Mining sector outlook improves despite losses and Brexit

- Published

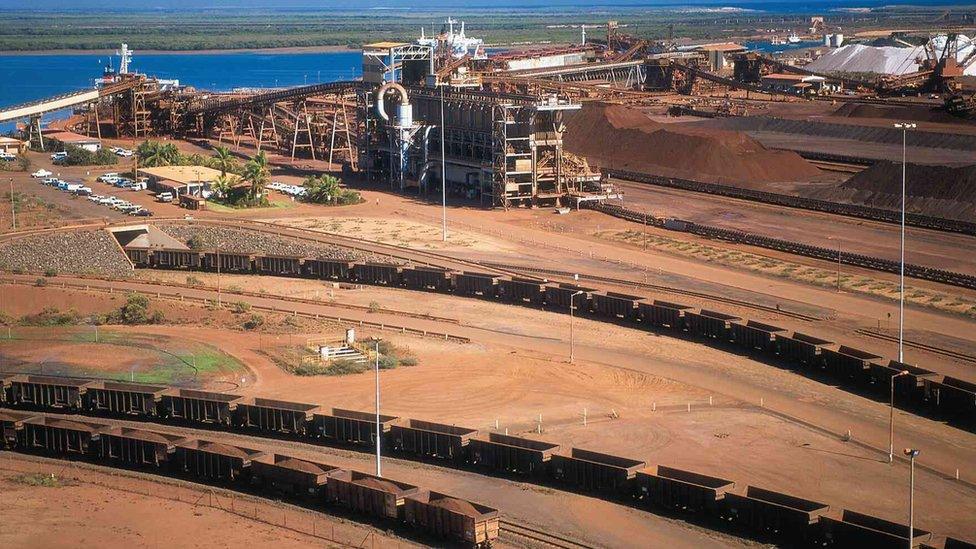

BHP Billiton iron ore depot in Port Headland, Australia

With mining company BHP Billiton reporting a record loss for the past year, you could be forgiven for thinking it was all doom and gloom for the sector. But all is not as it seems.

In fact, data from the FTSE 100 shows quite the opposite. The seven mining companies account for close to 5.5% of the value of the index.

"At the end of 2015 they accounted for around 2.5%, so they've more than doubled in a year, which is impressive," says Jeremy Wrathall, mining team leader at Investec.

The reversal in the fortunes of the sector is shown clearly by diversified mining company Anglo American's experience.

The FTSE 100 is made up of the largest 100 qualifying UK companies by full market value, and at one point Anglo was on the verge of being too small to remain a part of the list. Funding expansions led to a build up of debt which proved almost too much to handle when commodity prices crashed.

"There has been a dramatic turnaround in the industry since 2015," says Mr Wrathall. "It's now in relatively good shape whereas before we were seeing the likes of Anglo close to relegation."

Brexit Schmexit

Mining companies have been badly hit by slowing growth in China and dropping commodity prices.

One recent development that hasn't hurt the industry is the UK's referendum vote. That is because the firms do not make their money in pounds - and have therefore benefitted from the ensuing weak pound.

Mining stocks account for 5.5% of the FTSE 100

Tyler Broda, director of global mining research at RBC Capital Markets says the currency markets are certainly part of the mining industry's success so far in 2016.

"The sector is performing very well this year, they have 100% of revenues in US dollars so the weak pound has helped," he says.

The effect is clear to see. Since the vote on 23 June, share prices of mining companies have risen.

"For a UK investor searching for protection against pound weakness, looking for companies that earn in the dollar is a good idea," says Edward Sterck, metals and mining research analyst at BMO Capital Markets. "They represent a safe haven, but that's not restricted to mining companies."

Yield winners

Another bonus for investors in the sector, are the payouts being given to shareholders, known as dividends. With interest rates as low as they are, the news that shareholders were paid over and above what a company's dividend policy requires, as they were by BHP Billiton, has cheered investors.

"This is a notoriously volatile sector so it is high risk, but when the options are as dire as they are, mining comes into the view finder for those looking for a return," says Wrathall.

Precious metal prices have soared as investors look for a safe bet amid market ups and downs. This explains the stock price rally for the companies involved in mining for gold and silver.

Several mining companies have now indicated that they expect to see dividends resume or increase this year, which will no doubt be music to investors' ears.

Shareholders will be hoping for big dividends from mining companies going forward

Leading London

The London Stock Exchange has long been the home to many of the biggest diversified mining houses, including BHP, Rio Tinto, Glencore and Anglo.

That is in part down to the conditions the city offers. Being an established financial centre which continues to attract funds, companies can generally find the liquidity they need to go about their business. London is viewed as a secure place to invest money because of its solid regulations and strong rule of law. The country is also relatively politically stable, even post-Brexit.

Mr Sterck of BMO believes the trend was set a long time ago.

"This is a product of history," he says. "These companies have been around for a long time. In industrial revolution times, we had a lot of mines in the UK. British mining expertise has remained here. Therefore when looking for capital for exploration work, London became the natural place to come to."

RBC's Mr Broda agrees: "London has been the base for long term capital and as we went through the expansions in Australia, Canada and South America, you tended to see the historical relationships that Britain had with these countries come into play. London is open to global investing," he says.