Clydesdale confirms Williams & Glyn offer

- Published

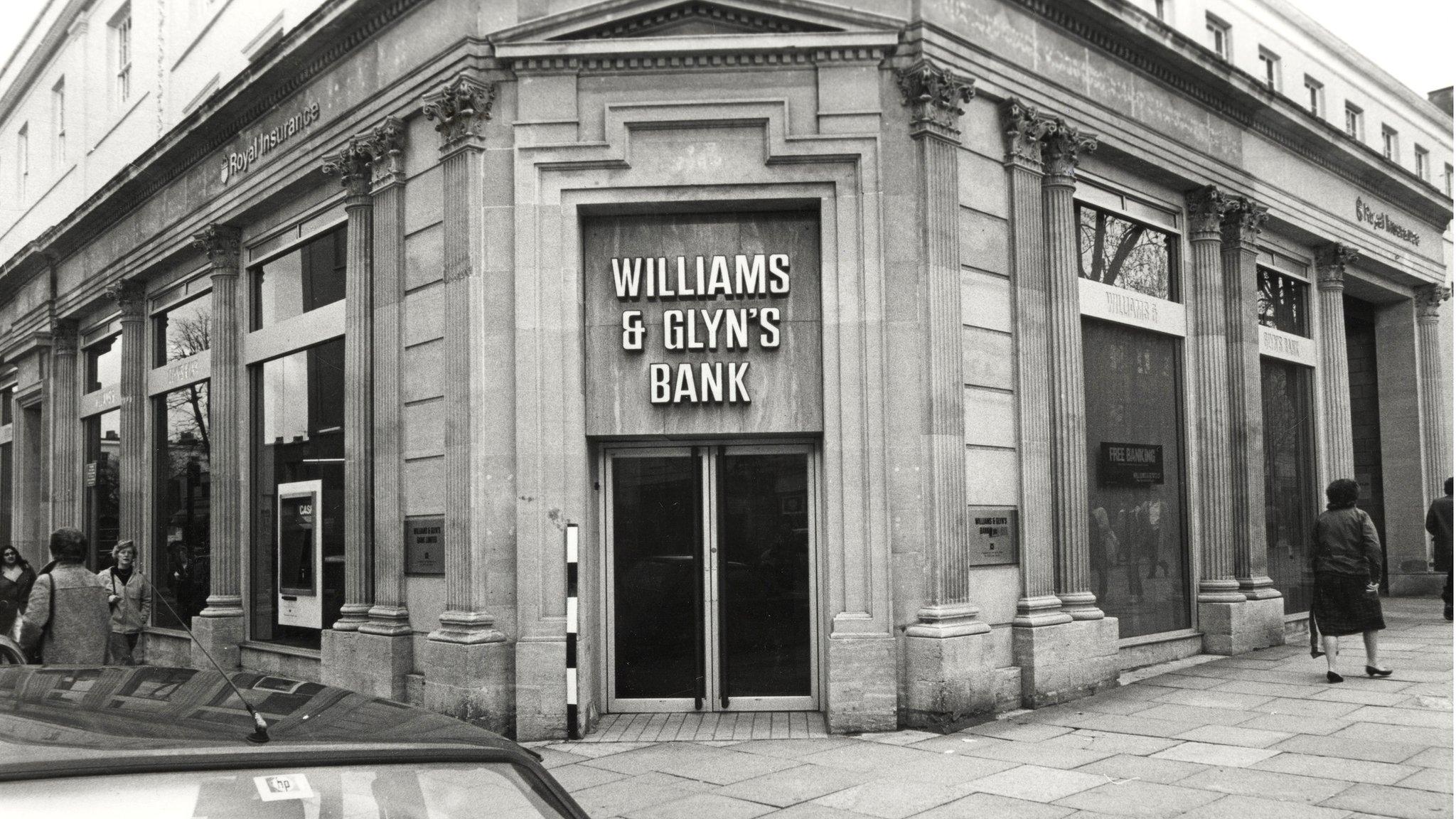

The Williams & Glyn brand disappeared in 1985

Clydesdale Bank has confirmed that it has made an offer for Williams & Glyn, the banking business that Royal Bank of Scotland failed to sell to Santander.

In a statement, external, Clydesdale said it had been in talks with RBS and had made a "preliminary non-binding proposal" for the business.

However, the bank said talks were continuing and there was "no certainty" that a deal would be struck.

RBS has been ordered to sell the business by the European Commission.

That order related to the bank's £45bn government bailout at the height of the financial crisis in 2008.

European regulators had originally demanded that the sale of Williams & Glyn should be completed by 2013 to prevent RBS, the UK's largest lender to small businesses, from having too dominant a position.

The European Commission has ordered RBS to sell the business by the end of 2017

Analysis: Douglas Fraser, Scotland business and economy editor

The Clydesdale wants to carve a niche as one of the bigger challengers to Britain's big five banks. A deal to buy Williams & Glyn would put it well ahead of the others jostling for that position.

The Glasgow-based lender has had a good run since it floated in February - in results and in share price, up from 180p to 275p.

Its 250-branch network has strengths in Scotland and Yorkshire. The RBS spin-off could be a good fit with that, complementing in geography while offering a similar range of service.

The big problem for Williams & Glyn has been technical. Splitting the IT systems has cost more than £1.5bn, and it doesn't sound like the process is finished yet.

Previous attempts at a sale have fallen through. A planned float was abandoned because Williams & Glyn wasn't strong enough to stand alone.

RBS is running out of both options and time. It has to meet a European Commission deadline of December 2017. One recent report speculated that the Brussels commission could put a trustee in place to sell Williams & Glyn.

That should help the Clydesdale's bargaining position. If it's smart about negotiations, there ought to be an attractive price for the buyer.

Clydesdale said: "A transaction will only be pursued if it is determined by the board to be in the best interests of CYBG [Clydesdale Bank] shareholders."

Santander abandoned plans to buy the business from RBS last month, with reports saying the two sides could not agree on a price.

The Williams & Glyn brand disappeared in 1985 after being replaced by the RBS brand. The resurrected Williams & Glyn business will have 300 branches and about 1.8 million customers.

Shares in Clydesdale Bank fell 0.6% to 270.4p on Wednesday, but have risen almost 44% since it floated in February.

- Published25 October 2016

- Published2 August 2016