Budget: Don't be fooled if it turns out to be dull

- Published

Consider Wednesday's Budget as part of a box set - the latest episode in a financial drama that began with the banking crisis.

Like all good series, there are episodes which allow the scriptwriters to set up the story for a more dramatic encounter later on.

That will be the case with Philip Hammond - ironically nicknamed "Box Office Phil" - as he writes his Spring Budget, experts say. They predict this Budget will be relatively low key, particularly because there will be another one in the autumn.

And - to stretch the metaphor even further - we have been told a lot about the plot already. A string of tax and benefit changes that will come into effect this April have been announced in previous Budgets and Autumn Statements.

So, here is the story so far.

This will be the last ever Spring Budget, with the main event moving to the autumn from then on.

The leading man in the Treasury has changed. Philip Hammond is delivering his first Budget as chancellor, following eight delivered by his predecessor George Osborne.

There's plenty of speculation that Wednesday's Budget could be pretty low key. Don't be fooled, though. Your finances are set to change anyway.

Some of the policies that affect UK residents' personal finances were announced in previous speeches by Mr Osborne, but will only take effect this April. Others were outlined by Mr Hammond in November's Autumn Statement and will also come into force in the spring.

A number will lead to a notable change in the finances of those of working age - particularly a shift in the income tax threshold and the benefit freeze - while others target particular groups of people such as landlords.

The amount people can earn before they are subject to income tax, known as the personal allowance, is currently set at £11,000 and it has already been announced that it will go up to £11,500 in April.

The Conservatives have promised to raise this to £12,500 by 2020-21 and increase with inflation after that.

The threshold for the higher 40% income tax rate will rise from £43,000 to £45,000 in April. However, in Scotland the higher rate will be paid on income above £43,000 a year - owing to the devolved tax powers the Scottish government now holds.

Other changes that had been announced by George Osborne, but which take effect in April, include:

Many working-age benefits remaining unchanged for a second year, as part of a four-year freeze. These include Jobseeker's Allowance, Employment and Support Allowance, some types of Housing Benefit, and Child Benefit. However, state pensions, Maternity Pay and disability benefits are excluded

The launch of a new Lifetime Individual Savings Account (LISA) for those aged between 18 and 40. They can save up to £4,000 a year, and the government will add a 25% bonus if the money is used to buy a home or as a pension from the age of 60

The start of a gradual process allowing people to pass on property to their descendants free from some inheritance tax

Any family which has a third or subsequent child born after April will not qualify for Child Tax Credit, which can be more than £2,000 per child. This will also apply to families claiming Universal Credit for the first time after April

The family element of child tax credits, worth £545 per year, will be abolished. So families in which the eldest child is born on or after 6 April will not receive this payment.

Many buy-to-let landlords will see the amount of tax relief that they can claim on mortgage interest payments cut over the course of four years from April. They will only be able to claim at the lower rate of tax, not the higher

Wage rises

Pay rates for millions of workers have already been cemented.

The National Living Wage will rise from £7.20 to £7.50 in April, for those aged 25 and over. Public sector pay has already been set at a 1% annual rise each year until 2019-20.

Salary sacrifice schemes allow some employees to give up some of their salary in exchange for goods and services. Some items bought under a scheme such as computers, gym membership, and health screening will be subject to tax from April - in effect, salary sacrifice will be cancelled on these items.

That was announced in Mr Hammond's Autumn Statement, as was mixed news for drivers.

Fuel duty will be frozen for a seventh year, but the cost of vehicle insurance may rise owing to an increase in the Insurance Premium Tax from 10% to 12% in June.

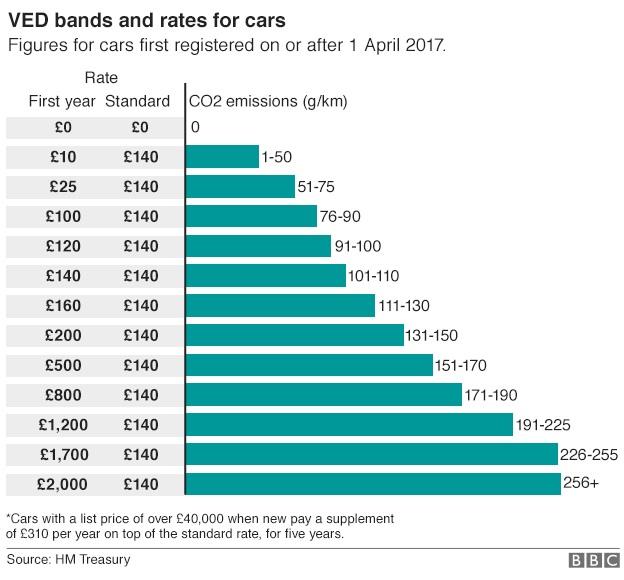

New Vehicle Excise Duty (VED) bands are to be introduced for cars registered from April - zero, standard and premium.

Some relief for savers?

In May, probate fees will change, costing significantly more for large estates.

Finally, we may hear from the chancellor on a start date and precise interest rate for the new government-backed savings bond.

In November, the chancellor said that the new savings product offering a "market-leading" rate of about 2.2% would go on sale through National Savings and Investments in the spring.

The bond will be open to those aged 16 and over, subject to a minimum investment limit of £100 and a maximum investment limit of £3,000. Savers must put in their money for three years.

- Published21 February 2017

- Published1 March 2017

- Published2 March 2017

- Published28 February 2017

- Published2 March 2017