Vehicle Excise Duty: Small car buyers face higher costs

- Published

If you're buying a new car, these changes could affect you

The way we pay road tax will change significantly from 1 April and it is something to consider if you're going to be buying a new car.

Crucially, it is those buying cars with low CO2 emissions that face the highest relative rise in the tax.

Currently many such vehicles don't incur the charges, known formally as Vehicle Excise Duty (VED).

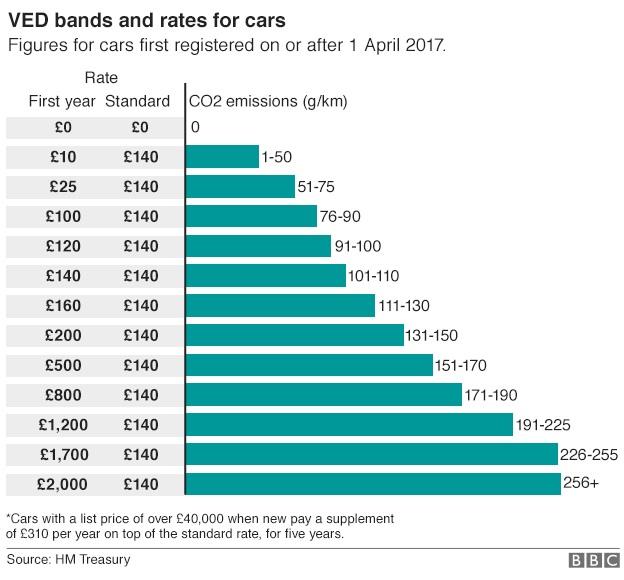

But for cars registered on or after 1 April 2017 there will be a first year of charges linked to carbon emissions.

After that there will be three bands - zero, standard and premium - determining how much you will pay as a car owner each year.

Importantly, if you have a car already, these rule changes do not apply and you will continue to pay VED under the existing rates.

What are the changes?

The changes, announced in the July 2015 Budget, reflect the fact that car manufacturers have cut many car models' CO2 emissions.

This means their owners benefit from the existing VED bands that tax lower-emissions vehicles more lightly.

Many more expensive cars will see a smaller relative hike in VED rates

As more cars get cleaner, the existing rules have cut back the Treasury's income - hence these changes. From 1 April onwards, only newly registered cars with zero emissions will escape VED - so that means electric and hydrogen cars only.

There is a sliding scale of charges for the first year of ownership and after that petrol or diesel vehicles are subject to a "standard" rate of £140 a year.

For those buying cars costing more than £40,000 there will be an additional £310 "premium" levy for the first five years of ownership.

What about older vehicles?

Cars registered before 1 April, 2017 are not affected by the VED changes - so for existing car owners, you will pay as before.

If your vehicle was registered before 1 March 2001 then the engine size is what determines how much you pay

If your car has an engine capacity of less than 1549cc (about 1.5 litres), then you will still pay £145 (if you pay upfront).

If you car has a bigger engine, then the annual charge is £235. Both these figures rise slightly if you pay in instalments. You can get a detailed breakdown here, external.

If your vehicle was registered after 1 March 2001, then it is emissions that determine how much you currently pay.

Vehicles have to be in Band D (emitting 121-130g/km of CO2) before you pay any significant annual road tax - in the case of Band D it is £110 a year.

What if I'm buying a second-hand car?

The VED changes do not apply to cars that are already on the road, so if you're buying a second-hand car then your vehicle will be taxed under the old system.

However, one wrinkle to bear in mind is that since the end of the paper tax disc in 2014 it is no long possible to transfer this tax between car owners.

You'll need to tax your new car yourself

As soon as the car is sold the seller should complete the "new keeper" bit of the car's registration document - the V5C certificate - and send it to the DVLA. You, as the new owner, keep hold of the green bit.

You can tax the car immediately online or over the phone with the DVLA, external, or at a post office. The seller gets a refund of unused tax from the DVLA.

Should I buy my new car now or wait until April?

It all depends what type of car you are thinking of buying, but in general it is the most economical vehicles which face the biggest percentage rise in road taxes.

Current charges are closely linked to a vehicle's CO2 emissions

For a small car like a Ford Fiesta 1.0T Ecoboost with CO2 emissions of 99g/km, you pay no Vehicle Excise Duty if you buy before 1 April. If you buy after that you pay up to £120 in the first year and £140 annually thereafter.

For a mid-range car, like the Honda Civic 1.4 i-VTEC Sport, with a higher CO2 emissions figure of 131g/km you currently pay £130 in the first year and then a standard annual rate - also £130. If you buy on or after 1 April you'll pay £200 in the first year and £140 thereafter.

For a top-end car like the Jaguar XE 2.0i R-Sport with CO2 emissions of 179g/km you currently pay £355 in the first year and £230 after that. If you buy on or after 1 April you will pay £800 in the first year, but your annual bill will then come down to £140.

I've got an electric car or an alternative fuel car, what will I pay?

From 1 April, only newly registered cars with zero emissions will escape VED - so that means electric and hydrogen cars only.

Only electric and hydrogen cars will escape paying VED under the rules changes

Cars with low CO2 emissions of up to 100g/km will pay between £10-£120 in the first year.

After the first year of registration, alternative fuel vehicles such as hybrids, or those using bi-ethanol and liquid petroleum gas will pay £130 a year.

So if you are considering buying a low-emissions car using an alternative fuel, it may make sense to bring forward your purchase to March.

What difference will this make to the car industry?

The money raised for this will be paid into a roads fund to help towards the upkeep of the UK's motorway and roads network.

Motoring groups have given a mixed reaction to the changes.

"While zero-emission cars will, on the whole, remain exempt from VED, the new regime will disincentivise take-up of low-emission vehicles," said Tamzen Isacsson of the Society of Motor Manufacturers and Traders (SMMT).

Car prices have been falling in real terms for some time

"For example, new technologies such as plug-in hybrid - the fastest growing ultra-low emission vehicle segment - won't benefit from long-term VED incentive, threatening the ability of the UK and the automotive sector to meet ever stricter CO2 targets.

"The introduction of a surcharge on premium cars also risks undermining growth in UK manufacturing and exports, which helps to support some 814,000 jobs in the UK."

The RAC said that while costs would rise for many drivers, the fact that new car prices had been dropping in real terms over many years would help offset this. It also welcomed the fact that money raised from VED would be ring-fenced for road investments.

Follow Tim Bowler on Twitter @timbowlerbbc, external

- Published8 July 2015