MPs hear call for five-year transitional Brexit deal

- Published

The head of the London Stock Exchange (LSE) has told MPs that the UK government should negotiate a five-year transitional Brexit deal.

Xavier Rolet told the Treasury Select Committee, external this was needed to protect the UK's financial industry.

He agreed that Brexit might see a massive migration of City employment to other EU countries, not just a few tens of thousands of jobs.

He said the projected two years of Brexit negotiation was "too short".

"What is required to maintain stability is nothing less than a grandfathering of the existing conditions of trade, for a limited period of time," Mr Rolet said.

He said this could be achieved by a five-year transitional deal, maintaining existing business arrangements and regulations, starting from the point at which Brexit negotiations were triggered.

The committee was hearing evidence about the UK's future economic relationship with the EU.

Mr Rolet was speaking alongside Douglas Flint, the chairman of HSBC, and Elizabeth Corley, vice chair of Allianz Global Investors.

'Clear path'

The MPs were told of the fears and concerns of the financial services industry if Brexit left it outside the EU's single market and without the ease of trade that comes with it.

Mr Rolet was asked what would happen if the outcome of Brexit negotiations was that LSE members could no longer handle financial transactions denominated in euros, such as the huge international trade in derivatives between the worlds banks and other financial institutions, which is centred in London.

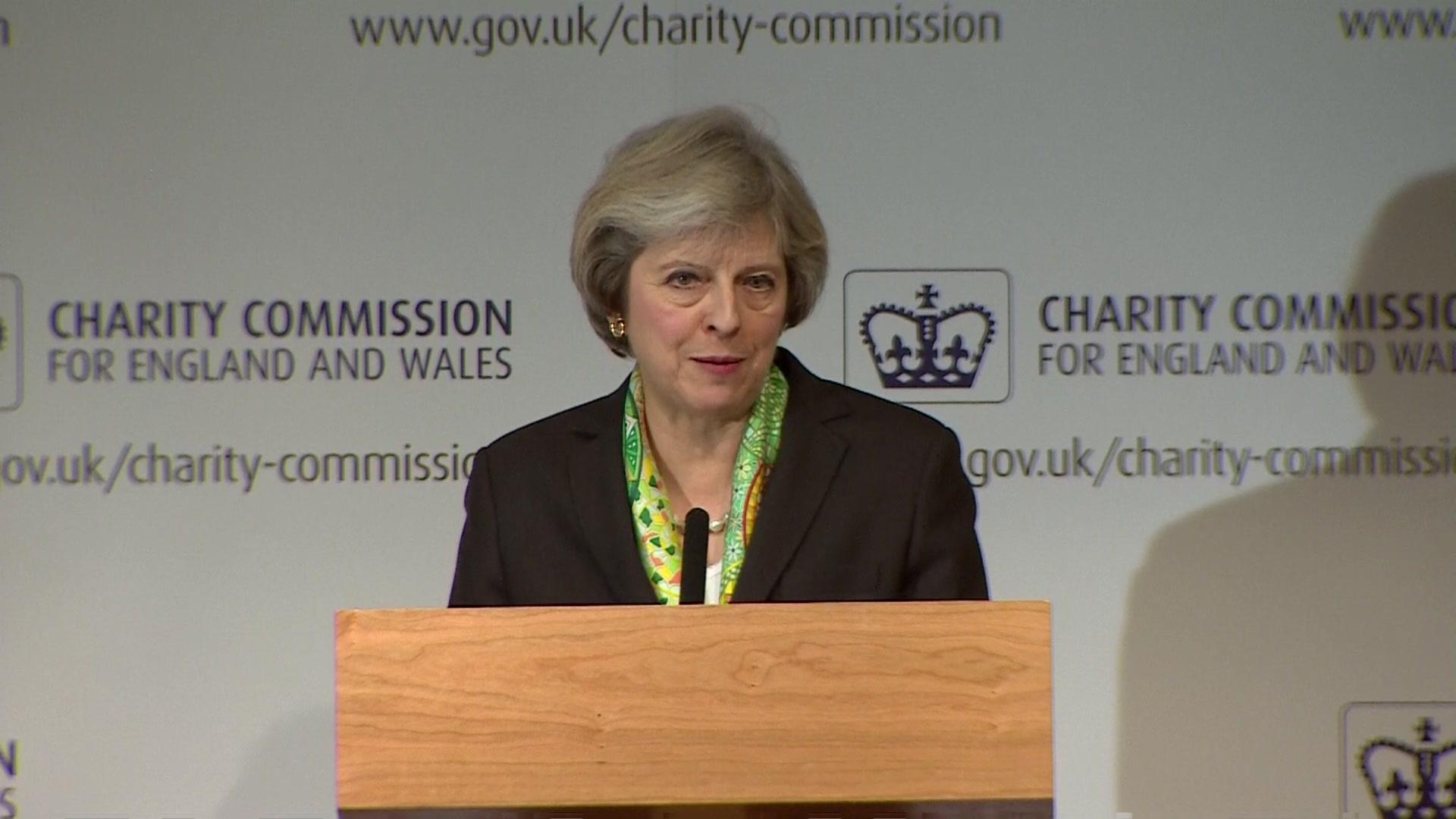

Xavier Rolet, head of the London Stock Exchange, said two years of Brexit talks was too short

He warned that many tens of thousands of jobs might move from the UK to elsewhere in the EU, because firms, especially foreign ones, currently based in the UK would wish to continue doing business with the rest of Europe under existing EU rules.

"Without a clear path to continued operation of our global businesses our customers simply would not wait," said Mr Rolet.

He added: "I'm not just talking about the clearing jobs themselves which number into the few thousands."

"But the very large array of ancillary functions, whether it's syndication, trading, treasury management, middle office, back office, risk management, software, which range into far more than just a few thousand or tens of thousands of jobs. They would then start migrating."

Mr Rolet added that such a movement of financial business to other countries would also lead to greater risks to the stability of the international financial system, which might undermine the Brexit negotiations themselves.

The solution, he suggested, was the policy of "grandfathering", whereby the old arrangements were kept in place.

"[This] is likely to strongly support a positive outcome for these [Brexit] negotiations," he said.

Jenga tower

Mr Douglas Flint, chairman of the huge international HSBC banking group, told the MPs he was worried about a negative outcome of the Brexit negotiations for the international banking industry based in London.

"The economic system (in London) is like a Jenga tower," he said. "You don't know what will happen if you pull pieces out."

And he explained some of the thinking at big banks behind the decisions they might make in the future.

"There are two risks to jobs. One is we move the jobs, the other is the jobs are simply eliminated because the market opportunity [in Europe] is unattractive," he said.

He added that if the UK's banking industry ended up outside the EU single market, customers would find that it was slower to make payments, and those customers such as smaller businesses would probably have to pay more for the banking services which take place in an almost seamless way today.

Mr Flint told the MPs his bank had already started contingency planning for a Brexit deal that left the UK outside the EU single market, with France, Dublin, Amsterdam and Luxembourg as likely destinations for banking operations currently based in London.

Last month a report from the House of Lords report warned that any disruption to the UK's financial industry during Brexit negotiations might lead to businesses and services moving to New York.

- Published9 January 2017

- Published9 January 2017

- Published9 January 2017

- Published8 January 2017

- Published6 January 2017