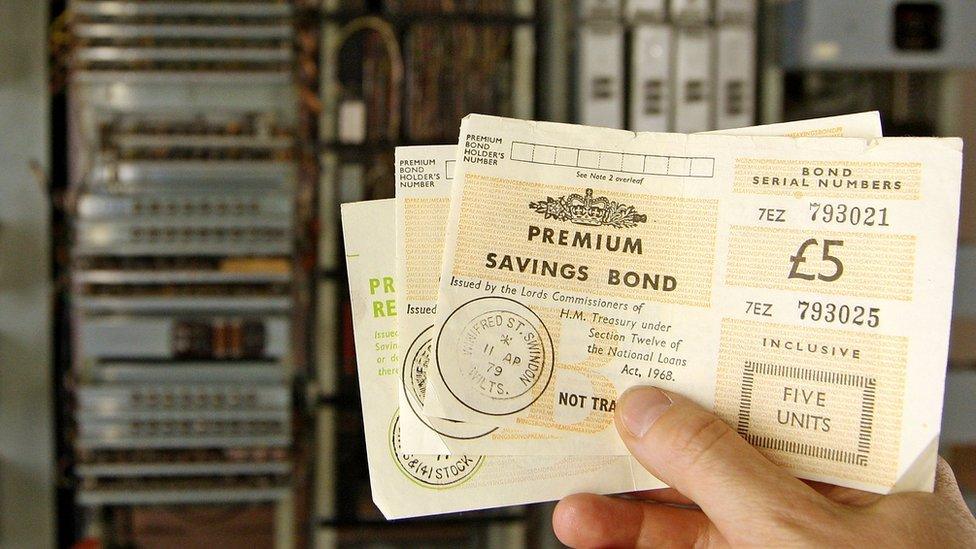

Premium Bond prizes will be cut from May, announces NS&I

- Published

Savers will have a slimmer chance of winning some of the biggest Premium Bond prizes from May, says National Savings and Investments (NS&I).

The estimated number of tax-free £100,000 prizes each month will fall from three to two, and there will also be two fewer £25,000 prizes.

The reduction is part of a wider cut in interest rates across a range of NS&I's savings products.

Cuts of up to 0.25 percentage points "reflect market conditions", it said.

They follow interest rate cuts on the same variable rate products - the Direct Isa, the Direct Saver and Income Bonds - in June last year.

Attractive?

There are about 21 million Premium Bond holders in the UK. The bonds are issued by NS&I which is guaranteed by the Treasury.

The total number of tax-free prizes will fall in May to an estimated 2,219,493 from about 2,224,513 now. There will be more £25 prizes but fewer of most of the higher value awards.

The total prize fund will drop from £69.5m to £63.8m over the same period, although the two jackpot prizes of £1m each month will remain.

Danny Cox, chartered financial planner at Hargreaves Lansdown, said: "Ironically with so little interest on cash for savers, Premium Bonds look more attractive - if your savings are returning basically nothing, you might as well opt for the chance of the jackpot prize.

"NS&I will remain popular for their cast iron security but lower interest rates and rising inflation will test savers' patience."

NS&I announced that the interest rate for the Direct Isa and for Income Bonds will fall from the current rate of 1% to 0.75% in May.

The Direct Saver account will see its interest rate drop from 0.8% to 0.7% at the same time.

NS&I blamed the cut in the Bank of England's base rate from 0.5% to 0.25% in August and the reaction to the move across the savings market.

"We have taken the time to absorb the impact of the Bank of England base rate reduction and subsequent changes across the savings market," said Steve Owen, acting chief executive of NS&I.

"The new rates reflect current market conditions and allow us to continue to strike a balance between the needs of our savers, taxpayers and the stability of the broader financial services sector.

"We appreciate that savers will be disappointed, but we believe that the new rates present a fair offer to customers."

In all, the changes will affect 21 million savers.

In November, Chancellor Philip Hammond said that a new savings bond offering a "market-leading" rate of about 2.2% would go on sale through NS&I in the spring.

Anyone over 16 will be able to invest up to £3,000 in the three-year bond. The precise interest rate will be confirmed in the coming weeks.