Odeon & UCI cinemas sold to China-owned firm

- Published

Odeon & UCI Cinema Group has been bought by AMC Entertainment, a US chain owned by Chinese conglomerate Dalian Wanda, in a deal worth £921m ($1.21bn).

Odeon & UCI is currently owned by private equity firm Terra Firma, and has 242 theatres with 2,236 screens.

Dalian Wanda, the world's biggest movie theatre operator, is led by China's richest man Wang Jianlin.

Odeon & UCI will continue to be based in London and will operate as a subsidiary of AMC.

Adam Aron, AMC's chief executive and president said in a statement, external: "This is a once-in-a-generation opportunity to acquire Europe's leading cinema chain and create the world's biggest and best theatre operator."

He said there were uncertainties created by Brexit, but added "we are encouraged that current currency rates are highly favourable to AMC with the pound falling to a three decade low versus the dollar".

Entertainment empire

The addition of Odeon & UCI will mean AMC has 627 theatres and more than 7,600 screens in eight countries.

The sale is still subject to competition clearance from the European Commission.

David Hancock, head of film and cinema at IHS Technology, said: "AMC is part of the Wanda group, which includes screens in China, AMC in the US, Hoyts in Australia and now Odeon UCI in Europe: all major exhibitors in their part of the world and making Wanda the largest global cinema exhibition group.

"In addition, Wanda has built the world's largest film production studio in China and acquired Legendary Entertainment, a US producer of blockbuster features, as well as assets in big data, entertainment marketing and gaming distribution."

Dalian's founder, Wang Jianlin, has a net worth of $32.6bn according to Forbes

Who is Wang Jianlin?

Wang Jianlin was born in 1954 and spent 16 years in the People's Liberation Army before moving into property.

He founded Wanda in 1988 and built it up to become China's biggest commercial real estate firm.

Wanda's expanding entertainment and tourism sector spans movie cinemas, theme parks and film production.

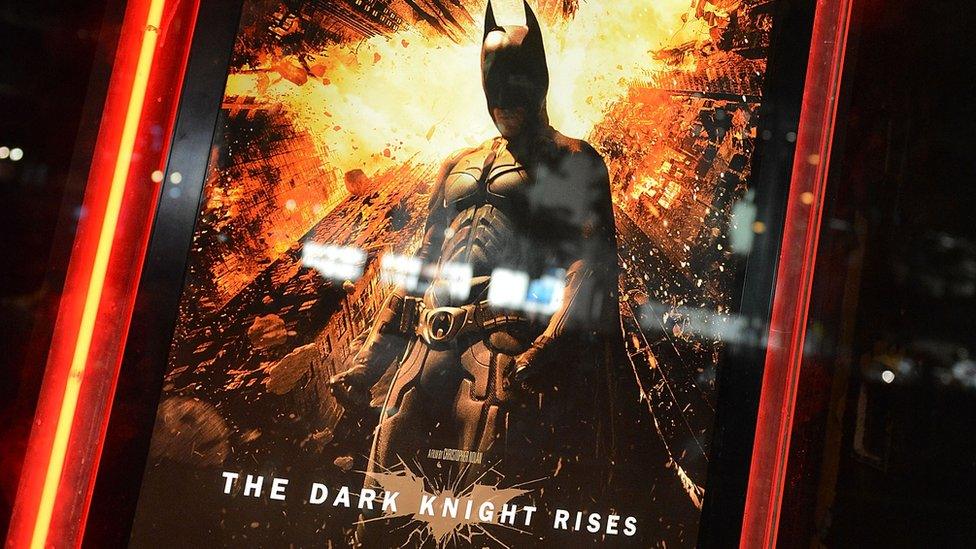

The company owns a share in a US film studio, Legendary Entertainment, the maker of blockbuster hits such as Jurassic World and the Dark Knight Batman trilogy.

As well as AMC, the Chinese giant has picked up a slew of other foreign companies - with a focus on investing in hotels and big foreign brands - including luxury British yacht maker, Sunseeker.

Sunseeker is one of the leisure-focused brands that Wanda owns

Mr Hancock said the Odeon & UCI sale had been a long-running saga.

Terra Firma paid €650m (£475m) for Odeon in 2004 and bought UCI the same year for €350m, merging the two groups.

The group, chaired by Guy Hands, is best known for its ill-fated £2.4bn takeover of record company EMI in 2007.

It tried to sell Odeon & UCI in 2011, but abandoned the process after failing to attract bids close to its £1.2bn valuation.

There was a second attempt in 2013 that also proved unsuccessful.

'Unrealistic view'

AMC was bought by Dalian Wanda Group in 2012.

AMC is still in the process of trying to buy US movie theatre operator, Carmike Cinemas.

It said the Odeon & UCI sale did not affect its ability to complete the Carmike deal.

But Mr Aron said there was a risk the purchase could fall through because some of Carmike's shareholders had an "unrealistic view" of the company's value to AMC.

- Published15 April 2016

- Published4 March 2016

- Published12 January 2016