Bank of mum and dad used by 27% of first-time buyers

- Published

The number of first-time home buyers relying on the bank of mum and dad in England has risen sharply, according to official figures.

The government's housing survey, external shows that last year 27% of such buyers relied on friends or family for help with a deposit.

20 years ago, the figure was 21%.

More people are using inherited money for their first purchase, more are teaming up with a partner, and their average age is rising too.

The total number of people buying has also fallen by a third in the last ten years, despite government programmes like Help to Buy.

In 2014/15 there were 564,000 purchases by first-time buyers, down from 815,000 in 2004/05, and 857,000 in 1994/95.

'Out of reach'

The figures also show how more people are relying on private landlords to rent from.

Last year 19% of English households were privately rented, amounting to 4.3m homes.

That compares with 11% of households ten years ago.

"These figures are a glaring reminder that this country's drastic shortage of genuinely affordable homes means for millions finding a place to call their own is fast becoming out of reach," said Campbell Robb, the chief executive of the housing charity Shelter.

"Instead more and more people on ordinary incomes have no choice but to face a lifetime of expensive, unstable private renting, unless they're lucky enough to have help from friends and family."

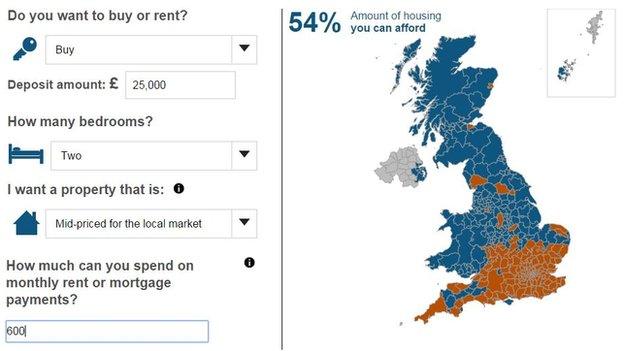

Where can I afford to live?