Brexit: French financial regulator wooing London banks

- Published

- comments

Benoit de Juvigny told BBC Newsnight that major banks have gone as far as conducting due diligence

Some major banks are in advanced stages of planning to shift some operations from London to Paris, France's leading financial regulator has told the BBC.

Benoit de Juvigny said that "large international banks" have undertaken the due diligence needed to set up a subsidiary in the French capital.

He also told Newsnight that "many other companies" had lodged informal inquiries about moving post-Brexit.

He expects similar talks to be going on in Europe's other financial centres.

Authorities in Frankfurt, Luxembourg and Amsterdam have said they would welcome banks moving operations from London for when the UK leaves the European Union.

For many years, British-based financial services companies have been able to operate throughout Europe using so-called passporting rights.

That scheme may end when Britain leaves the EU, with no guarantee that it will be replaced by a similar agreement.

It is that uncertainty that had led many financial companies - and particularly international banks - to make contingency plans that would see them transfer a chunk of their business to an EU member country.

Dangers

Newsnight has learned that at least eight centres are now actively vying for this business - Paris, Frankfurt, Dublin, Luxembourg, Amsterdam, Madrid, Bratislava, and the Maltese capital, Valletta.

But the extent to which these plans have been progressed has been hard to ascertain - until now.

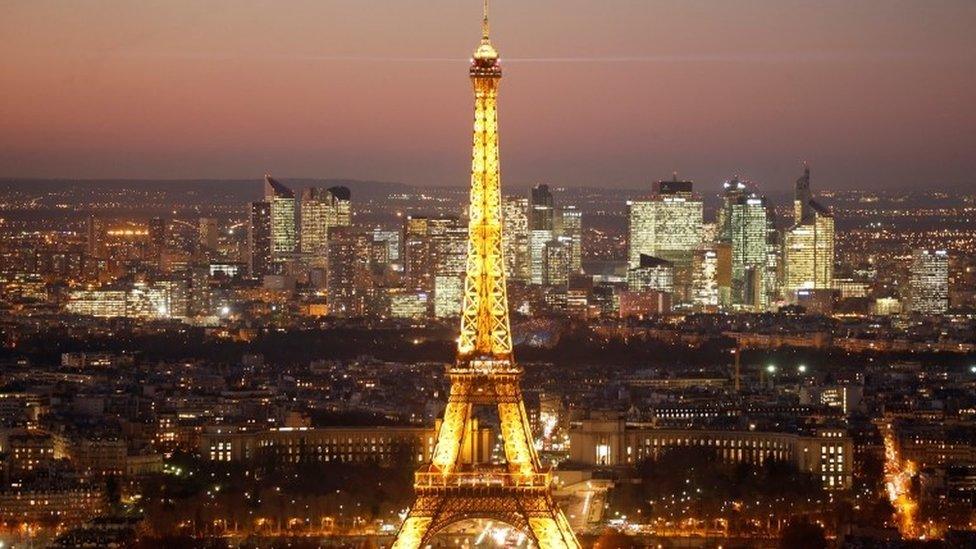

Many of Paris's major commercial and financial firms are located in La Defense

Mr de Juvigny's disclosure that major banks have gone as far as conducting due diligence shows an important milestone.

Due diligence is the process of close scrutiny that major businesses go through prior to a major deal. It is detailed and expensive, and even wealthy banks don't undertake it lightly. What's more, if Mr du Juvigny is right, then it's being conducted in multiple cities around Europe.

He said that the French regulatory department was likely to be expanded to cope with any influx of companies.

However, he warned about the impact of regulators trying to compete to attract banks, saying: "The danger is the race that we could have for a more lenient regulation with a more lenient regulator."

He said the risk of such leniency was lax regulation that could lead to another financial crisis, and called for Europe to stick "strictly" to existing legislation.

"I don't believe that [lenient regulation] should be the choice of the UK, but nobody knows," he said.

- Published6 December 2016

- Published23 October 2016

- Published7 December 2016