What's happening to the pound?

- Published

The pound plummeted in Asian trading early on Friday. And no-one really seems to know why.

Did a trader make a mistake? Did the computers go haywire? And where will the pound go next?

What actually happened?

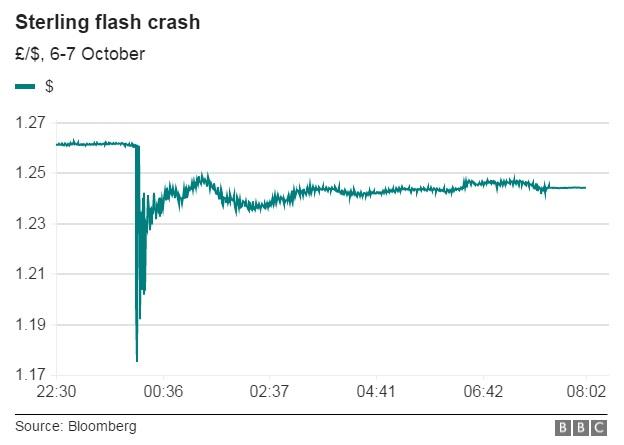

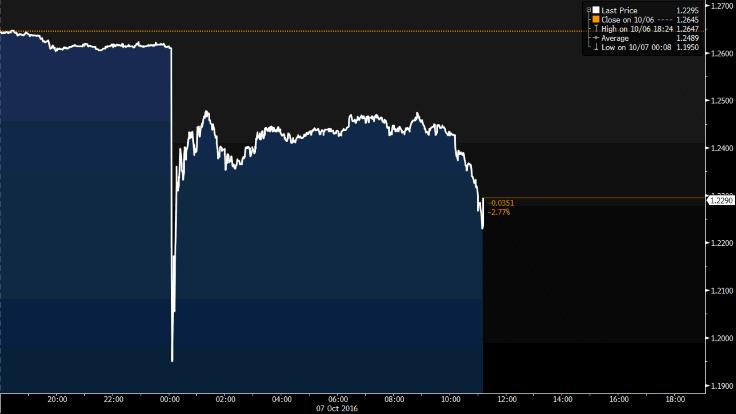

Overnight the value of the pound fell dramatically. It was briefly down 6%, hitting a value of $1.18 against the dollar, external at 7:09am in Hong Kong (00:09 in the UK).

The British currency has been on a downward trend since the Brexit vote, but this was the biggest move since the referendum on 23 June.

The pound recovered to $1.24, which was still down 1.5% on Thursday's value.

The flash crash happened during Asian trading

What caused the crash?

No-one knows for definite.

Market watchers quickly pointed to computer algorithms, which could have been reacting to a news story about French President Francois Hollande saying he wants to see tough negotiations with the UK over Brexit.

But it could also have been human error, as simple as a trader adding an extra zero to a number by mistake when making an order.

It could also have been exacerbated by the time. It was after 7pm in New York, so financial markets there had closed. It was the middle of the night in Europe, so markets here were also closed.

Both these regions are major players in the foreign exchange market. As the strife began for sterling, there were fewer buyers active in the market. Extreme movements are more likely at times of lower trading volumes as there are fewer trades to calm any market panic.

What exactly is algorithmic trading?

Also known as automated trading, this is where specialised, bespoke computer programs are designed to help traders work faster.

They will receive information from multiple sources such as data on previous crises and trades, as well as information from news sites and even social media. The programs then trade immediately in response.

The growth of automated trading has been rapid. The Bank for International Settlements says that between the 2007 and 2013, algorithmic trading at Electronic Broking Services (EBS), an FX trading platform used by market-making banks, grew from 28% to 68% of volumes.

Traders in Japan watch as the value of the pound tumbles

So do we need humans?

Absolutely. Computers cannot put the information they are receiving into context.

"The algorithms can over-react to news," says Kathleen Brooks, research director at spreadbetter City Index. "They are a fantastic tool, but cannot be used in isolation, you need a human keeping an eye on them."

Will we ever know what happened?

It's unlikely. The foreign exchange market is not one single market as it were, there are several platforms based in different countries.

A central clearing house, which records information on trades, as you have with stock market trading, would allow for an investigation into where a rogue trade came from.

Aside from the uncertainty as to whether this is what caused the pound to dive, the absence of a clearing house for the foreign exchange markets means this type of probe is not possible.

This means the person or firm responsible would have to own up.

Most experts predict further falls in sterling

Where will the pound go from here?

The good news is that the value of the pound recovered slightly, after the initial plunge. But the gradual decrease is expected to continue as the UK's economy struggles to cope with Brexit uncertainty.

John Wraith, head of UK rates strategy at UBS, predicts: "It is only a matter of time before less positive [economic] data starts to appear."

He expects the pound to reach parity with the euro by the end of next year - it last came close in late 2008.

Mr Wraith forecasts sterling will hit $1.20 by the end of 2017.

What does this mean for me?

In the short term, we will pay more for our holiday money, receiving less foreign currency for our pounds when we exchange them.

In the longer term, it is possible we will see prices in shops rise as companies importing goods into the UK pass on the higher cost they will see as a result of paying for things in currencies other than the pound.

- Published7 October 2016

- Published7 October 2016

- Published29 June 2016

- Published19 January 2016