US vs China – Trump tools up

- Published

- comments

When I asked the Chinese finance minister, Shi Yaobin, for his reaction to the allegation made by Donald Trump during the presidential campaign that China was "raping" America with its cheap exports I wasn't, if I'm honest, expecting a response.

Mr Shi was in Britain last month to talk about trade with Britain, not to respond to the election of a new US president who has said that China is guilty of currency manipulation - deliberately devaluing the renminbi to undercut global export prices.

Chinese officials had made it clear that Mr Shi would only be speaking about Anglo-Sino relations.

So, when he did answer, preceded by a very visible wince, it sent a clear message that China not only took the matter seriously but was willing to speak about it publicly.

China doesn't say anything without a good deal of calculation.

"I want to say that the US is the world's largest economy and China is the second largest economy, there are immense economic exchanges and co-operation between the two countries," he told me.

"And these kinds of economic cooperation and exchanges have yielded tangible benefits to the countries and people of both China and the United States.

"I think that these benefits should be recognised by the president-elect and the peoples of the two countries."

President-elect Trump, Mr Shi went on, might change his tune now he was about to enter the White House.

No such luck, I'm afraid.

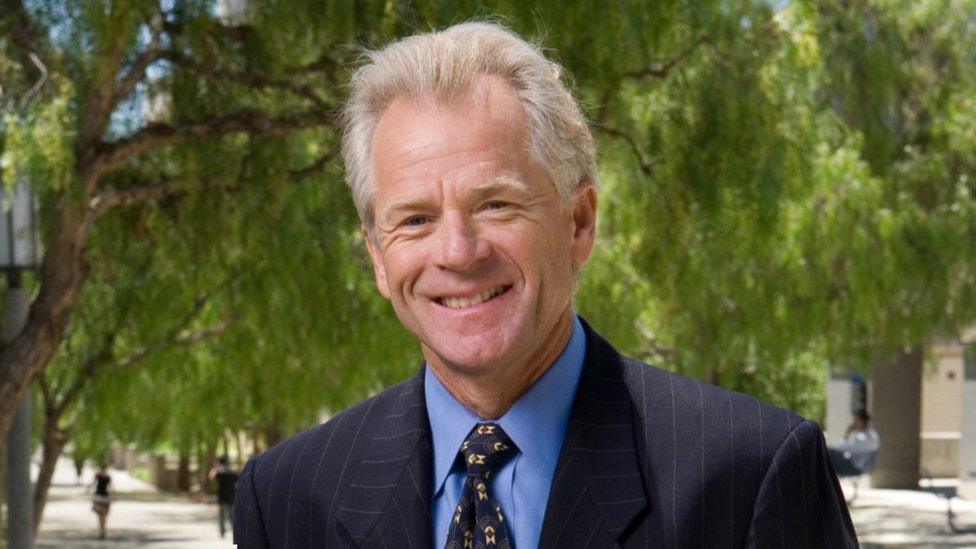

Last night, Mr Trump announced that the economist and China hawk, Peter Navarro, would lead his new National Trade Council.

Peter Navarro set out his arguments in his book, Death by China

Here's Mr Navarro on trade with China:

"The defining moment in American economic history is when Bill Clinton lobbied to get China into the World Trade Organisation. It was the worst political and economic mistake in American history in the last 100 years," he told PBS Newshour in August.

"From 1947 to 2001, the American economy grew annually at a rate of 3.5%.

"After China got into the World Trade Organisation, got access to our markets and flooded our markets with its illegally subsidised exports, we grew at a rate of 1.8% from 2002 to 2015.

"That's almost cut in half."

Some might point out the small issue of the financial crisis and the general collapse in Western economies in 2008, but Mr Navarro is making a broader point which speaks to a theme dominating present economic and political thinking.

'Play by the rules'

Globalisation and free trade have increased general wealth - and lifted millions of people out of poverty across emerging markets - but it has led to a perception that, in developed economies, groups of people whose jobs were particularly associated with traditional manufacturing have lost out.

Mr Navarro insists he is not against free trade and the advantages it brings - denying the "mercantilist" tag that America is simply seeking to set up protectionist barriers.

He claims agreement with the ultimate advocate of free trade economics, the 19th Century economist David Ricardo, who analysed the advantages of cutting tariffs and said doing so was an economic good.

Protectionism, he argued, led to lower growth.

Mr Navarro says the Ricardian model depends on freely floating exchange rates and participants in free trade deals "playing by the rules".

China still limits the flexibility of the renminbi on international markets.

And is accused of "short-cutting" WTO rules.

China has been accused of devaluing the renminbi to make its exports more attractive

"Protectionism is what happened leading into the Great Depression with things like the Smoot-Hawley Tariffs - the design was just to put these big walls up on your markets and then try to basically take unfair advantage," Mr Navarro said in the same PBS interview.

He backs what are called "countervailing tariffs" - barriers imposed to stop unfair trading practices that Mr Navarro accuses China of following.

Free trade, he insists, is still the end goal.

And here he lines up with Mr Trump's other trade adviser, Dan DiMicco, who told me before the Presidential election that Britain would be at the "front of the queue" when it came to a free trade deal.

Trade war

Now, Mr Navarro has his fair share of critics.

Firstly, the critics say, if China is the problem why has Mr Trump also said he wants to pull out of the Trans-Pacific Partnership, a free trade deal between America, Canada, Japan, Vietnam and Singapore (among others) which very deliberately does not include China?

And secondly, cheap imports from China may not have been good for some traditional steel producers for example but they have been very good for hard pressed US consumers who have enjoyed lower prices in the shops.

They have also, maybe counter-intuitively, been good for US businesses which have had to respond to competition from overseas by diversifying into new technologies and services, leading to higher levels of wealth creation.

For a particularly sharp take down of Mr Navarro's position, it's worth reading Tim Worstall in Forbes, external.

Mr Worstall says that international trade is by definition - as an agreement entered into voluntarily - beneficial to both parties and that the argument that America has lost its manufacturing base is "simply wrong".

Jobs have changed, not disappeared.

What is becoming clear is that the new man headed for the White House is serious about taking on China.

A significant trade war between the world's two economic super powers could well be approaching.

Which could affect global growth for all of us.