The economics of a £10 an hour living wage

- Published

- comments

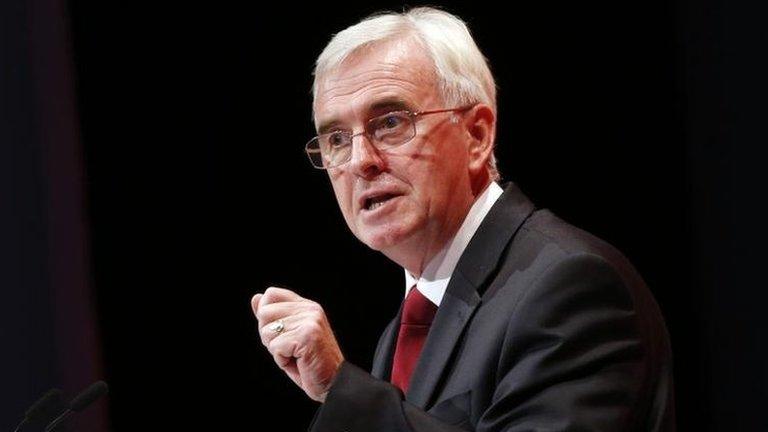

John McDonnell promised he would reveal a new "interventionist" underpinning to Labour's economic policy.

And the shadow chancellor did not disappoint.

New rules on takeovers to guarantee pay and pension payments, a doubling in size of the co-operative sector by giving workers rights to own businesses at the point of change of ownership or closure, bringing back "sectoral" collective bargaining "across the economy", and a change in tax emphasis from income to "wealth" - which could mean new taxes on assets, possibly homes.

But the biggest intervention was on the minimum wage, or as Mr McDonnell described it, Labour's plans for a "real Living Wage".

He suggested that it should be set at above £10 an hour.

That is a major increase - and well above the current government's plan to hit £9 an hour by 2020.

Mr McDonnell said he wanted to go further, making the bold statement that under a Labour government "everyone will have enough to live on".

Unions welcomed the move.

"Workers' difficulties keeping up with the cost of living has become a crisis across the country and it's up to the UK government to ensure that the lowest paid aren't left behind by the rising costs of rent, bills and essentials that threaten to overwhelm them," said David Hamblin of the GMB.

'Difficult decisions'

I am sure Mr McDonnell was ready for expressions of disapproval from business groups worried about costs.

"If a £10 minimum wage was to be introduced it would mean very difficult decisions for many small businesses - they would have to look at their business models," Adam Marshall, the acting director general of the British Chambers of Commerce, told the BBC.

"They may have to reduce their workforce, shift jobs overseas or look to automation.

"We should not be playing politics with these decisions. The rate should be set by the Low Pay Commission and be determined by the state of the economy.

"We criticised the [former] chancellor for his decision on raising the minimum wage to £9 an hour and we will criticise the shadow chancellor for proposing raising it to £10 an hour."

Higher costs

An extra £1 or £2 an hour may not sound like very much.

But for a business, over a year, it can make a considerable difference to the wage bill - often the largest part of any company's costs.

A £10-plus an hour minimum wage would raise an annual salary for the lowest paid to £19,250, according to the manufacturers' trade body, the EEF.

That would mean a business paying around £23,000 for each employee given the extra costs faced by employers such as national insurance contributions.

Labour has said that it will expand the Employment Allowance to mitigate the impact on the smallest businesses.

But nevertheless, the EEF fears that could make "entry-level jobs", often given to younger people and apprentices, far less attractive to businesses.

'Arms race'

Of course, that is not to argue that most businesses do not want fair wages.

It is just that, in economic terms, many argue that income levels need to be balanced with employment rates and how robustly the economy is growing.

The highly respected Resolution Foundation has done a substantial amount of research on how minimum wage policies best work.

One of their spokespeople said to me immediately after Mr McDonnell sat down: "Our view is that the national living wage should be linked to the strength of the economy; i.e. pegged to typical pay growth, rather than cash targets."

A little later Conor D'Arcy, Resolution Foundation policy analyst, told me: "The focus should be on tackling wider low pay problems, such as helping people progress off the wage floor and into higher pay roles, rather than engaging in an arms race."

The danger many businesses highlight is that the living wage is becoming politicised, a battle between two political parties keen to show the effort they are making on low levels of pay.

The Low Pay Commission - which has guided increases in the minimum wage since its inception in 1999 - was mandated to balance income levels with impact on employment and the strength of economic growth.

Many businesses believe it is a mandate that should not be abandoned lightly.