UK house price growth 'to slow in 2017'

- Published

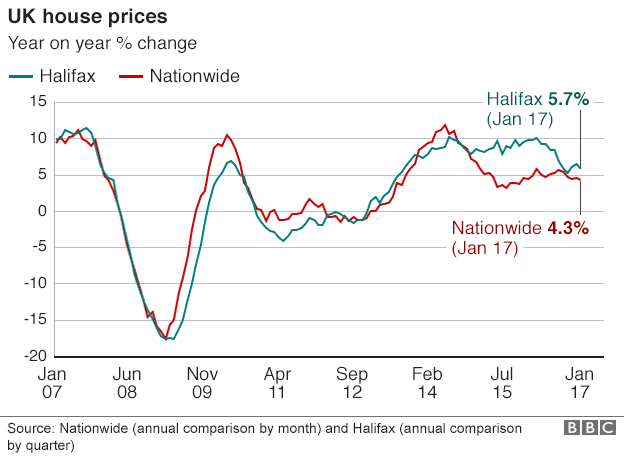

Annual growth in house prices slowed in January and the trend is expected to continue throughout 2017, according to a lender.

The Halifax, part of Lloyds Banking Group, said that property prices rose by 5.7% in the year to the end of January.

This was slower than the 6.5% annual growth seen the previous month, leaving the typical home valued at £220,260.

The figures come on the day the government unveils a housing strategy.

The view also comes a week after rival lender, the Nationwide Building Society, said that the outlook for the UK housing market remained "clouded".

'Lethargic'

The lender, the largest in the UK mortgage market, said its data showed prices in the three months to the end of January were 2.4% higher than the previous three months.

However, compared to a year earlier, price growth was starting to slow and was well below a peak of 10% seen last March.

Property values had actually dropped by 0.9% in January compared with December, prompting a mixed view of the outlook in the industry.

"January is always a lethargic month for UK property as a result of the Christmas break and so any fall in house prices at this time of year should be taken with a pinch of salt, rather than a handful of panic," said Russell Quirk, founder of eMoov.co.uk.

"Had any other market around the world been subject to such a sustained period of scaremongering and uncertainty amongst buyer and seller as the UK market has in the last year, I expect it would be a different story to the one we are seeing here."

Jeremy Leaf, a north London estate agent, said: "The figures show a broadly slowing market in response not just to seasonal but other factors, which we have also noticed in our offices.

"Worries about rising inflation and what this means for general living costs and interest rates, as well as stricter mortgage criteria and the focus on affordability, are having an impact on people's decision-making."

Relatively few properties on the market and low interest rates were keeping prices up, the Halifax said, but other factors would slow house price growth in 2017.

"Weaker economic growth and increasing pressure on spending power, along with affordability constraints, are expected to dampen housing demand, resulting in some downward pressure on annual house price growth during the year," said Martin Ellis, Halifax housing economist.

The lender said the number of first-time buyers had risen by 7% to 335,750 in 2016.

This was still 17% below the immediate pre-crisis peak of 402,800 in 2006.