Tata hits back at Cyrus Mistry claims

- Published

Cyrus Mistry said the company faced fundamental problems

Tata Sons has hit back at its former chairman, Cyrus Mistry, claiming he made "malicious allegations" against the Indian conglomerate.

Mr Mistry was unexpectedly sacked on Monday and a highly critical five-page letter he sent to the Tata board was leaked on Wednesday.

He alleged constant interference in his decisions and outlined a litany of fundamental problems at the company.

Tata Sons dismissed Mr Mistry's claims out of hand.

"The correspondence makes unsubstantiated claims and malicious allegations," Tata Sons - the holding company of Tata Group - said in a statement issued on Thursday. "These will be responded to in an appropriate manner."

Tata gave no explanation for replacing Mr Mistry with his predecessor, Ratan Tata, on Monday.

In his letter Mr Mistry offered a brutal assessment of many aspects of the Tata Group, warning it could face writedowns worth almost 1.2 trillion rupees ($18bn).

Tata Quiz: What did Cyrus Mistry say?

Bollywood drama: The Tata troubles

Mr Tata made numerous acquisitions in his time at the top, overseeing deals such as the $12bn acquisition of Corus, the former British Steel, in 2007, and the purchase of Jaguar Land Rover a year later.

Tata claimed that Mr Mistry's time as chairman was "marked by repeated departures from the culture and ethos of the group".

He had "overwhelmingly" lost the confidence of the board, the statement said.

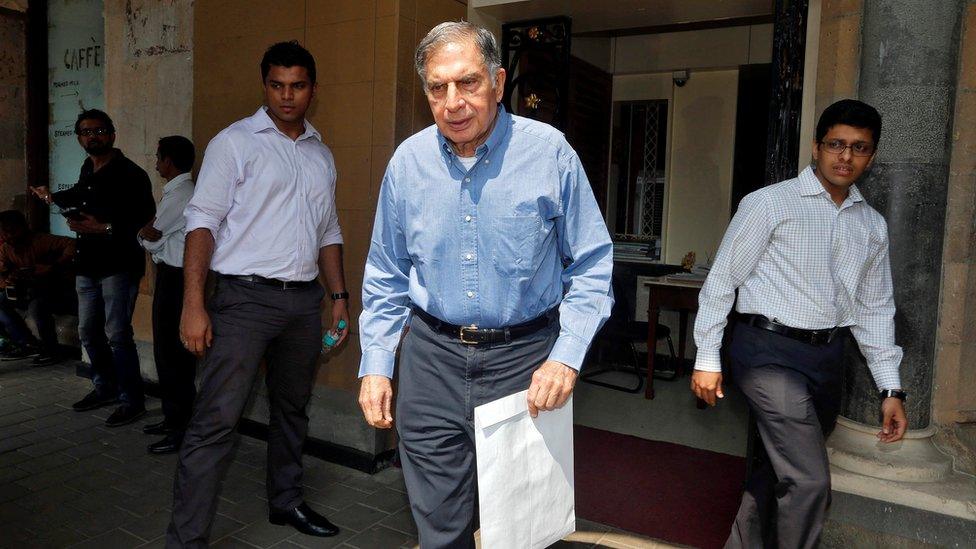

Ratan Tata leaving his office in Mumbai on Thursday

Public corporate spats are rare in Indian corporate life, particularly with well-established conglomerates and business elders such as Mr Tata, who ran the Tata group for more than two decades before hand-picking Mr Mistry as his successor.

J. N. Gupta, a former executive at India's markets regulator and now managing director at Stakeholders Empowerment Services, said: "It has taken everyone by surprise. Nobody would have thought such things could happen at Tata."

Nalin Kohli, a national spokesman of Prime Minister Narendra Modi's Bharatiya Janata Party and a supreme court lawyer, said: "The larger question will remain whether a legal battle will serve the interests of shareholders."

- Published27 October 2016

- Published27 October 2016

- Published26 October 2016

- Published24 October 2016