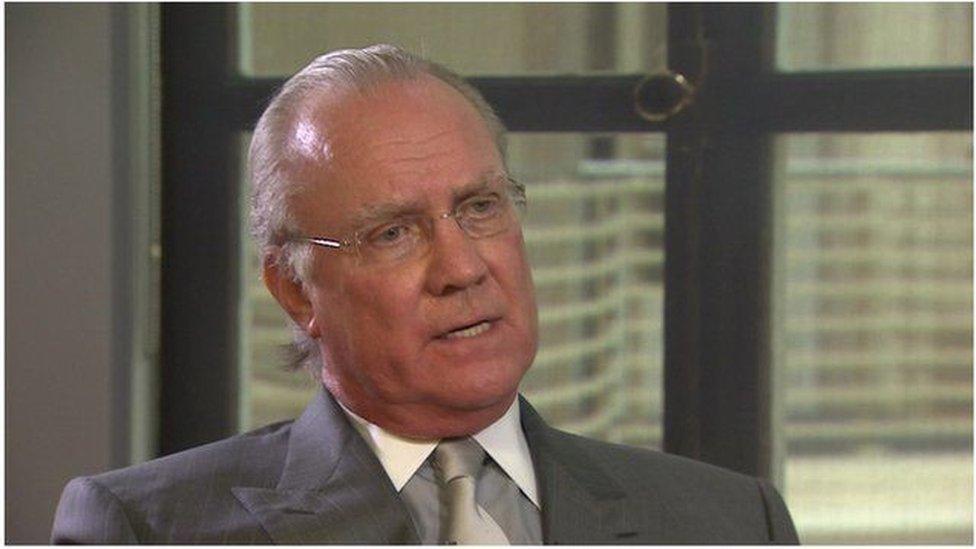

The American industrialist Gary Klesch has come out in favour of the UK leaving the European Union, saying the country could enjoy "explosive growth" if it was no longer tied to Brussels.

He said firms in the EU were hampered by too much "cumbersome" regulation.

Mr Klesch, who runs his own investment fund, Klesch & Co, specialises in turning round struggling companies.

His intervention comes amid a series of large companies writing to staff in support of Britain staying in Europe.

BT, Rolls-Royce and today Unilever have all told staff the uncertainty engendered by Brexit could hurt investment and sales.

Dynamic model

Mr Klesch has in recent years bought steel mills and refineries in Germany and Holland.

He was an unsuccessful bidder for the Milford Haven refinery complex in Pembrokeshire last year, and also tried to buy Tata Steel's plant in Scunthorpe.

He said that international investors would find the UK more attractive if it left the EU.

"The model is a very static model, a very regulated model. England is a part of that now. With Brexit, it can go to a dynamic model.

"It's not just me. Everyone [investors] talk about Asia, America and last of all Europe. The big advantage is that once you move into a dynamic environment it allows for explosive growth."

Long-term gain

He said there was no doubt there would be an economic shock were the UK to leave, saying there was "no such thing as a risk-free transaction".

"There will be short-term pain, but long-term gain."

The UK should be confident of its position and status in the world economy, he said.

"I'm offended by the President of the United States coming over here and saying we will have to go to the back of the queue - when [the UK has] the fifth-largest economy in the world. Has he talked to Ford? Has he talked to Apple?"

The UK votes on whether to leave the European Union on June 23.