UK inflation at 1% as price of clothes and fuel rises

- Published

- comments

Rising prices for clothes, hotel rooms and petrol have led to the highest rate of inflation in nearly two years, official figures show.

Inflation rose to 1.0% in September, up from 0.6% in August, the Office for National Statistics (ONS) said, external.

Clothing saw its biggest price rise since 2010 and fuel, which was falling a year ago, was also more expensive.

However, the ONS said there was "no explicit evidence" the weaker pound was the reason for higher prices.

Benefits hit

September's inflation figure has traditionally been crucial because it decided what rate benefits would increase by in the following year.

However, with the government having frozen many benefits and tax credits until 2020, many families will no longer see them keep up with rising prices.

More than 11 million households will, on average, be £360 a year worse off if inflation rises to 2.8% in the next few years, according to the Institute for Fiscal Studies (IFS).

For families on lower incomes who receive more in benefits, the hit will be bigger - on average a reduction of £470 a year, the IFS said.

'Price pressures'

Rising prices will "undoubtedly be tough on those with low incomes," said Ben Brettell, senior economist at Hargreaves Lansdown.

"It's also not good news for savers who are losing money in real terms," he added.

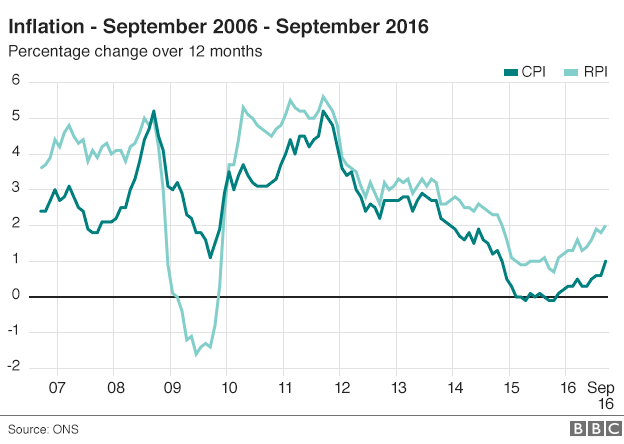

The jump in Consumer Price Index (CPI) inflation from 0.6% to 1.0% in September was the biggest month-on-month increase since June 2014.

The 1% rate is the highest since November 2014. However, ONS head of inflation Mike Prestwood said it was "low by historic standards".

Economists have predicted the cost of household items will rise further, particularly when the fall in the pound makes food and clothing from abroad more expensive.

Sterling has dropped nearly 20% against the dollar since the Brexit vote, including a 5% fall this month after Prime Minister Theresa May set a timeline for the UK's withdrawal from the EU.

Analysis, Kamal Ahmed, economics editor

The return of higher levels of inflation is likely to be one of the defining issues for Theresa May's government.

The reason for that is simple.

Once the figure for inflation rises above the figure for wage growth - at present running at just over 2% - then incomes start falling in real terms.

That is politically uncomfortable for any government, particularly one that has staked its reputation on making the economy work "for everyone".

Howard Archer, chief economist at IHS Global Insight, said: "Even before the pound has sunk to new lows in October, it is notable that price pressures were building up down the supply chain."

The recent row between Tesco and Unilever over the price of Marmite and other foods was "a taste of things to come", he said.

Kathleen Brooks, research director at City Index, said that with the fall in the pound: "Oil imports are getting more expensive, clothing imports are also costing more, and the weak pound is boosting the tourism industry, which appears to already be fuelling a rise in hotel prices."

Others said these pressures left the UK on course to exceed the Bank of England's target of a 2% inflation rate.

Chris Williamson from forecasters IHS Markit said the Bank's target could be "breached within months, though much depends on the exchange rate and the extent to which costs continue to rise".

The CBI business lobby group agreed, saying: "It's still too soon for sterling's recent depreciation to affect today's inflation figures, however we do expect it to push up prices through the course of next year, which will hit the pound in people's pockets."

Maternity and paternity pay, as well as some disability benefits, are set to rise, though, as they are some of the few remaining benefits linked to the September inflation figure.

The basic state pension is also likely to be raised by 2.5% from next April, taking it over £122 a week.

Since 2010, the government's "triple-lock" policy has meant state pensions rise by the inflation rate, average earnings or 2.5% - whichever is highest.

CPI inflation measures the price of a "shopping basket" of more than 700 items, from the cost of women's leggings to a multipack of fizzy drinks.

The Retail Prices Index (RPI) measure of inflation, which is calculated differently from CPI, rose to 2.0% in September from 1.8% in August.

- Published18 October 2016

- Published17 January 2017

- Published17 October 2016