Mobile banking is saving us 'billions' in charges

- Published

Younger generations seem happy to pay, save and borrow only using their smartphones

Mobile banking has changed the way we manage our money for good, and is saving us billions in bank charges, tech start-ups say.

Charlie Kingston, a 22-year-old software engineer based in London, banks with mobile-only newcomer Starling Bank, external.

"I joined a mobile bank to get more control over my money," he says. "The in-app 'pulse' gives me a quick and insightful overview about how I'm spending and the real-time alert really helps me to keep on top of things."

International money transfer service Azimo says Europeans could be saving up to £7bn a year in financial fees because mobile banking apps are helping them switch money more quickly and avoid overdraft charges.

Two-fifths of UK consumers say they have avoided up to £100 in debt or charges by using tech to manage their money.

Charlie Kingston says mobile banking helps him "keep on top of things"

Instant access to balances is also helping us keep an eye on our spending, says Azimo, which interviewed 4,000 people across France, Germany, Spain and the UK.

Carl Riordan, 36, another Starling Bank customer, says he didn't realise how easy it would be. "When I first thought about a bank without branches, I didn't realise it would only take a few taps," he says.

Global banking giant HSBC says that more than 90% of its interactions with customers are now through its digital channels.

That's why more than 1,000 local branches in the UK have closed down in the past two years with 400 more expected in 2017.

Of course, mobile banking is nothing new in Africa, with a service like M-Pesa recently celebrating its 10th anniversary. The mobile payments service launched by Vodafone Safaricom in 2007 now has about 25 million users in 10 countries.

Banks are closing hundreds of bricks-and-mortar branches as banking goes digital

But the reason why mobile banking has proved so successful in Africa is that traditional banking structures were inaccessible to most people. It was mobile or nothing.

In Europe, Asia and the US, it is the convenience of smartphone tech that is driving this huge change in our banking behaviour.

"Now that fintech [financial technology] companies can obtain a banking licence and compete on an equal footing, technology innovations in mobile make this possible," says Megan Caywood, chief platform officer at Starling Bank.

Younger generations in particular now trust the security of smartphones, with their ability to handle a range of biometric authentication methods, whether fingerprint, voice, or image and video recognition.

Fintech start-ups are making the most of a more relaxed financial regulatory environment within the European Union (EU), which from 2018, will also see banks forced to share customer data, as long as customers give their permission.

This will allow digital banking platforms to position themselves between banks and customers and offer a full money management service, bringing together products from a range of providers.

The future of payments is mobile and competition is likely to increase

New mobile-first banks, such as Atom, Monzo, Starling, Tandem and N26 are specifically targeting younger customers and linking up with other app-based service providers.

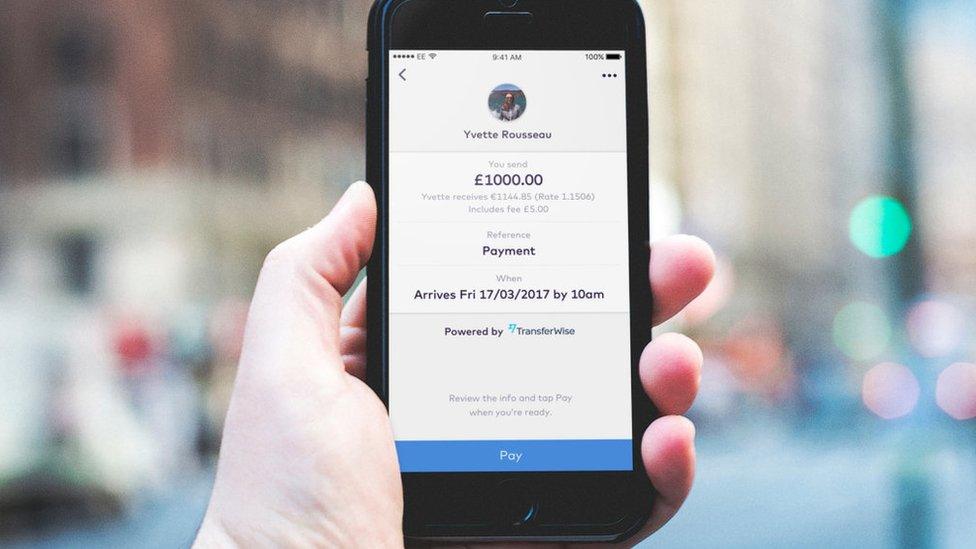

For example, Germany-based N26, which operates across 17 European Union countries and has about 300,000 members, offers an in-app marketplace that gives customers access to other fintech providers, such as TransferWise for international money transfers.

Starling Bank has also partnered with TransferWise.

Another German start-up SolarisBank, which recently raised 26.3m euros (£23.1m) from investors, has developed a platform that any company can plug in to and instantly offer financial services, from peer-to-peer payments to gift cards.

"The main idea behind banking-as-a-platform is to enable innovation in the finance and banking space," says Marko Wenthin, SolarisBank co-founder.

"It offers banking services as building blocks to fintechs, digital companies and banks who want to deliver on the experience modern customers demand."

Mobile-only bank Starling has partnered with another tech start-up TransferWise

David Brear, founder of fintech consultancy 11FS, says: "If, in five years time, [banks] are only selling their own products through their own channels to only their customers, they're in for hard times."

More enlightened traditional banks realise this and are partnering with start-ups or fostering their development within tech incubators.

"Transforming industries isn't always about disrupting the incumbents; collaboration is equally as important," says Erez Mathan, chief operating office of GoCardless, a company building a global bank-to-bank payment network.

"Through partnerships with major financial institutions, businesses across the eurozone can take recurring payments without high fees and piles of paperwork."

Another technology beginning to have a significant impact on innovation in financial services is blockchain, a secure digital ledger that records and verifies transactions without the need for a central database.

Circle, the peer-to-peer payments firm, makes use of blockchain to make sending money as easy as sending a text.

"When we founded Circle a big part of that was a long-term bet on blockchain and digital currency technology, which we thought held the potential to provide the missing layer needed for open value exchange," says Sean Neville, Circle's president and co-founder.

But all this innovation is only going to persuade us to switch to mobile if it makes our lives easier and less expensive.

And, as it turns out, smartphone banking is doing just that.

Follow Technology of Business editor Matthew Wall on Twitter, external and Facebook, external

Click here for more Technology of Business features, external