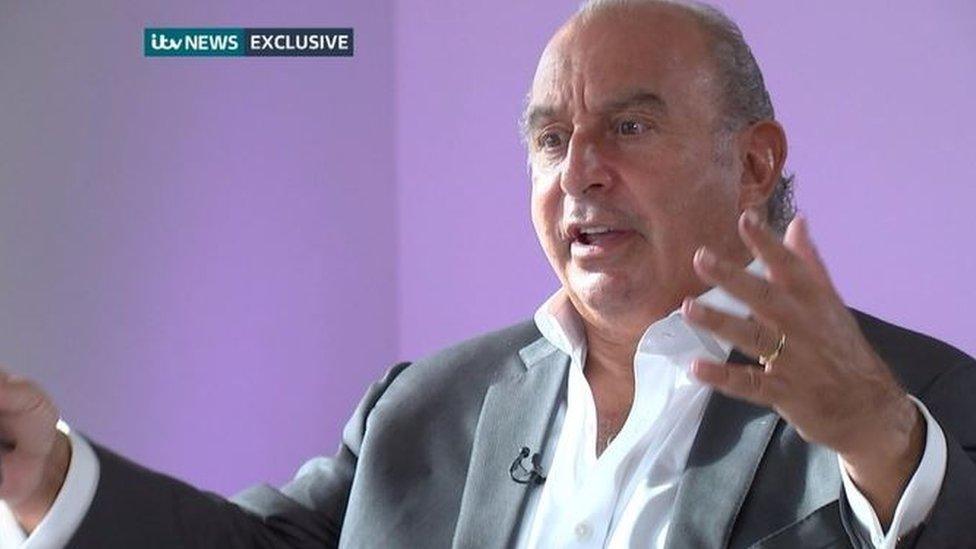

Sir Philip Green 'sad and sorry for BHS hardship'

- Published

Sir Philip Green has said he is "sad and very sorry" for the hardship caused by the BHS collapse and that he still wants to sort out the pension deficit.

The billionaire told ITV News that he "did everything possible" to keep the business from going under.

BHS, sold by his Arcadia Group for £1 last year, collapsed with the loss of 11,000 jobs and a big pension deficit.

Earlier on Tuesday, lawyers for Sir Philip hit back at MPs over a report into the BHS failure.

The MPs were accused of making "very serious factual and legal errors" in their report.

Sir Philip's ITV interview comes as parliament prepares to debate stripping him of his knighthood.

He told the broadcaster: "I want to start with saying how sad and very, very, very sorry I am for all the hardship and sort of sadness caused to all the people who worked there, and all the pensioners.

"I hope and believe all the people that worked very closely with me at BHS for all those years, and some for the whole journey, will know it was never my intention for the business to have the ending it did."

He said he was in a "very strong dialogue" with the pensions regulator to find a solution, but would not put a number on the level of financial support he would be willing to give.

"I can't get into a conversation with you about any of the detail," he said.

"The answer is, it will take what it takes to resolve it. We are in that discussion. There are some things outside of my knowledge... how it works, how the funds are deployed, how they're invested. The whole thing just needs to come together."

Sir Philip said the sale of BHS to former racing driver and bankrupt Dominic Chappell "was clearly, categorically the wrong buyer".

Sir Philip added: "But we made that decision and, you know, for the last year, and on a daily basis, I, and my family, have got to live with this horrid decision, and trust me, these are not fun days."

'Bizarre'

Before the interview was broadcast, details of a review commissioned by the retail tycoon, and carried out by two QCs, were released.

MPs criticised Sir Philip for the money he took out of BHS while leaving it with a £571m pensions deficit.

But Lord Pannick QC and Michael Todd QC called the MPs' findings "bizarre" and "unsupportable".

They claimed Sir Philip's decision to sell BHS to Mr Chappell was an "honest mistake".

A statement issued by Sir Philip's holding company, Taveta Investments, said: "The Taveta directors very much regret the terrible impact that the failure of BHS has had on former BHS staff and BHS pensioners and we accept that, with hindsight, it was a mistake to sell BHS to Retail Acquisitions Limited and Dominic Chappell.

