Disney to buy most of Euro Disney

- Published

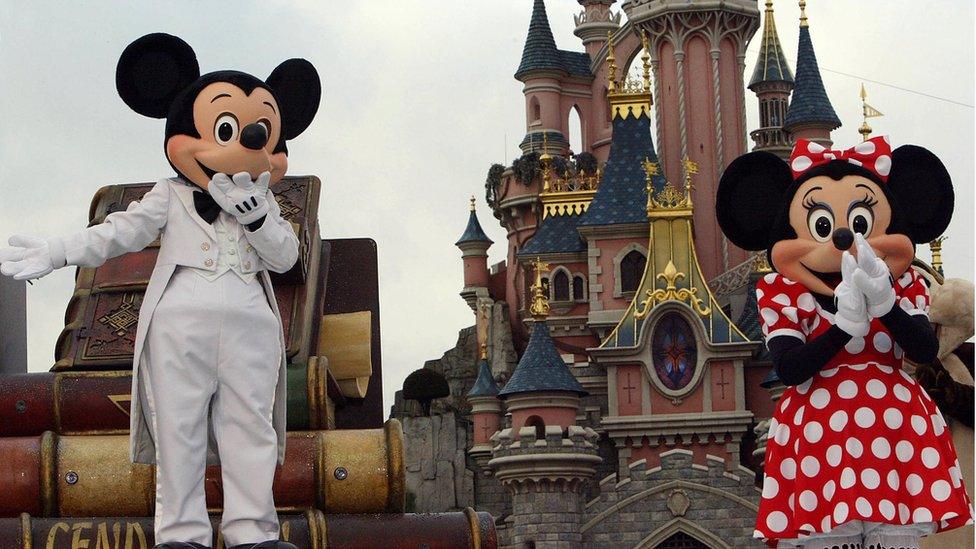

Disney is to take near-complete ownership of Disneyland Paris theme park operator Euro Disney.

The move could end private investing in the company after more than 26 years, leaving just two shareholders.

The US entertainment firm set up Euro Disney to run the Disneyland Paris resort, which opened in 1992.

Disney said it would plough 1.5bn euros (£1.28bn) into the company and aims to buy out private investors, offering 2 euros per share.

The 2015 terror attacks on Paris and "challenging business conditions" in France and across Europe have dented its finances, it said.

The latest rescue follows a 1bn-euro refinancing in 2014 in the wake of falling visitor numbers and spending.

Disney injected more than 400m euros into the business, while about 600m euros in debt was converted to shares in the US group.

Financial support

While the 2 euro-a-share offer is 67% higher than Thursday's closing price, it may not be as attractive to investors who bought shares earlier in the firm's history.

The company first sold shares to the public in 1989 for 72 francs apiece, the equivalent of 10.98 euros, and the stock climbed as high as 165.2 francs in 1992.

Disney has had to bail the company out through restructuring its debt on a number of occasions and has been gradually increasing its stake. Before the latest announcement it owned 76.7% of Euro Disney.

The latest move includes buying 9% of the company's stock from Saudi Prince Alwaleed Bin Talal's Kingdom Holdings, which bought a stake in the company in 1994 during one of its early restructurings.

Kingdom Holdings will keep a 1% stake in Euro Disney, and if the remaining private shareholders agree to the latest offer, Disney will own the rest.

Shareholders could reject the offer and keep their shares, but if Disney buys enough of the stock to own more than 95% of the company, it will have to buy the rest under French stock market rules.

Despite being the largest theme park in Europe, Euro Disney has recorded losses in 18 of its 25 financial years. Fewer than expected visitors and fees charged by Disney for the use of its branding have been blamed by investors for its poor performance. Last year, it paid 75m euros in royalties and management fees on revenue of 1.28bn euros.

- Published8 February 2017

- Published10 May 2016