Property market lull may follow vote to leave EU

- Published

Now we've voted to leave the EU, are house prices really going to fall, asks Simon Gompertz

Commentators suggest the lull in the UK property market will continue following the UK's vote to leave the EU.

Some mortgage brokers and estate agents say that potential buyers could delay any purchase owing to the uncertainty that is likely to follow the result.

There is less consensus on what the effect might be on the cost of mortgages and house prices.

The share prices of house builders took a big hit in early trading following the result.

House prices

Ahead of the vote, the UK Treasury said that over the next two years, house prices could end up being 10-18% lower compared with where they would have been had the vote been to remain.

"When there is uncertainty it affects confidence and people put off making decisions. Those who were thinking about buying property may now decide to leave that decision to say next year, in the hope that property prices will fall in the meantime," said Mark Harris, chief executive of mortgage broker SPF Private Clients.

If the Treasury prediction is true, such a change would be good news for first-time buyers, but not for existing homeowners, particularly if they have bought recently.

Predictions of how far the pound would fall have so far been an overestimate, so there is clearly a possibility that the change in house prices may be less dramatic. Any forecasts of property prices are notoriously difficult.

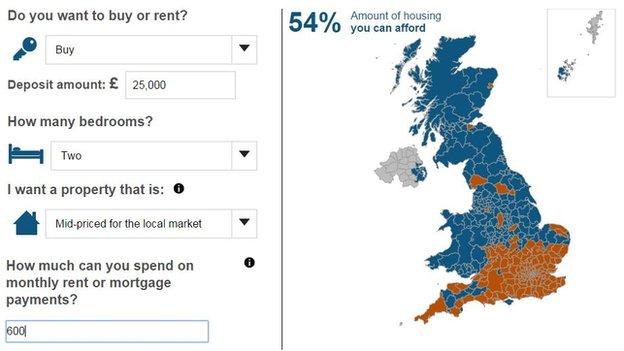

Geography will also play a major part in any change - with the UK having a wide range of regional property markets.

The National Association of Estate Agents (NAEA) previously estimated that house prices in London could see the biggest change. It said prices would be £7,500 lower on average over the next three years than they would have been had the vote been to remain.

Elsewhere, it said house prices could see a slower rate of increase, rising by £2,300 less.

Mortgage costs

All eyes will be on the Bank of England when it comes to assessing the cost of a mortgage.

If inflation rises, the Bank of England may consider raising interest rates, making mortgages and loans more expensive to repay. During the campaign, the Treasury forecast a rise of between 0.7% and 1.1% in the cost of a mortgage. This would filter through to rental costs too.

Any shock to the UK economy may lead the Bank of England to consider a cut in rates. In that case, the cost of lending could actually fall.

David Tinsley, from Swiss bank UBS, said the Bank of England's Monetary Policy Committee (MPC) was expected to make interest rate cuts and extend its quantitative easing programme.

"We expect the MPC will cut policy rates to zero and make further asset purchases, in the first instance of £50-75bn, not later than February 2017," he said.

Bank of England governor Mark Carney made it clear in a speech that no quick decisions would be made.

Mortgage brokers say that any change should be viewed in the context of historically low mortgage rates at present.

"The banks and building societies still have incredibly low rates and mortgage acceptance criteria is better than it has been for years," said Aaron Strutt, of Trinity Financial mortgage brokers.

"One of the biggest problems is confidence, particularly as we have political and economic instability. People still need houses to live in and while we have a functioning banking system they will have options."

David Hollingworth, of London and Country mortgages, said: "Borrowers will be struggling to understand whether this [result] could mean an increase in base rate or whether it might precipitate a cut.

"With sterling plunging the expectation will be for rising inflation which would typically lead to rising interest rates. However, fragility in the economy could well see the base rate held or even fall.

"If funding costs for lenders were to rise then that could put upward pressure on mortgage rates whether base rate were to shift or not. The only certainty at the moment is that borrowers have a range of extremely competitive fixed rate deals on offer."