Q&A: Better banking for you - what is the plan?

- Published

Some very big changes are now in the pipeline for the way people use their bank accounts and the way banks charge their customers.

The aim is to help people save money by encouraging them to change their banks, especially if they are likely to go overdrawn.

The plans come from the Competition and Markets Authority, external, which has the power to enforce its proposals.

They are the result of its two-year investigation.

What is this all about?

The big idea is that something must be done to break the inertia of the UK banking public.

Just 3% of individuals and 4% of businesses switch their banks in any one year.

The CMA has already come to the conclusion that there is not enough competition to pressurise the banks into offering significantly better or cheaper services than their rivals.

In effect the big five banks - RBS, Barclays, HSBC, Lloyds and Santander - plus the Nationwide building society have their own huge, but largely captive, markets.

So the aim is to make it easier for people to switch banks and accounts, and to encourage them to save money by finding a better deal.

"The older and larger banks, which still account for the large majority of the retail banking market, do not have to work hard enough to win and retain customers and it is difficult for new and smaller providers to attract customers," the CMA says.

What else is the CMA worried about?

The other big issue is one that has dogged the industry and its customers for many years - the ability of banks to charge more or less what they like if you go overdrawn without permission.

In 2009, the Office of Fair Trading (now part of the CMA) failed completely in a legal challenge which would have overthrown the right of banks to set their own charges as they saw fit.

Now the CMA is ordering the banks to set their own monthly cash limits - a monthly maximum charge - on just how much they can charge if you go into an unauthorised overdraft - going into the red without asking your bank in advance.

Of course that doesn't go as far as a regulator being allowed to set a monthly limit on overdraft fees and charges.

But the fact there will be some sort of stated cash limit will make things clearer.

"Many personal customers, in particular overdraft users, could make significant savings by switching to a different current account," says the CMA.

That particular change should happen by September next year.

What else will I see?

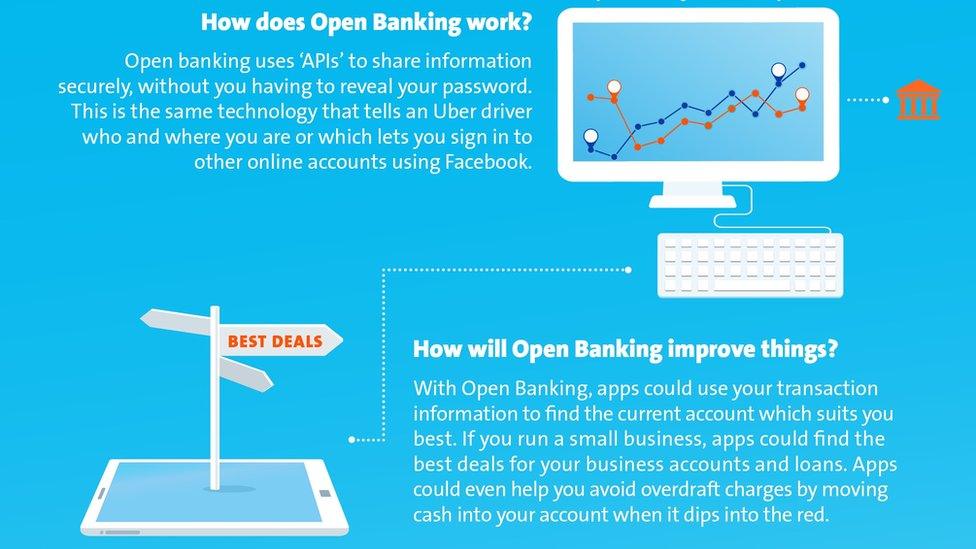

To encourage customers to switch or shop around, the CMA is ordering the banking industry to embrace the idea of Open Banking.

That means the financial technology industry is being invited to develop a computer application which will let bank customers run all their bank accounts, including moving money between them, even if they have several accounts spread around different banks.

The CMA describes how Open Banking will work

At the moment the increasingly popular bank apps, which are issued by banks to their own customers for use on mobile phones, operate that bank's accounts only.

This new, all-purpose, banking app should be able, the CMA says, to let customers upload all their banking details so that "authorised intermediaries", such as price comparison services, will be able to tell them where the best accounts and services are to suit the way they typically save and spend.

The CMA hopes that this will encourage customers to move money around, either to avoid upcoming overdraft charges, or to gain higher interest on more generous accounts.

What else?

There are quite a few other proposals, for instance:

obliging banks to publish more information on service quality

insisting that customers are sent occasional reminders to review their banking arrangements

and making it even easier for people to move their current accounts from one bank to another by improving the current account switch service, which was introduced three years ago.

How soon will all this happen?

The CMA has spent the past two years investigating the banking industry.

Its final report, published today, is just the latest in a very long line of official inquiries into the banking industry that have been held over the past 20 years or so.

But now the CMA's plans have been finalised and published, they have various implementation dates ranging from the beginning of 2017 to the autumn of 2018.