Wetherspoon's boss attacks 'lurid' Brexit claims

- Published

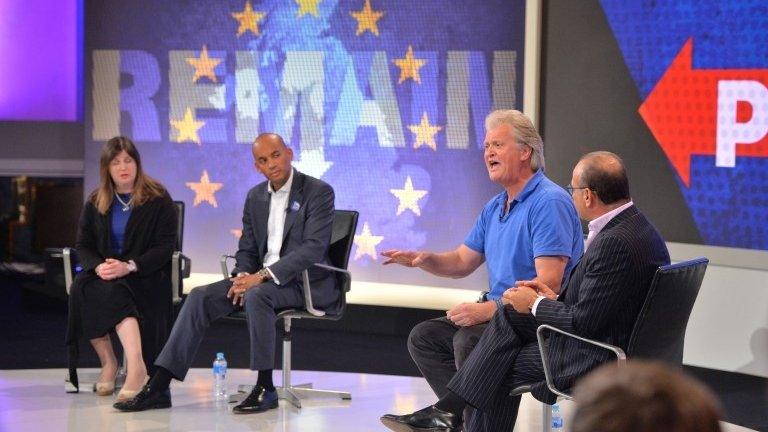

JD Wetherspoon's chairman has said claims that the UK would see serious economic consequences from a Brexit vote were "lurid" and wrong.

Tim Martin, an ardent supporter of Brexit, used his company's profits statement to attack a host of targets, including the CBI, the IMF, Goldman Sachs and the former prime minister.

They and others warned the economy would suffer post-Brexit.

Data on the UK economy showed a dip in July but has been positive for August.

Wetherspoon's itself saw annual profits rise 12.5%, external after exceptional items to £66m.

Tim Martin says UK does not need an EU trade deal

In a detailed and extended statement, Tim Martin lambasted those who had failed to "see through the flaws" of the European Union, and said their forecasts had been proved wrong following the 23 June referendum.

Using striking language, he told the BBC: "We were told it would be Armageddon from the OECD, from the IMF, David Cameron, the chancellor and President Obama who were predicting locusts in the fields and tidal waves in the North Sea."

Closely-watched economic surveys have shown a sharp rebound for UK services and manufacturing in August after the industries took a hit in July.

Mr Martin also suggested that the UK did not need a trade deal with the EU, adding that an unsigned agreement with a major supplier had worked perfectly well for his business for a number of years.

"Common sense ... suggests that the worst approach for the UK is to insist on the necessity of a 'deal' - we don't need one and the fact that EU countries sell us twice as much as we sell them creates a hugely powerful negotiating position," he said in the trading statement.

In May, Mr Martin printed 200,000 beer mats criticising the head of the IMF, Christine Lagarde, for saying that a vote to leave the EU would be "pretty bad to very, very bad".

'Tough'

In contrast to Mr Martin at Wetherspoon, pub and restaurant chain, Greene King, said it was cautious about the impact of Brexit on the pub business.

The company reported a 1.7% rise in like-for-like sales for the 18 weeks to 4 September, crediting the European football championships and decent weather for what it described as a "strong start" to the year.

It said that uncertainty surrounding the UK's future withdrawal from the EU had translated into a weakening of some economic indicators and a reduction in consumer confidence.

It said it had noted a number of recent industry surveys flagging risks to leisure spending and said it was "alert to a potentially tougher trading environment ahead".

The divergent messages saw the shares move accordingly. Wetherspoon shares were up 5% and Greene King down 5%.

- Published5 September 2016

- Published13 July 2016