Banks promise to increase support during branch closures

- Published

Birchington in Kent has lost all four of its banks over the past year

High Street banks have promised to give more support to those customers who are affected by plans to close local branches.

Banks say they are altering guidelines and will inform people more promptly and put better trained staff in place.

The decision follows an independent report which said for some losing their bank branch was like a "bereavement".

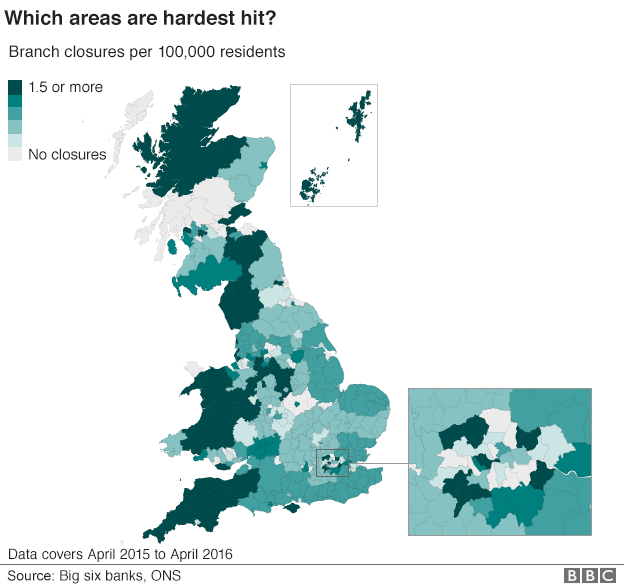

The UK has lost 1700 bank branches in recent years as customers switch to online banking.

The British Bankers Association's pledge to update its Access to Banking Protocol - the guidelines covering the way banks manage branch closures - comes in response to an independent report by Professor Russel Griggs.

Professor Grigg's report said banks were using the correct "robustness and rigour" when deciding whether to shut branches, but could "significantly improve" the way they engage and communicate with their customers over the closures.

"Many of those receiving this information [that a branch is to close] will disagree with it and be unhappy about it," he said.

"I likened it to one group as a bereavement, which may seem harsh but in terms of the emotion it generates I think it is very similar."

Support the vulnerable

The British Bankers Association (BBA) said it would be working with Professor Griggs to update the guidelines.

"As Professor Griggs recognises, we are in the midst of a consumer-led digital revolution in the way we do our day-to-day banking. However, banks are very aware no customer or business should be left behind and branches play an important role in the life of local communities," said Anthony Browne, chief executive of the BBA.

The BBA said its updated guidelines will suggest that banks:

have specially trained staff to help customers find alternatives when a branch is closing

tell local communities as quickly as possible after the decision to close a branch has been made

work more proactively to support elderly and vulnerable customers

The new guidelines come into effect in 2017.

Caroline Abrahams, charity director at Age UK said she welcomed the results of the review but said "it's clear that banks need to give much more thought to what their older customers actually need.

"The over-65s are a highly diverse cohort... but many remain digitally excluded and are unable to access online banking or embrace new technologies."

The banking chains have decided to close branches in different parts of the country

- Published13 May 2016

- Published17 October 2016

- Published6 May 2016