Adopt Swedish-style shareholder committee on pay, says MP

- Published

UK companies should adopt a Swedish-style shareholder committee in an effort to curb excessive pay for bosses, an MP has said.

The five biggest shareholders in large publicly-traded companies would sit on the committee, said Chris Philp, MP for Croydon South.

It would make decisions on pay and hiring directors.

His plan follows a call from Prime Minister Theresa May for tighter controls on corporate excess.

"I'm concerned that large shareholders in big public companies are simply not sufficiently engaged in taking responsibility for their investments in the companies they are invested in," he told Radio 4's Today programme.

"Reckless corporate behaviour and out-of-control executive pay" were symptoms of shareholders not being in charge of companies they own, he added.

'Taking responsibility'

The top five shareholders, based on holdings of at least a year, would be part of the committee.

Shareholders could decline to be on the committee, but would be "named and shamed," said Mr Philp, who is also a member of parliament's Treasury committee.

Large shareholders such as pension managers and fund managers should be "more involved in taking responsibility" on pay and governance, said Mr Philp, who published his proposals in a report with the High Pay Centre.

In July, Mrs May said she wanted to tackle the "unhealthy and growing gap" between "bosses" and "workers".

"It is not anti-business to suggest that big business needs to change," she said.

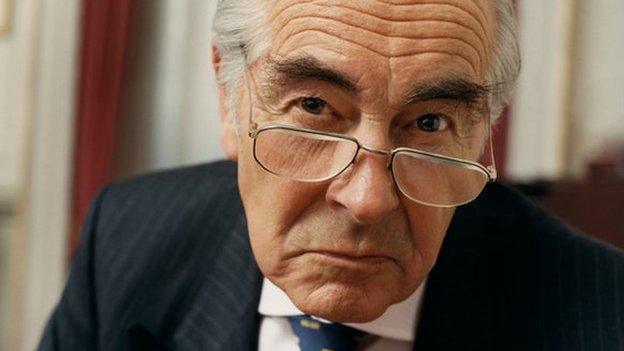

Analysis: Dominic O'Connell, Today programme business presenter

At another time, Chris Philp's ideas for the reform of executive pay might have fallen on stony ground. But the Conservative MP has chosen his moment well; when she was campaigning to lead his party, Theresa May singled out chief executive remuneration in her one speech on policy.

The new Prime Minister is clearly in the market for a cunning plan to tackle fat cats, and Mr Philp's strategy - or parts of it - might fit the bill.

Mr Philp wants to force big institutional fund managers to take a greater interest in pay, and an active role in policing.

The top five shareholders of every large listed company would be asked to go on a governance committee, and named and shamed if they refused. No longer would fund managers be able to duck out of tough decisions on pay packets, or hide behind the convenient fiction of the "abstain" vote at shareholder meetings.

There are obvious problems with Mr Philp's scheme. Fund managers have in shown themselves ready and able to revolt on executive pay - witness the stunning defeat of BP's board over pay at its annual meeting last year.

The inconvenient truth is that most fund managers are happy with most pay schemes and are only minded to act in egregious cases. The shareholder committees might simply replicate this sleepy status quo.

As shareholders are being taken to task by government, they have a target of their own in their sights.

A group of investors, led by the Local Authority Pension Fund Forum (LAPFF), is at odds with the Financial Reporting Council (FRC), a regulator for corporate governance and accounting standards.

At the heart of the row is whether investors and the public can trust company accounts.

'True and fair'

The row started when the FRC criticised a legal opinion which the LAPFF got from George Bompas QC on a point of company law. The LAPFF also employed Cherie Blair, the wife of Tony Blair, to argue its case.

Mr Bompas said in his opinion that new international accounting standards risked clashing with existing UK law that says companies must provide a "true and fair view" of their financial position.

Some shareholder groups, including the LAPFF, feel this clash has contributed to a range of scandals, from Tesco's accounting black hole to the collapse of HBOS and RBS.

The FRC wanted to say it had the government's backing, but now emails obtained under a freedom of information request showed the government actually refused to back the FRC's position and ordered it to tone down a response to the legal opinion.

'Real profits'

The LAPFF has written an open letter to FTSE 350 chairmen to show that the government would not back the watchdog.

"It's about whether we can trust the accounts and about whether the accounts have real profits which can find their way to shareholders' pockets or whether the accounts are imaginary," said Tim Bush, director or research at Pirc, which advises LAPFF.

The Financial Reporting Council said in a statement: "The FRC discusses policy issues on a regular basis with central government, as this [Freedom of Information] response shows.

"Our position on this issue is clear: the Companies Act 2006 does not require the separate disclosure of a figure for distributable profits.

"Ultimately interpretation of the Act is a matter for the courts. The FRC stands by what it has previously said on this matter."

- Published31 March 2015

- Published20 July 2016

- Published11 July 2016