Toshiba shares crash as nuclear writedown crisis deepens

- Published

Shares in Toshiba have dived 16% on reports that the embattled Japanese conglomerate faces bigger losses at its US nuclear power business.

It is feared Toshiba may have to write down the value of the unit by a larger-than-expected 700bn yen ($6.1bn; £5bn).

There are unconfirmed reports Toshiba is seeking aid from the government-backed Development Bank of Japan (DBJ).

Toshiba said the exact writedown figure was not finalised, and declined to comment on any DBJ approach.

The laptops-to-hydro power giant was plunged into crisis late last year when it emerged it faced huge cost overruns on projects handled by a newly-bought company that builds US nuclear power plants.

Toshiba's US operation Westinghouse paid about $229m in 2015 for Stone & Webster, the nuclear construction subsidiary of Chicago Bridge & Iron.

But on 27 December Toshiba admitted that it faced writedowns of "several billion dollars". The company later indicated that the size of the writedowns would be between $1bn and $4.5bn.

Toshiba's nuclear services business brings in about one-third of the industrial giant's revenue.

The share price, down 26% at one stage on Thursday, is now 50% lower than when the writedown revelations emerged amid fears that the company still has no firm grip on the final costs.

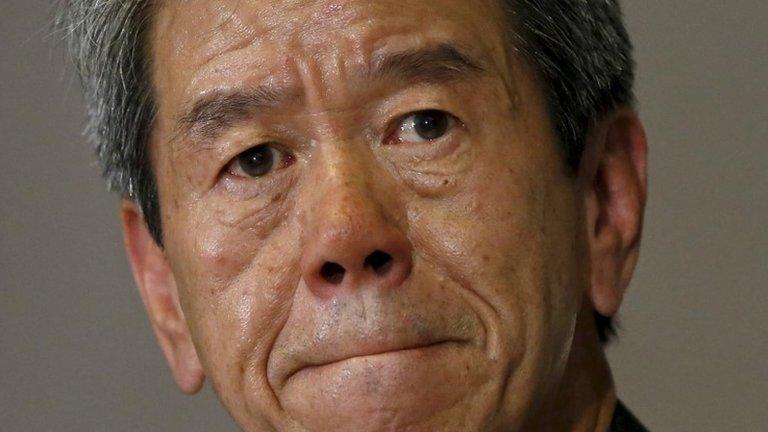

The company, at the heart of Japan's industrial development for decades, is still recovering from revelations in 2015 that profits were overstated for seven years.

That accounting scandal led to the resignation of the company's chief executive.

Bank talks

Japan's Nikkei newspaper and the Reuters agency were among news groups reporting that Toshiba had approached the country's development bank, and is looking to spin-off its profitable Nand computer memory division to raise cash.

Toshiba is thought to have been in close contact with its bank lenders about providing more financial support. Reuters said there would be more meetings with the main banks this week.

"The key thing to watch here is whether Toshiba's liabilities will exceed its assets. If that happens it will be difficult for some banks to step up with new financing," said Mana Nakazora, chief credit analyst at BNP Paribas.

Mr Nakazora said, however, she did not expect Toshiba to default on its debt as its main banks would stick by it, adding that some sort of package involving asset sales, financing and capital from the government was the most likely solution.

In a statement on Thursday, Toshiba said it was still assessing the scale of the writedown.

"We are still discussing how to deal with this issue, and no concrete decisions have been made," the company said.

- Published29 March 2017

- Published21 July 2015