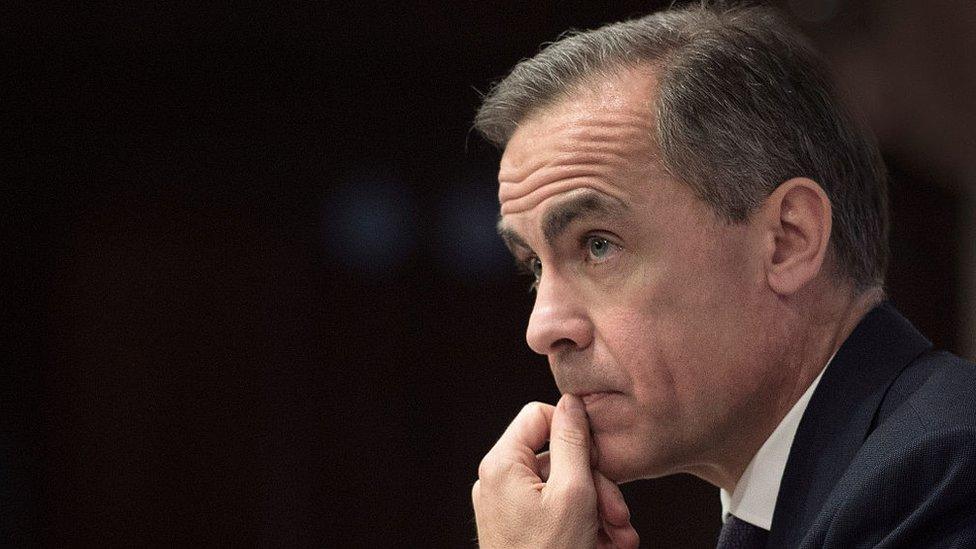

Carney has 'wobbled' on Bank future

- Published

- comments

The governor has always made it clear - his decision on whether he will extend his time as head of the Bank of England until 2021 will be made by the end of the year.

But with speculation rife about what that decision will be, pressure is growing on Mark Carney to make the position clear as soon as possible.

Sources close to the governor are now saying he may be obliged to make his announcement on Thursday at the time of the Inflation Report, the Bank's quarterly assessment of the state of the economy.

Given he may not want to overshadow that important event, could he even be persuaded to make an announcement a day or two earlier?

Has he decided?

That depends on whether his mind is definitely made up.

And if it isn't, quite, then his next appearance before the Treasury Select Committee later in the month will loom into view.

Certainly those close to him believe he is leaning towards staying for a full eight year term rather than the five years he initially signed up to.

And this morning The Financial Times reported that Mr Carney was "ready to serve" a full eight year term.

That would mean remaining governor until 2021, rather than 2018, and is certainly the government's preferred option.

But, Mr Carney's journey to that position has not been a smooth one.

Immediately after the referendum, the Governor felt a 2018 exit might be the best option according to several sources.

Did he really want to stick around to "manage decline" as one person familiar with his thinking put it to me.

Or watch a "slow motion car crash" as another described it.

But since then Mr Carney's resolve, I am told, has stiffened.

The August cut in interest rates by the Bank and the expansion of quantitative easing - the supply of extra financial support to the government, banks and businesses - was welcomed by many and lifted economic confidence.

And with the wholesale change in the top positions in government, many in the markets looked to him as one of the few voices of continuity - well known on the world stage and still in post after the Brexit vote.

'Bad side effects'

The governor remained a reassuring voice, a number of senior figures in the financial world argued.

Since then, there have been further wobbles when some senior figures close to the governor have sensed he might look again at a 2018 end date.

Theresa May's comments at the Conservative Party conference suggesting the Bank's ultra-loose monetary policies had "bad side effects" went down badly with many at the Bank.

The Prime Minister's further argument that "a change has got to come" only exacerbated a sense that the Bank's independence might be in question.

Downing Street has since reassured the Bank that it has no intention of clipping his wings.

If politicians had suggested anything else, Mr Carney would surely have walked.

The governor has also made it clear that it is not just his future he is talking about, but that of his wife and four daughters who all moved to the UK with him in 2013.

I am told he wants to ensure they are all happy with any decision to stay.

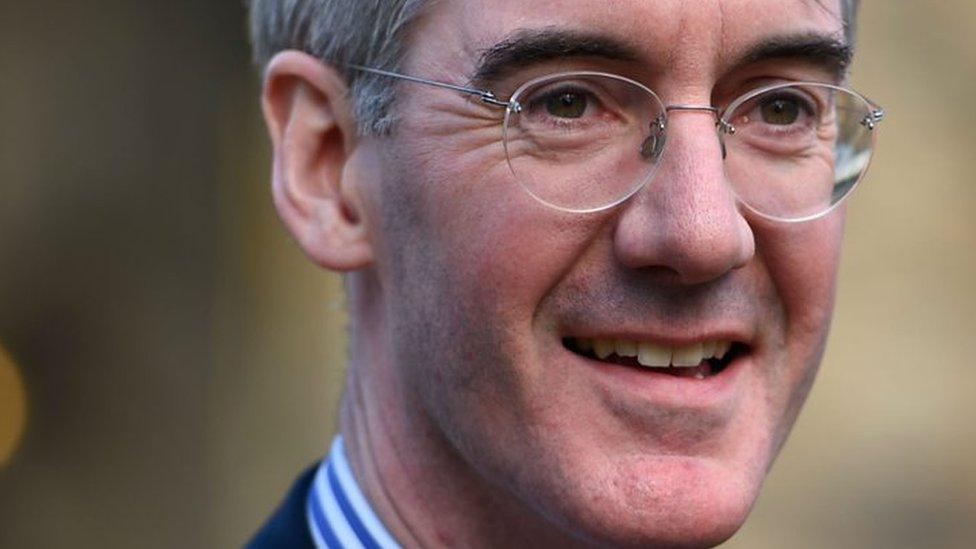

Treasury Select Committee member Jacob Rees-Mogg thinks Mark Carney should resign

Nothing I have heard over the last few weeks - and I have spoken to many people in Mr Carney's inner circle - suggests to me that the governor wants to leave in 2018.

To announce now that he will go in two years would see power immediately begin draining away.

The markets would also be left with a further layer of uncertainty to contend with.

And the voices of those politicians such as Jacob Rees-Mogg, a member of the Treasury Select Committee, and Lord Lawson, the former chancellor, who think the governor should resign immediately given his economic warnings before the referendum, would only become louder.

I think Mr Carney would also see it as a personal defeat.

The Governor of the Bank of England, not staying to make Brexit a success, which he says it can be, but walking off the pitch at just the time the markets are calling for economic stability and certainty.