Japan shares recover after Friday's post-Brexit bout

- Published

Japanese shares have managed to recover some ground after their historic plunge last Friday following the UK's vote to leave the European Union.

Traders have taken some confidence from a pledge by the Japanese government to stabilise the financial markets.

The Nikkei closed 2.4% up at 15,309.21 after losing almost 8% on Friday.

The yen, though, remains strong at 101.8 to the dollar. This hurts Japan's exporting firms by making their goods more expensive on world markets.

Follow the latest developments on our live page

The yen has gained ground because it is considered a haven currency, a status which has been bolstered by the continued decline of the pound.

The pound continued to slide in trading in Asia on Monday, adding to Friday's record one-day decline.

Japan reassures investors

In a response to the currency moves and the risk it poses to Japan's crucial export sector, the government held an emergency meeting with the central bank.

Prime Minister Shinzo Abe told Finance Minister Taro Aso to watch currency movements "ever more closely" and take steps if necessary.

"Risks and uncertainty remain in financial markets," Mr Abe said. "We need to continue to work toward market stability."

Analysis: Mariko Oi, Tokyo

It is difficult to guess if investors are bargain hunting or if the prime minister's repeated promise to intervene if necessary have calmed the market.

The yen, which surged to the highest level since 2013 on Friday, has stabilised for now, which helps shares in Japanese exporters.

But analysts say the volatility in the Japanese yen will continue and the government might still have to intervene.

Shoppers that I spoke to in Ginza on Sunday all expressed concerns.

"It is disappointment for Japan," one woman said. "In terms of exports and especially when we think about those Japanese companies in UK. I hear Brexit may have a longer effect than the financial crisis so I am worried."

Others were concerned about the direct impact on Japanese companies with their overseas investments being affected.

"I am worried because my company has business with UK so I am concerned about the future," one shopper told me.

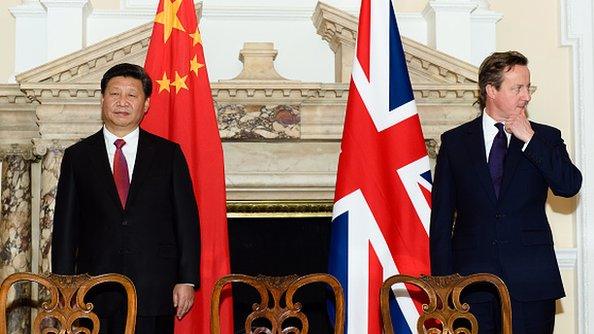

Brexit: Asian powers warnings over global stability

There was mixed picture in other Asian markets.

Hong Kong's Hang Seng index closed down 0.2% at 20,227.30 points, while China's benchmark Shanghai Composite finished up 1.5% at 2,895.70.

Over the weekend, China's Finance Minister Lou Jiwei said the consequences of the UK leaving the EU were still unclear, but that they would be felt for years to come.

The country's central bank weakened the yuan fix by 0.9%, on Monday, the biggest daily move since August 2015.

South Korea's benchmark Kospi index finished flat at 1,926.85.

Australia's ASX/200 in Sydney closed 0.5% higher at 5,137.20.

Both the Kospi and the ASX/200 had lost more than 3% on Friday in the wake of the UK's vote to leave the EU.

- Published27 June 2016

- Published19 June 2016

- Published27 June 2016

- Published27 June 2016