Retail winners and losers this Christmas

- Published

Now the leftovers are all curry and the tree is at the tip, it's time to digest the news from the retail sector over just how merry a Christmas it really was.

And it seems that just like Mr Scrooge, UK shoppers were persuaded to open their purses just a little wider this year.

So if you're one of those who splashed out on gin, indulged in a new jumper and pulled out all the stops for your festive feast, you are in good company.

But how and where was the festive cheer felt most? Here's our look at where the glass is half full and where half empty as we head into 2017.

The winners

Supermarkets

It's not likely to be a dry January if you're running one of the UK's supermarkets. They have good news to toast this week.

Tesco and Morrisons, which have both had a difficult few years, have reported stronger sales. Tesco said fresh food had been "particularly popular, outperforming the market", adding that there had been a 24% increase in party food sales over Christmas, while Morrisons reported its strongest Christmas sales for seven years.

Even Sainsbury's, which saw a meagre 0.1% overall rise in sales, managed to beat analyst expectations of a 0.8% fall.

Discounters Lidl and Aldi don't report their figures in quite the same way - they do not give like-for-like sales, which strip out the effect of new store openings and are therefore a better comparison - but both reported double-digit increases in Christmas sales, reflecting brisk business.

It looks like we collectively loosened our belts at just the right time for the big food retailers. "I guess the biggest impression so far is that food retailers did better than non-food in December," says independent retail analyst Nick Bubb.

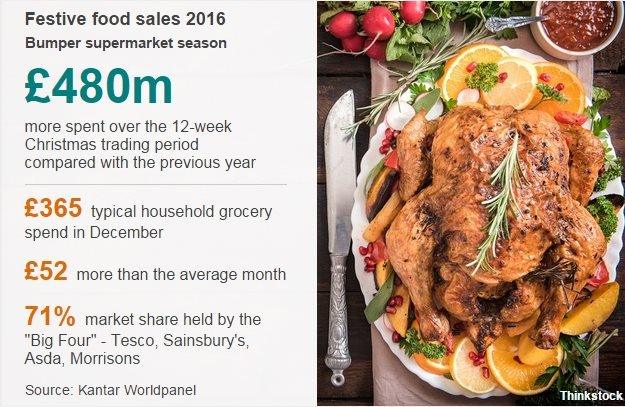

According to Kantar Worldpanel we spent almost half a billion pounds more, external in the final 12 weeks of 2016 compared with the year before (so no wonder we're still ploughing through the chocolate biscuits and checking out stilton soup recipes).

But putting it into context, a lot of the good results now are set against a backdrop of pretty weak performances the previous year.

If you look at the grocery sector in 2015, Tesco and Morrisons were both implementing turnaround plans, while Sainsbury's and Asda also faced sales challenges.

"Overall, food had an ok end of the year and traded ok over the course of the year but that was against very low comparitors," says Paul Martin, UK head of retail at KPMG.

Dressed to impress

It wasn't just the food stores that have given the market cause for cheer.

High Street stalwart Marks and Spencer finally shrugged off a decline in clothing sales

Early in the month Next had everyone spooked as it reported a drop in sales in the run-up to Christmas, but plenty of other clothing retailers have reported strong results.

M&S surprised the market with sales in its clothing and homeware division up 2.3% - well above expectations for about 0.5% - while John Lewis, Debenhams, Ted Baker and online retailers Boohoo.com and Asos also reported sales growth.

Strong festive periods were also seen at Primark, JD Sports and Superdry owner Supergroup, which saw like-for-like sales up 15% over the Christmas period.

The losers

Next said it was preparing for "tougher times" in the year ahead

"The biggest loser is obviously Next so far. They've had a bit of a shocker," says Patrick O'Brien from Verdict Retail. Next saw sales of full-price items fall 0.4% and warned of a "challenging" 2017.

"Next [used to be] way ahead of the others with its online operation. But competitors have now caught up with that in terms of online and collection, with really high growth in online specialists like Boohoo," he says.

But apart from that the really surprising thing is how few bad results there have been. Partly that is because they started from a low base after the poor sales of 2015, and partly because British consumers simply held their nerve.

"Consumers have understood that prices are going up and it's been a good time to buy," says Mr O'Brien.

Paul Martin, head of UK retail at KPMG, adds: "The British defied the mood music out there and wanted to go out and treat themselves and celebrate Christmas. That's the most surprising thing in a world where negative news is easier to come by than positive."

What's in store in 2017?

John Lewis has warned of a "challenging" outlook and said that its staff bonus will be "significantly lower" this year

But if 2016 ended on a positive note, Paul Martin says retail is moving into a "perfect storm" in 2017.

He warns that around April to July the hedging positions retailers took against currency fluctuations will begin to run out and the full force of the pound's devaluation since the Brexit vote will start to be felt through higher prices for imported goods.

Multinationals will flex their muscles a little more over pricing imported goods for the UK market. And costs will be rising as business rates are revalued and the minimum wage rises.

Inevitably, he says, retailers will have to look at what kind of price rises their customers can bear. "We think it will be 5% to 8%. But that can vary substantially across sectors - you will find some cases where it will be 50%," he warns.

In addition to Next, other retailers including John Lewis and Sainsbury's have warned about the uncertain impact of a weaker pound.

While others have warned of price hikes, Ted Baker has said it will not raise prices this year

The boss of fashion chain Ted Baker has vowed, however, that "there won't be any price increases this year".

Chief executive Ray Kelvin told the Press Association: "We were hedged for two years and we have one year left on that. We're a public company, we don't gamble with things like this, plus we also have a big dollar income."

The consensus though, is that consumer spending will be squeezed this year, and Rachel Lund, head of retail insight and analytics at the British Retail Consortium, says that will make it harder for retailers to generate growth.

She also points to the uncertainty around what trading relationship the UK will have with the rest of the world once it leaves the EU.

"An announcement about that that doesn't seem favourable could have an impact on confidence," she says. But she adds that the mood among retailers is "not one of doom and gloom, it's caution".