Tesco 'encouraged' by sales progress

- Published

Tesco has said it is "encouraged" by its progress in a challenging market as it reported a second consecutive quarter of higher sales.

In a trading statement, external, the supermarket said its UK like-for-like sales were up 0.3% in the 13 weeks to 28 May.

For the group as a whole, including its businesses in Ireland, the European mainland and Asia, the rise was 0.9%.

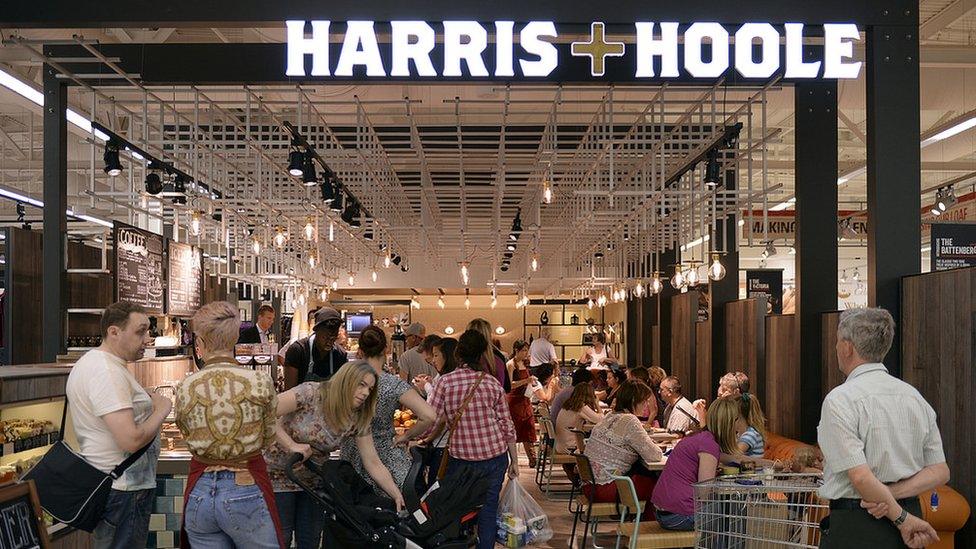

Tesco also said it had agreed to sell its Harris & Hoole coffee shop chain to Caffe Nero.

In recent weeks the retailer has announced the sale of its Dobbies Garden Centres chain and restaurant chain Giraffe, so that it can focus on the main supermarket business.

Dobbies was sold to a group of investors led by Midlothian Capital Partners and Hattington Capital, while the owner of Harry Ramsden's restaurants, Boparan, snapped up Giraffe.

In April, Tesco announced its first growth in quarterly sales for three years, with UK like-for-like sales up 0.9%.

'Fictional farms'

Tesco chief executive Dave Lewis said: "We have delivered a second quarter of positive like-for-like sales growth across all parts of the group in what remains a challenging market with sustained deflation. We are encouraged by the progress we are making."

Shares closed up 1.8% at 169.49p, bringing the rise this year to just over 12%.

Harris & Hoole is the latest Tesco business to be sold off

Tesco also hailed the success of its new fresh food brands, with two-thirds of its customers having already tried the ranges.

"Customer ratings for the quality of our fresh food offer as a whole have improved to their highest level in more than two years," the supermarket said.

The fresh food ranges, launched in March, courted controversy because they were named after fictional farms with British-sounding names. However, the produce is often sourced from abroad.

"While the naming controversy provoked something of a media storm, this may have been lost on customers," said David Alexander, senior analyst at Verdict Retail.

"After all, the strategy is similar to that employed by Aldi and suggests that for most shoppers, the perception of provenance is sufficient, provided the products are perceived to be good value."

Price pressure

Tesco and its "big four" peers - Asda, Sainsbury's and Morrisons - are under continuing pressure as they face competition from discount supermarkets Aldi and Lidl.

And earlier this month, online retailer Amazon launched its Amazon Fresh grocery delivery service in central and east London, with plans to roll the deliveries out further across the UK.

Since taking over as Tesco chief in September 2014, Mr Lewis has put Tesco's focus on price cuts and putting more staff in stores in an attempt to revive the company's fortunes.

As a result of its price-cutting efforts, Tesco said, the cost of a weekly shop in its supermarkets was now 6% lower than when Mr Lewis took over.

The Giraffe restaurant chain has already changed hands

Richard Hunter, head of research at Wilson King Investment Management, said Mr Lewis was "clearly aiming to return the stock to its former status as a market darling, an accolade which has long since disappeared".

"Nonetheless, a number of red flags remain," he added.

"Ongoing investment in the business as announced at the full-year results will drag on profits, competition in the sector remains fierce and the shares are on an expensive multiple compared to its peers.

"Even so, the previously highlighted reductions in net debt and costs are complemented by strong revenue streams and there appears to be a clear line of progress emerging.

"It remains to be seen whether this new-found optimism will percolate to a share price which has dropped 22% over the last year, as compared to an 8% dip for the wider FTSE 100."

- Published17 June 2016

- Published10 June 2016

- Published13 April 2016

- Published23 June 2016

- Published24 March 2016