Tesla bid for SolarCity 'shameful'

- Published

An investor has called Elon Musk's bid for SolarCity "shameful"

Tesla's bid to buy struggling solar energy firm SolarCity has been called "shameful" by financier Jim Chanos.

Mr Chanos, who is betting against the shares of both firms, described the bid as a "shameful example of corporate governance at its worst".

Tesla made a $2.8bn (1.9bn) offer for SolarCity on Tuesday.

Tesla's chief executive Elon Musk said the deal, which will be paid for in Telsa shares, was a "no brainer".

The two firms have close ties.

Mr Musk owns 22% of SolarCity and sits on the company's board. SolarCity's chief executive Lyndon Rive and Mr Musk are cousins.

"As a combined automotive and power storage and power generation company, the potential is there for Tesla to be a trillion-dollar market cap company," Mr Musk said.

'Burning cash'

Mr Chanos has taken short positions in both Tesla and SolarCity.

When investors take short positions they borrow shares of a company, sell those shares and try to buy them back at a lower price.

Mr Chanos said SolarCity was "headed toward financial distress," and neither company could handle the burden of a tie-up.

"[SolarCity] is burning hundreds of millions in cash every quarter, a burden that now Tesla shareholders will have to bear, at a total cost of over $8bn," he said.

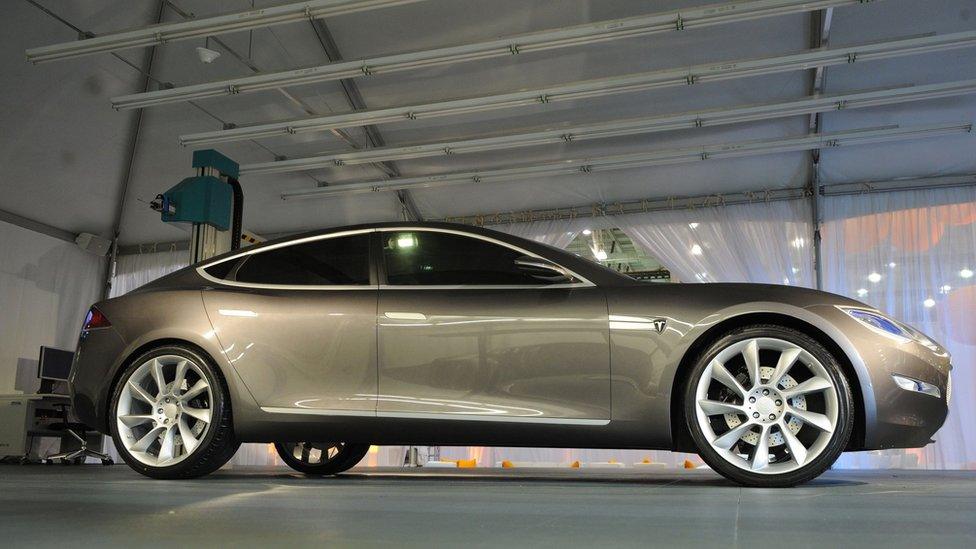

Tesla has been investing heavily to develop its range of electric cars

Mr Musk said SolarCity would not impact Telsa's cash flow and would have its own positive cash flow in the next three to six months.

SolarCity reported a loss of $25m in the first quarter and has liabilities of $6bn, which includes debt and unpaid tax.

On Wednesday, Tesla's share price put the company's value at $29.8bn while SolarCity's was $2.2bn.

SolarCity's shares have fallen over 50% during the last year, but rose more than 3% on Wednesday.

Tesla shares closed more than 10% lower.

- Published22 June 2016