UK pay: British workers see biggest fall in wages - TUC

- Published

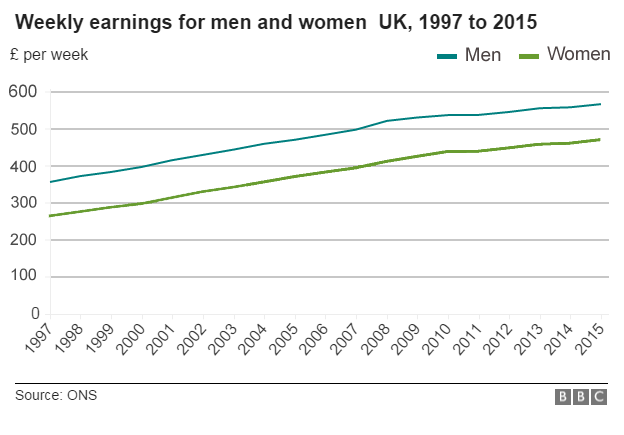

Women are still earning less, on average, than men, official figures suggest

Workers in the UK have suffered the biggest fall in wages among the world's richest countries since the financial crisis, research has suggested.

Between 2007 and 2015 wages in the UK fell by 10.4%, a drop equalled only by Greece, the analysis by the TUC found., external

Women's pay in particular needs to be boosted, the union body said. Women earn on average 19.2% less than men, according to the latest official data., external

The Treasury said the TUC's analysis did not fully reflect living standards.

The UK is the joint biggest faller on pay in 29 countries of the Organisation for Economic Cooperation and Development (OECD) - a forum for wealthy countries who work together to promote financial growth and social wellbeing.

The UK, Greece and Portugal were the only three OECD countries that saw real wages fall, according to the research complied by the TUC.

'Boost women's pay'

Over the same eight-year period real wages grew in Poland by 23%, in Germany by 14% and in France by 11%, the TUC found. As an average real wages increased in OECD countries as a whole by 6.7%.

Real wages is a term used for wages that have been adjusted for inflation over time.

"We need to boost pay across the board, particularly for the one in four women still facing low pay," said Frances O'Grady, general secretary of the TUC, a federation of trade unions in England and Wales.

"Wages fell off the cliff after the financial crisis and have barely begun to recover," she added.

She said people could not afford another hit to their pay packets, and that working people should not foot the bill for a Brexit downturn.

'We're living in a different age'

Hannah Jongsma, 27, who is originally from the Netherlands and previously worked for the British Medical Association for three years, is now studying for a PhD in psychiatry at Cambridge University

She gets about £1,100 a month and says the idea of her buying a house is "distant notion" and admits that life has become a "hand-to-mouth existence".

Hannah says her rent alone eats up more than half of her regular monthly allowance.

"We are living in a different age," she says.

"In terms of employment, permanent contracts for example have become so rare... temporary contracts basically mean you cannot plan for the future in the same way."

Conor D'Arcy, a policy analyst for the Resolution Foundation - a non-partisan think tank that looks at ways of improving living standards for Britons on low and middle incomes - said the financial climate had been particularly harsh for "millennials" like Hannah.

He said: "The UK has experienced the most prolonged pay squeeze in over a century in wake of the financial crisis, with young people feeling the biggest pay squeeze of all."

Millennials - people aged 34 and under - earned £8,000 less over the course of their 20s compared to the generation before them, he added.

A Treasury spokesman said the TUC's analysis ignored the fact that since the financial crisis the UK's employment rate had grown more than any country in the G7 - which is the world's leading seven industrialised nations.

"Living standards have reached their highest level and wages continue to rise faster than prices - and will be helped by the new National Living Wage," he said.

"But there is more to do to build an economy and country that works for everyone not just a privileged few, and we are determined to do exactly that."

What are average earnings in your area?

Click on this link, external to find out

- Published12 February 2016

- Published8 March 2016

- Published11 February 2016

- Published14 July 2015

- Published3 June 2016

- Published25 April 2016

- Published19 November 2015