Spring Budget 2017 tax rise: What's the fuss about?

- Published

The most controversial measure announced in the Budget was the tax rise facing more than a million self-employed people.

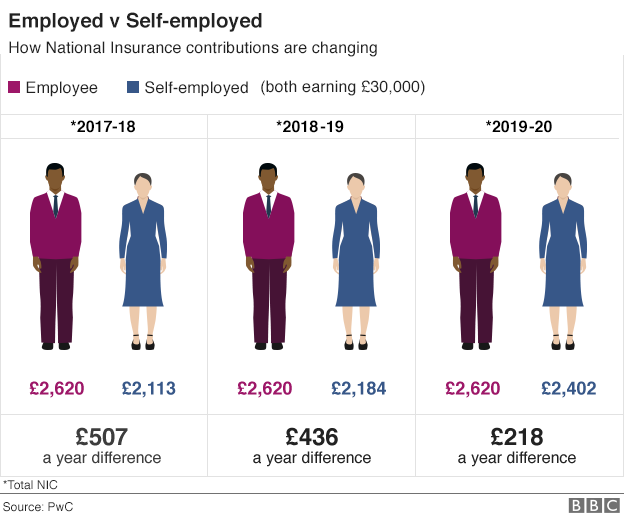

Chancellor Philip Hammond announced an increase in the National Insurance rate for the self-employed, with one rise taking effect next April and another increase due in April 2019.

So, what does this all mean?

How does National Insurance work?

Workers - whether they are employees or self-employed - pay National Insurance to qualify for certain benefits, such as the state pension.

As the self-employed do not have access to some benefits they pay less in National Insurance. This discount also reflects the greater risks the self-employed take. For example, they do not get statutory sick pay if they cannot work owing to illness.

Technically, there are four different classes of National Insurance. Class 1 is paid by employees. Class 2 and Class 4 are paid by the self-employed, and Class 3 is for voluntary top-ups.

Class 1 contributions are a proportion of pay that are paid by employees and are automatically deducted by their employer

Class 2 contributions are a flat rate paid by self-employed workers making a profit of more than £5,965 a year

Class 4 contributions are a proportion of profits, paid when making a profit of more than £8,060 a year

Employers also pay a contribution, of which more later.

What is changing?

In March last year, the chancellor at the time, George Osborne, confirmed that Class 2 contributions would be abolished in April 2018.

In other words, that means a tax cut of £146 a year for anyone who is self-employed and making profits of more than £5,965 a year.

A year on, and the current chancellor, Philip Hammond, said that the amount the self-employed pay in Class 4 contributions would rise from April 2018. Class 4 contributions will increase from a rate of 9% to 10% on profits above £8,060, going up to 11% the following year.

Taken on its own, this means the self-employed, with profits of more than £8,060, will have a tax rise averaging £240 a year.

Mr Hammond in his speech and afterwards, while under fire for the move, has chosen to explain the impact by taking into account both the Class 4 and the Class 2 changes.

He says that only the self-employed with profits over £16,250 will have to pay more as a result of these changes - at an average cost of £31 a year to those affected.

Treasury has 'taken the easy route'

Alettia Elwin says the tax rise is unfair

Alettia Elwin, who is self-employed and teaches music to children, says that Mr Hammond should have targeted large businesses, who are seeing a cut in corporation tax, rather than the self-employed.

"Why is he targeting small business when there are so many global companies out there that pay very little tax at all in the UK?" she asks.

"They [the government] have taken the easy route by taxing us. It is a bit lazy of them."

Sarah Lawrence, a self-employed bookkeeper from Somerset, says that employees and the self-employed should be treated differently.

"The biggest difference between me and the employed person getting the same gross income as my profit is the frequency of being paid," the 62-year-old says.

"I cannot and never have been able to rely on when I get paid. The employed person typically gets paid at the end of the month.

"I do not have holiday pay or sick pay or maternity pay, so how can I be deemed have parity with my employed counterpart?

"With no illness or holiday I may get the same but if I am ill my income will drop.

Who will be hit?

There are 4.8 million self-employed people in the UK.

Of these, the Treasury says there are more than 2.5 million who make enough money to end up paying more tax from April 2018 owing to the Class 4 change announced by Mr Hammond.

Taking the Class 2 change into account as well, then 1.6 million will end up paying more.

The more money workers make, the more National Insurance they will pay. By April 2019, a self-employed worker will pay 11% on profits between £8,060 and £45,000, and 2% on profits over £45,000.

The Institute for Fiscal Studies says that, overall, any self-employed person with profits of less than about £15,570 will be better off. The maximum loss, affecting those with profits of more than £45,000, will be £589 per year.

What is the justification?

Mr Hammond says that changes, primarily to the pension system, mean that the difference in benefit entitlement between employees and the self-employed is now narrower.

The new state pension, introduced last year, gives the self-employed better access to more than just the minimum possible amount.

What is the bigger picture?

The way we work is changing. More flexible, some say. More insecure, say others.

The number of self-employed workers has risen from 3.23 million at the end of 2000 to 4.8 million now.

Average wages for self-employed workers were lower last year than in 1994-95, research from the Resolution Foundation suggests, although it also says that the rise in self-employment was driven by higher earners.

The Treasury is missing out on some tax revenue as a result.

So, with the chancellor under pressure to pay for social care, he decided to raise taxes from this group. In total, the National Insurance increase announced in the Budget will bring in £2bn for the Treasury by 2021-22.

Why don't employers pay more?

Employers who use self-employed workers do not have to pay national insurance contributions. Indeed, they also avoid paying pension contributions, holiday pay, sick pay and the like. They pay 13.8% of a traditional employee's salary in National Insurance.

So questions have been raised as to why the chancellor chose to raise money from the self-employed, rather than from the businesses that use their services.

That is part of a wider review led by Matthew Taylor, the chief executive of the Royal Society for the encouragement of Arts, Manufactures and Commerce. He is balancing the extra efficiency and lower prices that have resulted from new businesses such as Uber, with the lower tax revenue that results.

- Published8 March 2017

- Published11 March 2020

- Published8 March 2017