UK inflation at two-year high as clothing prices rise

- Published

- comments

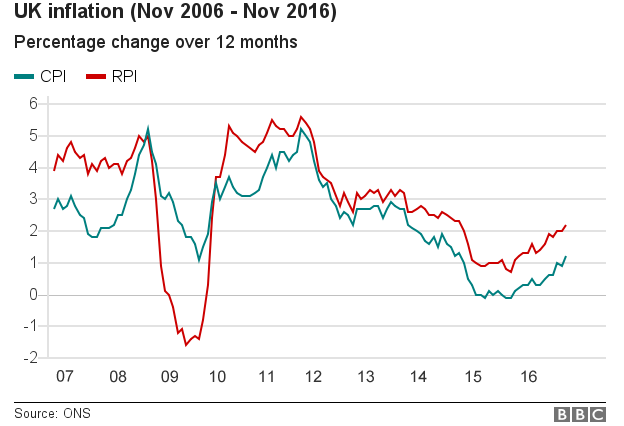

The biggest rise in clothing prices in six years helped to drive the UK's inflation rate up to 1.2% in November, up from 0.9% in October.

November's Consumer Prices Index (CPI) inflation rate was the highest since October 2014, when it stood at 1.3%.

The Office for National Statistics (ONS) said increases in the price of petrol were also responsible for the slightly higher than expected rise.

Those increases were partly offset by falls in air fares.

Mike Prestwood, ONS head of inflation, said: "November's slight rally in the value of sterling eased the inflationary pressure on businesses importing raw materials, but consumer prices continued to edge upwards, due mainly to the rising cost of clothing and fuel."

Kamal Ahmed: Why the inflation figure matters for Theresa May

Howard Archer, chief UK economist at IHS Markit, said both clothing prices and consumer behaviour had been "particularly erratic" in recent months, which has affected the timing of discounting by retailers.

"It seems that there was less discounting of winter clothing in November and the ONS indicated that price increases were particularly marked for women's and men's outerwear," he said. "There was no reference to the pound's weakness increasing prices of imported clothes, but that will surely be a factor going forward."

Tony Shiret, senior analyst at Haitong Securities, said UK weather had been more typical this year, compared with an unseasonably warm November in 2015, so clothing retailers did not need to cut their prices to shift stock: "There will be less sold on discount this year."

However, he said the slide in sterling would start to feed through to shop prices in February or March.

That view was echoed by Ian Shepherdson, chief economist at Pantheon Macroeconomics, who said: "The drop in sterling means we have to expect a further increase in clothing inflation over the next year."

Petrol prices rose 1.6p a litre to 115.4p between October and November, after falling by 1.5p a litre a year ago. Diesel prices added 2p a litre to 118p, in contrast to a 0.6p fall last year.

The price of food and non-alcoholic beverages climbed 0.4% in November - four times the rate for the same month last year.

Bread and cereals, including garlic bread and pizza, along with milk, cheese and eggs were also more expensive.

Weak sterling

Ben Brettell, senior economist at Hargreaves Lansdown, said October's slight fall in the CPI now looked like a blip.

"Sterling weakness continues to raise the cost of inputs for UK businesses, and there are signs these cost increases are slowly being passed on to consumers," he said. "This in turn could hit consumer spending, which has so far held up well despite Brexit-related uncertainty."

The Bank of England expects inflation to continue to rise during 2017 to 2.7% and remain above the 2% target until 2020.

However, Mr Brettell said other forecasters predicted a much sharper rise, to as much as 4%.

Inflation as measured by the Retail Prices Index (RPI), which includes housing costs, rose from 2% in October to 2.2% in November.

From March, the ONS will switch to using CPIH, which includes owner-occupied housing costs, as its key measure of inflation. That measure stood at 1.4% in November, up from 1.2% in October.

- Published13 December 2016

- Published9 December 2016

- Published5 December 2016

- Published1 December 2016

- Published17 January 2017