The highs and lows of the pound

- Published

As the nation anxiously waited for the EU referendum results last month, currency traders were busy making bets on which way the vote would go.

The pound started to rise just before the first results came in as traders predicted a win for the Remain side - eventually hitting a high of over $1.50.

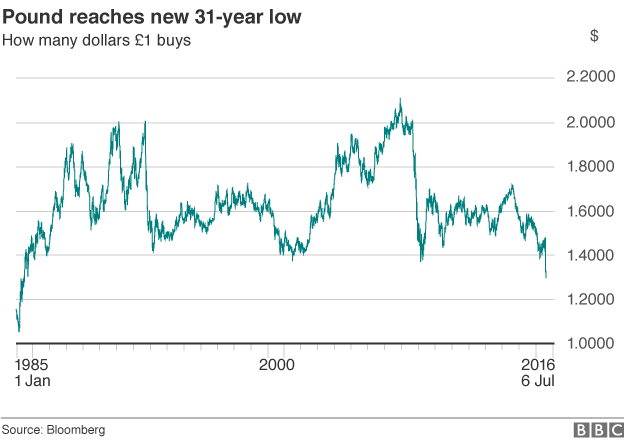

But as reality sank in and the Leave side pulled away the currency went into freefall touching lows of $1.30, levels not seen since 1985.

Since then the pound has had some better days but has still lost over 13% of its value against the dollar.

How low could it go?

The value of a nation's currency is often described as its effective share price - a gauge of how investors see the strength of the economy.

"The fall in the pound can be seen as a barometer of sentiment in the markets," says Jeremy Stretch, a currency analyst at CIBC.

"If a currency falls traders are effectively saying that it needs to go lower to make it attractive enough for them to make investments."

Despite having fallen to lows we have not seen for 30 years, some in the market think the pound could still fall further against the dollar.

"When you look at how quickly the pound has fallen in the past, I don't think it is beyond the bounds of possibility that we could see the pound in the low $1.20 range against the dollar," says Simon Derrick, head of currency research at Bank of New York Mellon.

So what does history tell us about one of the key drivers of the UK economy?

The highs

November 2007: sterling reached $2.11

The pound soared from $1.40 in 2002 right up to $2.10 in October 2007.

British tourists flocked to the US as the pound strengthened, often coming backed weighed down with suitcases full of clothes and gadgets.

The pound soared in the 2000s, up until the financial crisis of 2008

"It was in some respects the golden days for the UK with a booming financial sector and the sense of 'Cool Britannia' in the country," says Prof Albrecht Ritschl an economic historian at the London School of Economics.

The pound strengthened as the UK economy boomed, inflation stayed relatively low and interest rates offered a decent return for investors.

"It was a very settled economic environment with few political upheavals, completely different from the post-Brexit world we see today," says Howard Archer, an economist at IHS Global Insight.

Those heady days of economic boom were replaced with the financial crisis of 2008 which saw the pound collapse as the UK economy fell into recession.

The pound fell 35% to lows of about $1.40 in early 2009, before picking up as the UK slowly emerged from the downturn.

The lows

February 1985: Sterling reached $1.05

Back in February 1985, the pound slid to $1.05. But unlike today it was less a story of pound weakness and more to do with a very strong dollar.

President Reagan's fiscal policies pushed up long-term interest rates - and the value of the dollar

The combination of Ronald Reagan as US president and the tenure of Paul Volcker as chairman of the Federal Reserve saw the dollar appreciate 26% between 1980 and 1984.

President Reagan instituted a series of tax cuts and spending rises in an attempt to revive the economy. This in turn pushed up long-term interest rates, attracting inflows of capital and pushing up the value of the dollar.

Despite the pressure of the strong dollar, the UK economy was performing well at the time with economic growth of 2.3% in 1984 and 4.2% in 1985.

The strength of the dollar created international tension which was addressed in an unprecedented meeting of world leaders and central bankers at the Plaza Hotel in New York in September 1985.

The central bankers agreed that other currencies should appreciate against the dollar and followed their words with interventions in foreign exchange markets, selling dollars in exchange for other currencies.

The actions of those involved in the so-called "Plaza Accord" contributed to the dollar falling 40% between 1985 and 1987.

The pound gained ground on the dollar in the months that followed, hitting $1.88 in December 1987.

- Published6 July 2016

- Published7 October 2016

- Published29 June 2016

- Published5 July 2016

- Published5 July 2016

- Published5 July 2016