Deutsche Bank shares hit by cash call

- Published

Shares in Deutsche Bank closed 3.7% lower on news it plans to bolster its finances through selling new shares.

Germany's biggest bank plans to raise about 8bn euros (£6.9bn, $8.5bn) through the sale, due later this month.

The sale by the troubled bank is part of a wider shake-up.

Deutsche will also partially float its asset management business and retain Postbank - the retail banking business that it had been expected to sell.

The company will be reorganised around three divisions: private banking and wealth management; asset management; and corporate and investment banking.

The bank is trying to reshape itself after grappling with huge losses and a 15bn euro legal bill imposed by regulators since 2012.

In December, Deutsche Bank said it had agreed a $7.2bn (£5.9bn) payment to US authorities to settle an investigation into mortgage-backed securities.

The sale of residential mortgage-backed securities played a significant role in triggering the 2008 financial crisis.

Peter Hahn at the London Institute of Banking and Finance said it was the first capital raising from Deutsche since it had drawn a line under many of its legacy issues.

"The atmosphere for banks has got much more positive in the last several months," Mr Hahn told the BBC. Deutsche Bank shares have risen 44% in the last six months, for example.

But there were still question marks over whether its investors would "put money in one more time", he said.

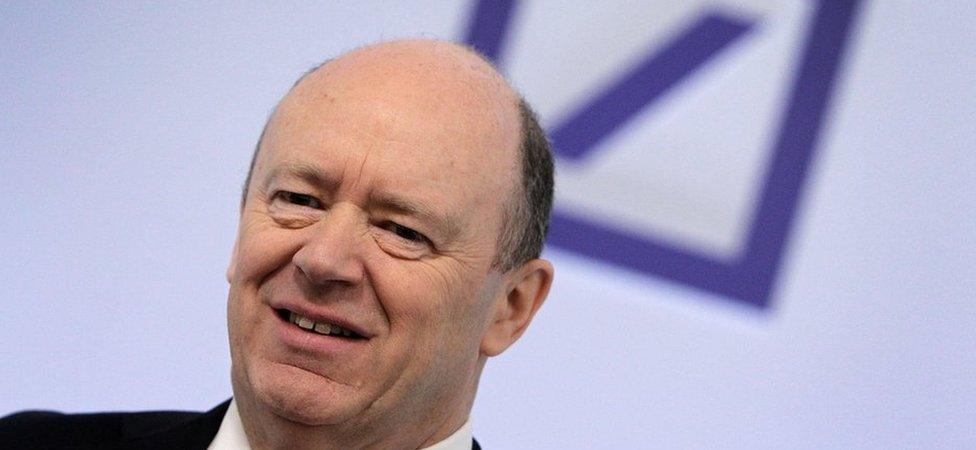

Chief executive John Cryan will be supported by two new co-deputies

Deutsche will also promote chief finance officer Marcus Schenck and retail banking boss Christian Sewing to become co-deputy chief executives under chief executive John Cryan.

Mr Schenck will also become co-head of the investment bank alongside Garth Ritchie, who runs the bank's bond and equities trading activities.

Jeffrey Urwin, head of corporate and investment banking, will step down, and a new chief finance officer will be sought.

Deutsche aims to cut costs from 24.1bn euros to 22bn euros by 2018, as well as resume paying a "competitive dividend" to shareholders.

- Published2 February 2017

- Published23 December 2016