Tesco in dispute with Unilever over price rises

- Published

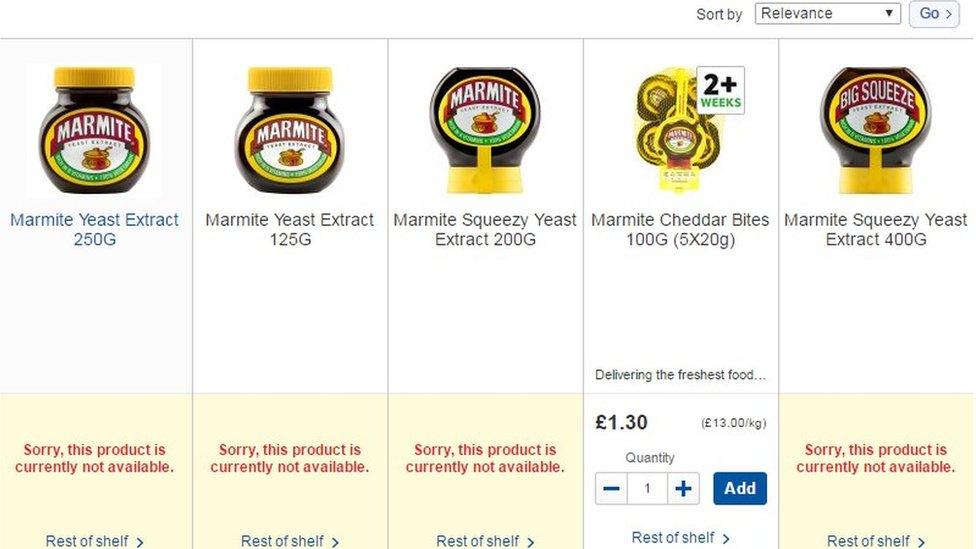

Popular products including Marmite and Pot Noodles have been disappearing from Tesco shelves amid a dispute between the supermarket and supplier Unilever.

The row developed when Unilever, which faces higher costs after the fall in value of the pound, attempted to pass them on in higher wholesale prices.

Tesco said only: "We are currently experiencing availability issues on a number of Unilever products."

"We hope to have this issue resolved soon," the company added.

However, it did not indicate when that might be.

Sterling has dropped by 16% against the euro since the UK's Brexit vote.

Unilever is the UK's biggest food and grocery manufacturer with many famous brand names.

Household names

Among those currently absent from Tesco's website are Marmite spread, Surf washing powder, Comfort fabric conditioner, Hellmann's mayonnaise, Pot Noodles and Ben & Jerry's ice cream.

Analysis: Emma Simpson, business correspondent

Who should absorb the increase in costs as a result of the weaker pound? It's the question that retailers have consistently been asked these last few months as import prices start to rise. Now that debate has exploded into the open with a stand-off between Britain's biggest consumer goods company and its largest retailer, Tesco.

Household staples, from Ben & Jerry's ice cream and Pot Noodles to Persil and Dove soap, are at stake. The extra spice to this story is that Tesco's boss, Dave Lewis, spent most of his career at Unilever before being poached by Tesco.

In the cut-throat world of grocery shopping, retailers are reluctant to pass on price rises to shoppers. But many suppliers are already seeing input costs rise because of the fall in the pound, although many will also have hedged their currency positions until at least the start of next year. So who ultimately takes the hit?

One grocery insider says in the case of Unilever, the weak currency was a smokescreen to raise prices, as some of the products are made in the UK.

Whatever the truth, this relationship is too important for the two sides not to reach a deal in the end. Will the other big grocers follow suit?

Unilever has declined to comment.

But the former head of rival firm Northern Foods, Lord Haskins, told the BBC's Newsnight that Brexit had caused "a huge wobble" in the market, which was already suffering tensions because of the rise of online shopping and discount supermarkets Aldi and Lidl.

"Undoubtedly what Unilever is doing is justified in terms of the economics of it, but Tesco's worried that Aldi may not follow suit," he said.

"They will have to follow suit, because the costs as a result of devaluation are too big for any company to carry."

Lord Haskins, who wanted the UK to remain in the EU, forecast that food price inflation would hit 5% in about a year's time.

He added: "The moment the great British public realises that there's a real cost to pay for Brexit, then the government will have to take account of that."

Cost squeeze

The former boss of Sainsbury's, Justin King, has given an indication of the problem, saying that shoppers should expect higher prices because supermarkets will not be able to absorb the extra cost of imported goods.

According to media reports of a conference speech by Mr King, he said: "Retailers' margins are already squeezed. So there is no room to absorb input price pressures and costs will need to be passed on.

"But no one wants to be the first to break cover. No business wants to be the first to blame Brexit for a rise in prices. But once someone does, there will be a flood of companies, because they will all be suffering."

Leading retail analyst Richard Hyman told the BBC: "This shines a light on something that is going to be happening all the time.

"The problem is that retailers can't just put up their prices and get away with it.

"Oversupply of retailers means that for the past 24 months there has been food price deflation. What makes them think they can just push prices higher?" he added.

- Published13 October 2016

- Published16 June 2016

- Published12 October 2016

- Published10 October 2016

- Published10 October 2016