"But it was an honest mistake and the sale was made in good faith to a buyer who retained a large team of well-known professional advisers, including Olswang and Grant Thornton."

'So unfair'

However, it added: "There was nothing unlawful, improper or even unusual about Taveta and Sir Philip Green's decision to assist Dominic Chappell and Retail Acquisitions Limited in the purchase of BHS. The select committees' criticism in this regard is bizarre."

The QCs' review claimed that the select committees' inquiry process was "so unfair that, if parliamentary privilege did not prevent a legal challenge, a court would 'set aside' the report".

Mr Chappell took a total of £2.6m out of BHS, including a £600,000 salary

A joint report by MPs on the Business and Work and Pensions select committees has held Sir Philip responsible for leaving BHS with the pensions black hole, taking about £400m in dividends from the department store chain, and then eventually selling it to Mr Chappell for just £1.

'Wiggle'

The retailer's collapse resulted in the loss of 11,000 jobs and has left 20,000 pensions in limbo as the Pensions Regulator remains in talks about the scheme's future.

The Taveta statement said: "These dividends were lawful and were paid at a time when the BHS pension schemes were in surplus. BHS was not sold until 10 years later."

"The law does not prevent a company from paying dividends because of a risk that the company might become insolvent many years later.

"The main causes of the pension deficit were the increasing longevity of pensioners and the global financial crisis in 2008," the company added.

Iain Wright, chair of the Business select committee, accused Sir Philip of trying to "wiggle off the hook for his responsibilities".

"The report from Sir Philip Green's no doubt expensively appointed lawyers is just the latest wheeze by Sir Philip to wiggle off the hook for his responsibilities to BHS pension holders," he said.

Knighthood debate

Frank Field, chairman of the Work and Pensions committee, said the report was agreed unanimously by MPs on two committees and based on "huge amounts of evidence".

"MPs are entitled to have views and to take those views with them into parliament," he said. "But the House will draw its own conclusions later this week," he added.

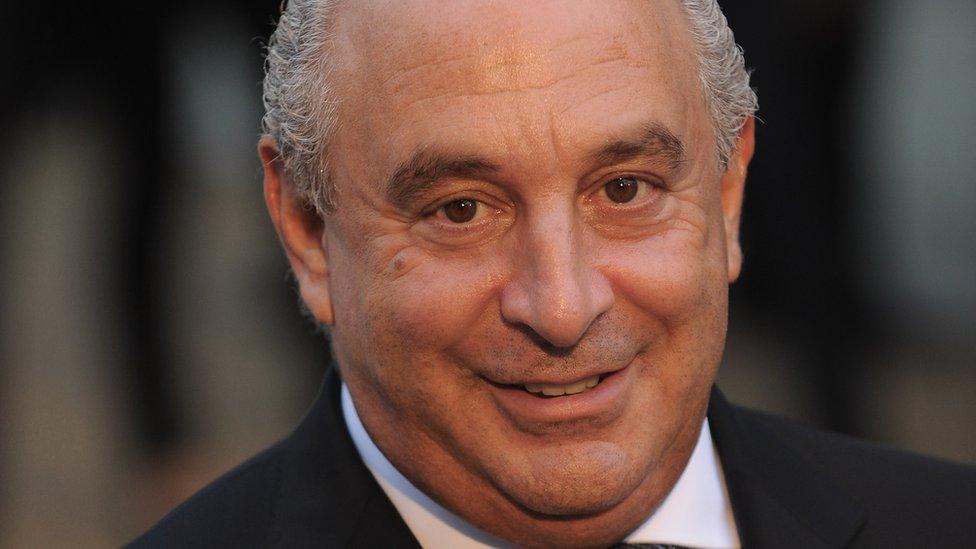

A debate in the House of Commons on Thursday will discuss whether Sir Philip's knighthood, awarded in 2006 for services to retail, should be removed.

- Published13 October 2016

- Published27 November 2020