Bank of England economist says sledgehammer needed for economy

- Published

The Bank of England's chief economist supports a "sledgehammer" approach to stabilising the post-Brexit economy as he admitted unemployment could rise.

In a speech, Andy Haldane supported easing monetary policy next month.

He said it needed to be "delivered promptly as well as muscularly", adding: "By promptly, I mean next month."

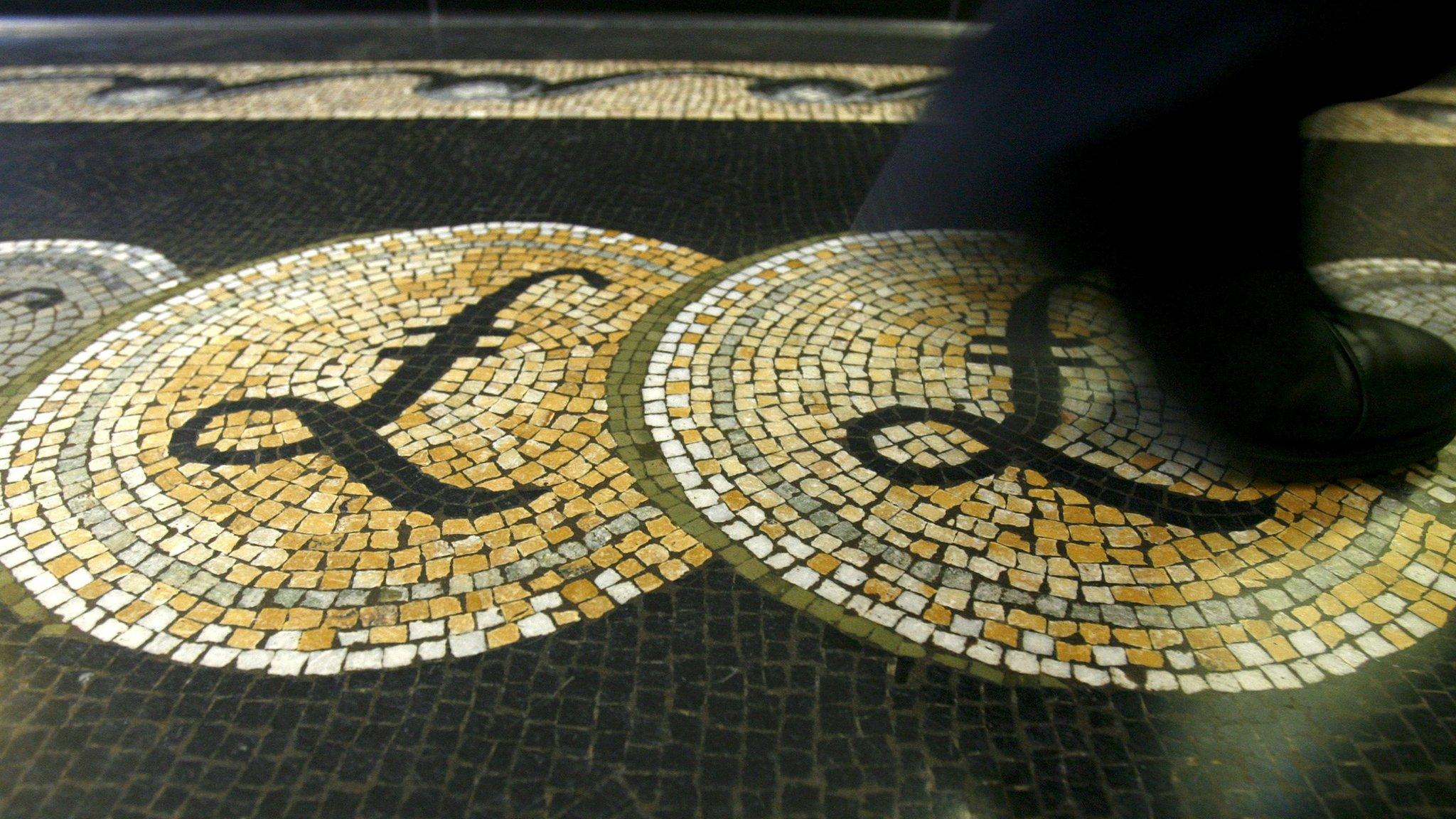

On Thursday, the Bank kept the interest rate on hold at a record low of 0.5%, where it has been since March 2009.

But minutes from the meeting of the Monetary Policy Committee, which includes Mr Haldane, said: "Most members of the committee expect monetary policy to be loosened in August.

"The precise size and nature of any stimulatory measures will be determined during the August forecast and Inflation Report round."

Speaking at a gathering in Port Talbot on June 30, before the speech was released on Friday, Mr Haldane said there is evidence that companies are reducing both hiring and investment.

He said: "There is no sense of slash and burn. But there is a strong sense of trim and singe."

He also admitted that there is a risk that "perhaps" unemployment could rise.

'Shawshank' move

Commenting on the need to act to stabilise the economy, Mr Haldane, said: "Put differently, I would rather run the risk of taking a sledgehammer to crack a nut than taking a miniature rock hammer to tunnel my way out of prison - like another Andy, the one in the Shawshank Redemption.

"And yes, I know Andy did eventually escape. But it did take him 20 years. The MPC does not have that same 'luxury'."

The fall in the pound against the dollar could provide a "shot in the arm" for UK exports and help propel inflation towards and even through the Bank of England's 2% target.

He emphasised that the Brexit was not a rerun of the financial crisis. He said: "The situation today could not be more different. The UK banking system is, by an order of magnitude, better capitalised and more liquid than then."

- Published14 July 2016

- Published14 July 2016

- Published13 July 2016