Blame it on the Brexit: But is it just an excuse?

- Published

Vote Leave campaigners say Brexit is just being used as an excuse

There is no shortage of companies blaming Brexit for their bad news these days.

Recent headlines have suggested Britain's decision to leave the EU is the cause of job losses in many parts of the UK, price rises for technology companies, the world's largest uncut diamond failing to sell at auction and even a major media group cancelling its staff party.

But is Brexit being blamed for a slew of bad news that was going to be released anyway?

That's the view of many Vote Leave supporters - a suggestion that is heavily disputed by leading figures in the Remain campaign.

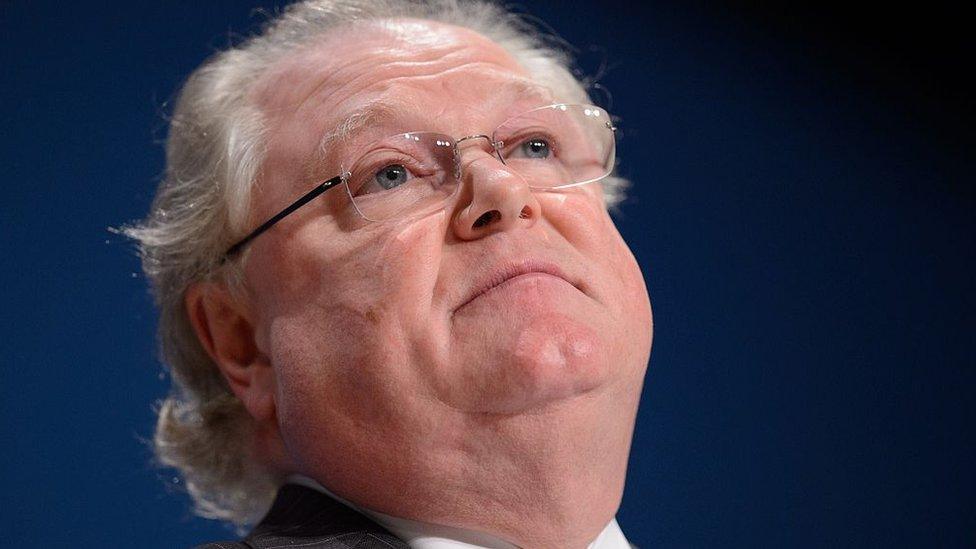

Making the case for Brexit being an easy thing to blame for wider problems is the former director of the big business lobby group, the CBI, Digby Jones.

Lord Jones, who was Gordon Brown's trade minister, is himself a Brexit supporter.

He believes the real impact of Brexit will be tiny: "There's not going to be any economic pain. If there are job losses, they will be very few.

Former CBI boss Digby Jones argues there will be few jobs lost because of Brexit

"One of our customers was thinking last week that they might not do a certain deal. Today they've said they won't and the reason is Brexit.

"It's got nothing to do with Brexit - but it's a very convenient thing to blame."

Business implications

That view leaves the people who ran the unsuccessful campaign to persuade Britain to stay in the European Union shaking their heads in despair.

Roland Rudd runs one of the UK's most influential PR companies, Finsbury, and was heavily involved in the Remain campaign. He says there is very little truth in the "Brexit as an excuse" theory.

"Of course, if a company has got a bad news story, and part of the reason is to do with Brexit, and part of it is to do with its own problems, they'll try and shift some of it onto Brexit.

"But the analysts aren't fools, the market can't be deluded like this. And so most companies will not do that, because it simply isn't credible."

Chancellor Philip Hammond said he might "reset" the UK's fiscal policy

Lucy Thomas, who was the deputy director of the Remain campaign, agrees and argues that the business implications of Brexit are obvious.

"Businesses hate uncertainty. That is exactly what we have now, we are going to have at least two years of uncertainty while a deal is negotiated."

Because businesses do not know what the UK's terms of trade will be with the EU once it eventually leaves, investment is being frozen, she says.

"Businesses are reconsidering all of their decisions - to dismiss that is frankly dishonest."

The financial markets are still making up their minds as to which side to believe. The pound fell heavily against the US dollar immediately after the vote, before making up some ground.

The pound may now be about 10% weaker, but the FTSE 100 is actually higher

Yet the UK's main share index, the FTSE 100, has reached levels not seen so far this year.

Meanwhile there has been a dramatic fall in economic activity, not seen since the aftermath of the financial crisis.

Both manufacturing and service sectors saw a decline in output and orders, though exports picked up, driven by the weaker pound.

Digby Jones says the big drop in the value of the pound should be taken with a pinch of salt.

"It wasn't a signpost to the British economy at all. It was a signpost of an immediate reaction to a decision."

He wants to focus on real economic data: "What's it going to do to the European economy, including us?

"It's not in the interests of 520 million people to indulge in the 'Great Remain Sulk'," he says.

'Buying opportunities'

This view is supported by seasoned market commentator, David Buik of Panmure Gordon.

He says the market gyrations that follow some headlines can often lead traders towards buying opportunities.

Each new set of economic data is likely to be argued over by both sides

"As long as they're on the right side of the trade, whoopee! There is money to be made whichever way the market is going.

"It's a little harder than it used to be a few years ago. It requires tremendous resolve, great character and quite a lot of guts," he says.

It will be some time before we know for sure which side is right when it comes to Britain's post-Brexit performance.

Which means that until a clear pattern emerges, we can expect each new set of data to be argued over by both sides for what it may say about the UK economy.

- Published22 July 2016

- Published22 July 2016