Business revolt grows over 'outrageous and unfair' rate change

- Published

- comments

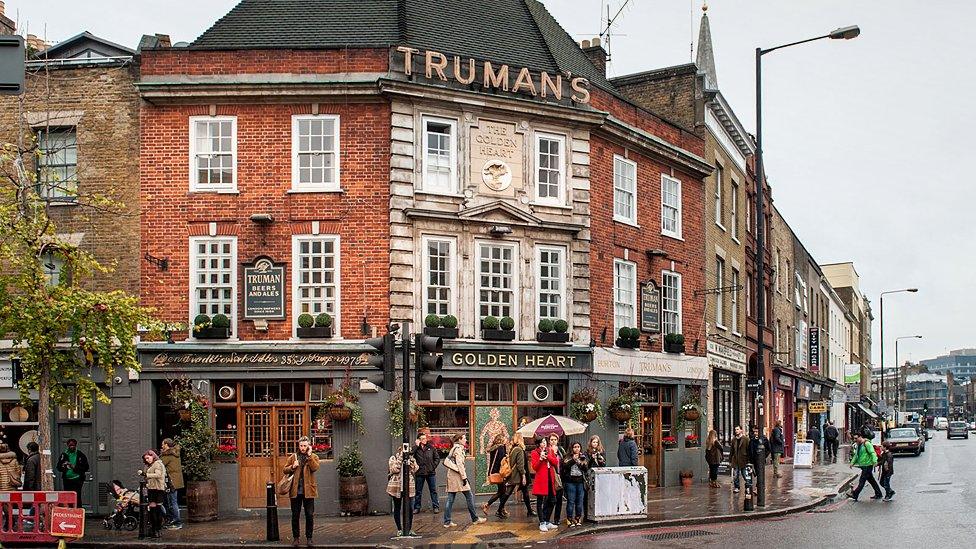

Business rates for retailers could see huge falls - and rises - depending on where they are

Some of the UK's biggest employers' groups have united in condemning the government's "outrageous" changes to business rates in England.

They are most vexed about a clause they say could prevent firms appealing against rate rises, even if firms can prove they are wrong.

Thirteen of them, including the British Retail Consortium and CBI, have written a letter calling for it to be dropped.

But a government spokesman said the "claims are simply false".

And Treasury Minister, David Gauke, told the BBC three in four businesses would not see an increase in their bill.

Other signatories to the letter include the Federation of Small Businesses, Revo, the Association of Convenience Stores, the British Chambers of Commerce and the British Property Federation.

The next business rates revaluation comes into effect on 1 April - the first for seven years - but the lobby groups said that tens of thousands of firms still face uncertainty over bills.

Earlier this week, pubs and restaurants called for Chancellor Philip Hammond to dilute the impact of the business rate rises in his March Budget.

What is the rates row about?

Business rates are in effect the commercial version of council tax, and are paid on the rental value of the space that businesses occupy. The amount depends of the size of the property and what it's used for.

The last time properties were valued, in 2010, almost half of businesses appealed against how much they were due to pay.

The government wants to cut down on the number of these appeals.

The trade groups say the government wants the right to dismiss appeals against incorrect valuations that are deemed to be within the bounds of "reasonable professional judgement", or margin of error.

This allowable margin of error has not been disclosed, but experts say it could be as much as 15%.

Rates in Scotland are also being reassessed. The Scottish Assessors' Association, which sets the rateable value, has been carrying out a revaluation of properties, the first since 2010. It is supposed to do this every five years but the 2015 revaluation was delayed by the Scottish government.

Wales is also reassessing rateable values for business.

Both will come into effect on April 1.

Reality Check: Are there more winners than losers on business rates?

St Ives fish and chip shop owner Neil Whitham tells Today his business rates are going up 62%

Neil Whitham runs a fish and chip shop in St Ives and will be paying about £4,000 more per year under the new system. He says:

"We will be passing on some of the costs to our customers unfortunately. Life is never easy if you wish to be successful but I don't believe [the rates system] is fair.

"I believe the losers are supplementing the winners - those who have had rate reductions.

"I would look to have a fairer system. Our rent has increased 25% over five years - we can stomach that - but in the same period rates up 62% just seems totally unfair...with other business taken out of the system altogether.

"[If your property is worth] up to £12,000 in rateable value - you pay no rates. From £12,000 to £15,000 there's a taper system, and as soon as you hit £15,000 you're on a full 100% rates.

"They're creating a tiered system on the High Street.

"You and a neighbour may have similar shops, with maybe 25% difference in square footage and one is paying full rates, £15,000 or more. so that equates to about £7,500 per year, the slightly smaller shop is paying nothing at all."

John Webber, head of ratings at property company Colliers International, said the problem was that the "margin for error" allowed by the government was simply too wide.

He told the BBC: "Every rateable value is an opinion, so there will be a boundary of judgement there. The problem you're going to have is if you have a property with a rateable value of £100,000 and you think it should be £90,000, then that 10% tolerance is arguably still within the bounds of reasonable professional judgement.

"Therefore, the list will not be altered and as the rating list lasts for five years potentially you will be paying, over a five year period, at least 10% more than you should do," Mr Webber adds.

Helen Dickinson, director-general of the British Retail Consortium, told the BBC that the tax was "no longer fit for purpose in the 21st Century".

She says that although technically, under new government rules, business owners will be able to appeal against a higher valuation, a clause states that even if rates are found to be unfair they can still stand if they lie within the bounds of "reasonable professional judgement".

This somewhat vague wording is, she says, "what everyone is upset about".

'Overpaying'

Jerry Schurder, head of business rates at property consultancy Gerald Eve and a supporter of the protest, said: "The government's outrageous proposals... would force hard-pressed businesses to cough up an extra £1.9bn to pay for the Valuation Office Agency's (VOA) mistakes.

"The way that trade bodies from a wide spectrum of industries have been motivated to unite against this clause shows the strength of feeling against what is a punitive and deeply unfair proposal," Mr Schurder said.

But the government issued a strong rejection of the claims.

A spokesman said: "These claims are simply false. We are not preventing anyone from appealing their bills, or setting any margin of error for appeals being heard.

"We're reforming the appeals process to make it easier for businesses to check, challenge and appeal their bills, while at the same time generous business rate reliefs mean thousands more businesses are seeing a reduction."

He added that, once the changes come in to effect, 600,000 businesses will pay not rates at all.

- Published17 February 2017

- Published17 February 2017

- Published17 February 2017

- Published16 February 2017

- Published13 February 2017