Vauxhall's uncertain road ahead begins

- Published

- comments

Carlos Tavares, the man who will determine the future of Vauxhall workers, downplayed the threat to more than 4,000 Vauxhall workers - but he chose his words very carefully.

The head of PSA insisted that the new combined company would have an opportunity to set new internal benchmarks for performance.

They will allow plants to be compared and improve.

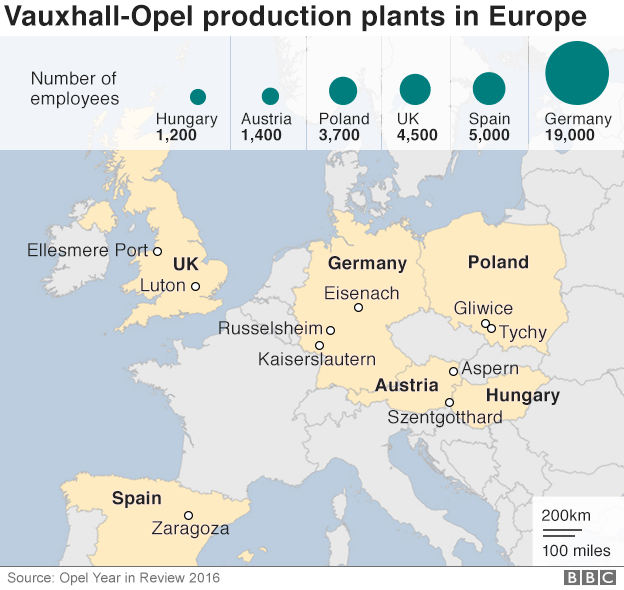

Production commitments expire in 2021 for Ellesmere Port and 2025 for Luton.

After that it will be every plant for itself in a battle for jobs.

The combined company will have 24 factories and everyone at the Geneva motor show agrees that is a few too many.

Several senior executives who asked not to be named had the same message. Consolidation is good because it's the best way to take out overcapacity. That has to happen and that means plants will close and jobs will go.

In this inevitable fight for survival, the UK starts at a disadvantage according to most executives here.

Uncertainty over Brexit and the terms of trade with Europe is one handicap. The fall in sterling is another. Although labour costs have gone down, the price of the 75% of parts for a Vauxhall Astra that come from Europe has gone up.

Having said that, Mr Tavares said that in the event of a "hard" Brexit, it may be more - not less - important to have manufacturing in the UK.

'Cautious optimism' on Vauxhall deal

Why is Vauxhall being sold to Peugeot's owner?

The fine print behind the GM deal

Andy Palmer, the chief executive of Aston Martin agreed. He told the BBC that for a company like PSA - if there is a tariff wall - having some production on the other side of it could make sense as a measure of insurance against high tariffs and volatile currency moves.

For that to work, though, more of the supply chain would need to move to the UK and that takes government help.

Over to you, Mr Hammond...

When it comes to car manufacturing, governments rarely sit on the sidelines. Car industry jobs seem to have a particular political resonance around the world.

As well as Ellesmere Port and Luton competing with more than 20 other plants in Europe, the UK government will be up against some stiff competition from European politicians.

The UK government scored an early success by persuading Nissan to increase investment in Sunderland after promising support for skills and training. There was a particular focus on electric cars and battery technology - themes that are red hot in the industry presentations here.

What worked with Nissan may be popular with PSA, which lags some of their rivals in electric and self-driving cars.

Extra motivation - if any were needed - for the chancellor to play those cards in Wednesday's Budget. I expect he will.