Snapchat 'files for stock market float'

- Published

- comments

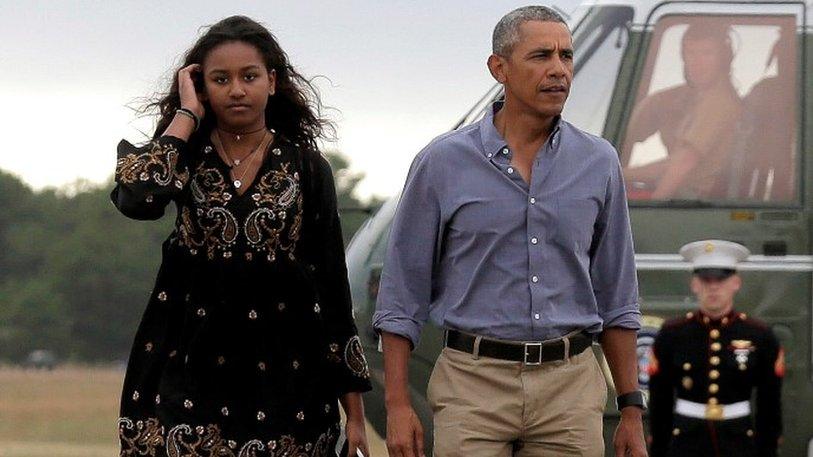

Dave Lee takes to Snapchat to ask if it is really worth $25bn

Snap, the parent company of messaging app Snapchat, has filed to list on the US stock market, according to several reports.

Based on investments so far, the California-based firm would be worth between $20bn and $25bn (£16bn-£20bn).

That would make it the largest US flotation since Chinese e-commerce giant Alibaba listed two years ago.

Snapchat's parent company Snap declined to comment on the reports to the BBC.

Young audience

The company began in 2012 as a mobile app that allowed users to send photos that vanish within seconds.

It now has 100 million daily users, which is more than Twitter.

And with 60% of its users aged between 13 and 24, it is seen as an appealing way for advertisers to reach young people.

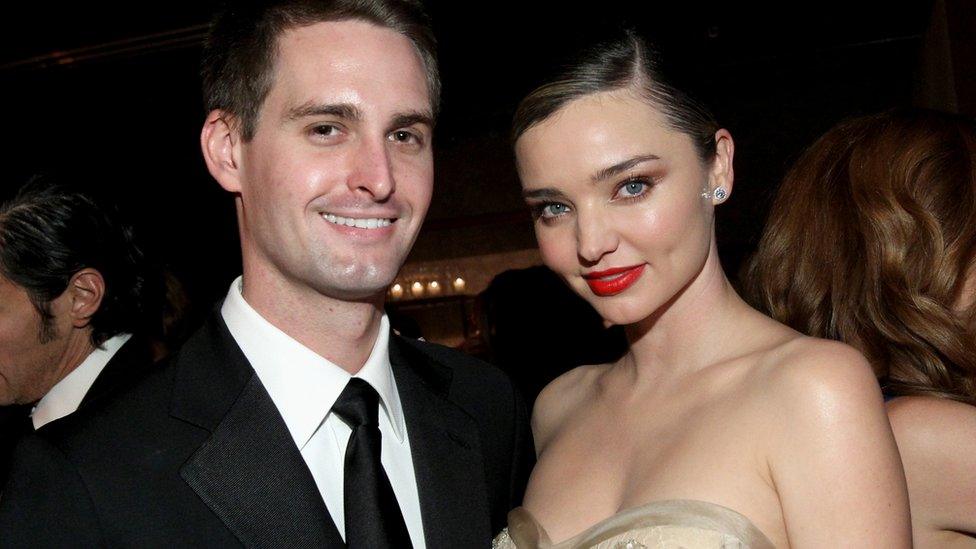

Snap's founder, 26-year-old Evan Spiegel, turned down an offer from Facebook founder Mark Zuckerberg to buy Snapchat for $3bn just three years ago.

Evan Spiegel, seen here with his fiance Miranda Kerr, co-founded Snapchat while still at university

If it goes ahead, it would be the biggest US technology flotation since Facebook's $81bn launch in 2012.

According to several reports, Snapchat has filed a confidential application for an initial public offering with the Securities and Exchange Commission.

The US Jumpstart Our Business Startups Act allows companies with less than $1bn in revenue to secretly file.

The idea is that firms can test the appetite among investors, while keeping their finances confidential.

Analysis - Dave Lee, BBC North America technology reporter, San Francisco

For a platform built around disappearing messages, Snapchat has had incredible staying power. The distinctive app has mostly shaken off its reputation as a place for sexting and morphed into a major publishing platform.

Snapchat is in many ways the 'txt spk' or slang of yesteryear. The fact it's a mystery to many over 30 is presumably at least part of the reason it's so appealing to teenagers across America and beyond.

That "beyond" will be the big question hanging over Snap's possible IPO. Twitter's stock has tanked thanks to an inability to grow beyond its core US audience. Snap will need to avoid the same fate by building on tentative steps in overseas markets.

But the signs are good. As well as rapid growth so far, Snap has impressed by rolling out feature after feature to the platform - all executed seamlessly.

Just last week their Spectacles hardware went on sale - showing the company perhaps has wider potential than just producing great software.

All in all, an attractive proposition for investors, and that's reflected in the valuation. It seems likely to price higher than Google's $23bn debut in 2004.

The company has attracted major investors, but with some questioning whether having advertising sales as the only significant form of revenue was sustainable, the firm is branching out.

In September it rebranded itself as Snap, and earlier this month debuted its video-camera sunglasses called Spectacles.

The kit can connect to smartphones and send video and photos to the app.

- Published24 September 2016

- Published26 October 2016