Apple 'paid no tax' in New Zealand for at least a decade

- Published

Apple is facing scrutiny in New Zealand following reports it paid no tax for at least a decade, despite having logged billions in sales.

An investigation by the New Zealand Herald newspaper, external found Apple's local unit paid about NZ$37m ($26m; £21m) in taxes since 2007 in Australia instead.

Apple New Zealand's parent company is registered in Australia and the two countries have a treaty where tax is only paid in one jurisdiction.

Apple said the arrangement was legal.

"Apple is the largest taxpayer in the world and we appreciate and respect the role taxes play as necessary and important in our society," the company said.

"We follow the law and pay tax on everything we earn, wherever we operate. Apple aims to be a force for good and we're proud of the contributions we've made in New Zealand over the past decade."

Some tax experts have called the arrangement unusual given that Australia's corporate tax rate of 30% is higher than New Zealand's.

Apple has been criticised by politicians including New Zealand Green Party co-leader James Shaw.

"It is absolutely extraordinary that they are able to get away with paying zero tax in this country," he told the NZ Herald. "It looks like their tax department is even more innovative than their product designers."

New Zealand revenue minister Judith Collins recently announced plans to strengthen tax laws.

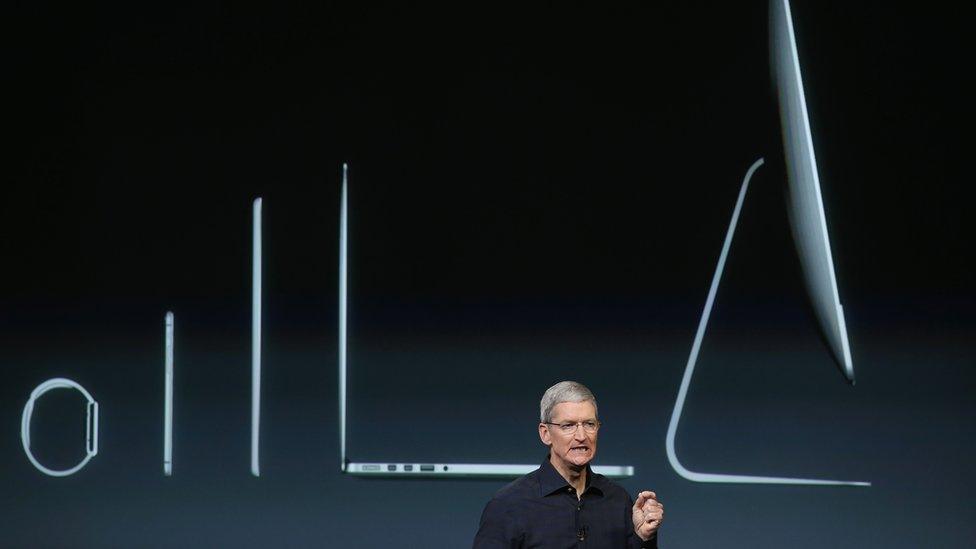

Apple says it is the largest taxpayer in the world

The technology giant has been under scrutiny in recent years for its tax practices around the world.

In 2014 it was revealed that Apple shifts much of its international profits offshore to Ireland, which has a corporate tax rate of just 12.5%.

However, the European Commission found the final tax paid by Apple amounted to a rate of less than 2%, which the Commission declared illegal.

Apple is engaged in a major legal battle with the European Union after it was ordered to pay a record 13bn euros in retroactive taxes to Ireland. It is appealing against the decision.

Apple said "the vast majority" of its taxes were paid in the US, where its "products and services are created, designed and engineered".

The company reported record quarterly revenues in the last three months of 2016 following strong sales of the iPhone 7.

- Published21 March 2017

- Published15 March 2017