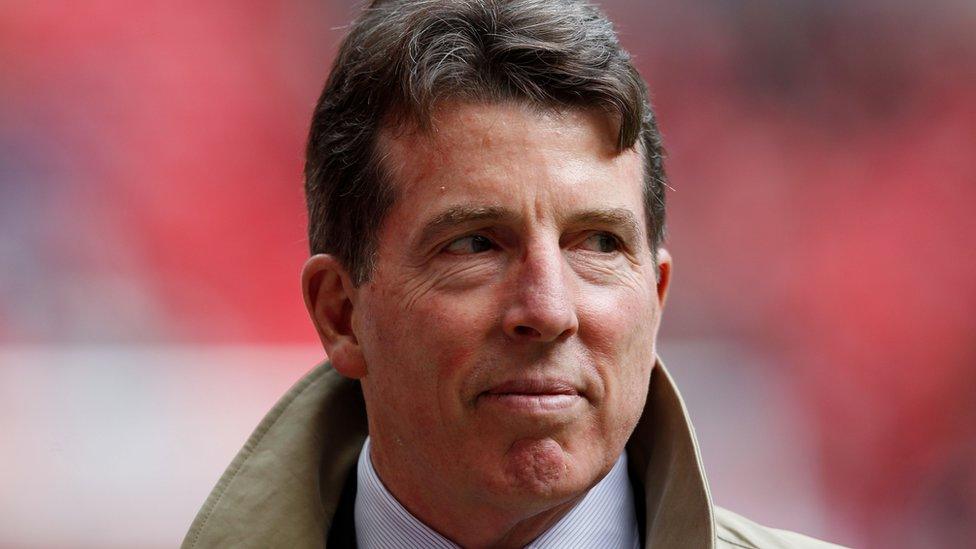

Bob Diamond in deal to buy stockbroker Panmure Gordon

- Published

Bob Diamond resigned from Barclays in 2012

Bob Diamond has joined forces with the Qatari royal family to buy Panmure Gordon, the loss-making stockbroker and investment bank.

The former Barclays chief executive has made the offer through his Atlas Merchant Capital vehicle and QInvest, the Qataris' investment arm.

QInvest already owns 43% of Panmure, a firm that dates back some 140 years.

The offer, which values Panmure at £15.5m, has been recommended by the board.

Shares in the company soared 76% to 105p in morning trading - 5p above the offer price.

Andrew Adcock, chairman, said the independent directors believed the offer was "fair and reasonable".

Matthew Hansen, head of UK and Europe for Atlas, said there was a "significant opportunity to enhance Panmure Gordon's strong reputation and build a larger, successful boutique investment bank".

That could only be done as a private company, "out of the glare of the public market and the effects of share price movement".

Return to the City

QInvest bought its stake in Panmure in 2009. Tamim Al-Kawari, its chief executive, said it was "excited about this opportunity to work with Atlas to develop the business, alongside its management team and employees, and to assist it in fulfilling its potential".

The deal will be regarded as a return to the City by Mr Diamond, who resigned from Barclays in the wake of the Libor rigging scandal in 2012.

The Boston-born banker was a controversial figure. Before being elevated to run the bank in September 2010, he was head of Barclays Capital, its investment banking division.

Former Labour minister Lord Mandelson described Mr Diamond as the "unacceptable face of banking", claiming he had been paid a salary of £63m for "deal-making and shuffling paper around".

Barclays dismissed the figure as "total fiction", saying that his salary as head of Barclays Capital was actually £250,000.

He joined Barclays in 1996, having worked in senior roles at Credit Suisse First Boston and Morgan Stanley International.

As the global financial system teetered on the brink in 2008, Mr Diamond won praise for his role in the successful and profitable takeover of the US operations of Lehman Brothers.

The deal, which he described as "transformational", catapulted Barclays into the top league of global investment banks.

The bank declined a bailout by the UK government at the height of the credit crunch crisis and instead sold a large stake to foreign investors, mainly from Qatar and Abu Dhabi, to raise cash.

- Published3 July 2012